Startup Fundraising Checklist: A Step-by-Step Guide

Use this startup fundraising checklist to prepare your pitch deck, financial model, and investor outreach strategy step by step.

Many founders jump into investor meetings before they are actually ready. They have a product, a vision, and a lot of energy, but no clear process.

Fundraising is not just a series of pitch meetings. It is a structured process that takes planning, the right documents, and a solid understanding of what investors expect.

If you are preparing to raise capital for the first time, this startup fundraising checklist is for you. Use it as a practical guide to get investor-ready before you send a single email.

Key Takeaways * Founders who treat it as a structured journey from setting goals to closing the round are better prepared and close faster. * A strong pitch deck, financial model, cap table, and data room are the baseline investors expect at every stage. * Investors want to see growth metrics, retention data, and a clear valuation rationale even at the early stage. * A focused list of 30-50 well-researched, stage-appropriate investors will outperform a generic blast to hundreds every time.

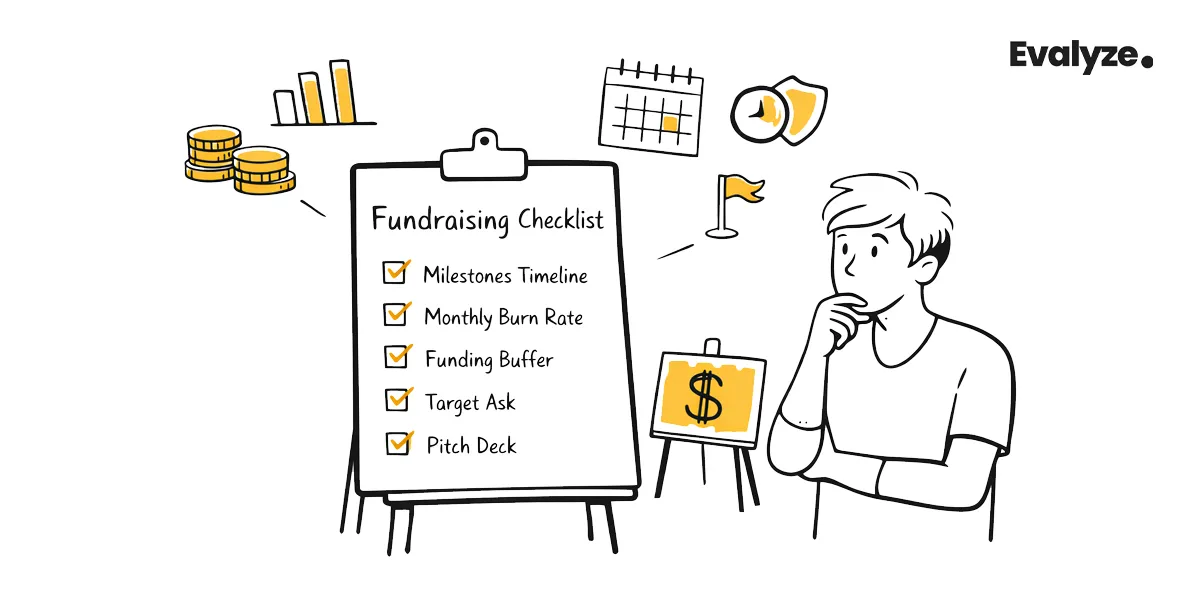

Startup Fundraising Checklist

Step 1: Define Your Startup Fundraising Goals

Before you talk to a single investor, you need to be clear on the basics:

“How much are you raising, why, and what will you do with the money?“

-

These seem like obvious questions, but many first-time founders skip this step, and it shows.

-

Start by connecting your fundraising target to specific milestones, not just to your monthly burn rate. Investors want to know what progress their money will unlock.

-

For example: "We are raising $800,000 to reach product-market fit and hit $50,000 in monthly recurring revenue within 18 months." That is a fundable story.

-

"We need six months of runway" is not.

-

It also helps to be clear on what stage you are at:

-

- Pre-seed: You are testing an idea, building an MVP, or validating early assumptions. Rounds are typically small, often in the $100,000 to $500,000 range.

-

- Seed: You have an early product and some traction. You are raising to grow. Rounds typically range from $500,000 to $3 million.

-

- Series A: You have demonstrated product-market fit and a repeatable growth model. Rounds are usually $3 million and up.

💡 Tip: Founders who tie their fundraising goals to clear milestones, not just burn rate, tend to close rounds faster and on better terms. Know your numbers and your plan before the first meeting.

Step 2: Prepare Your Fundraising Documents and Data Room

One of the most common reasons early-stage fundraising stalls is the documentation. Investors will ask for specific materials at every stage of the process, and not having them ready sends the wrong signal.

Here is a startup pitch deck checklist and document list to prepare before you start outreach:

Core Documents Checklist ☐ Pitch deck (10-12 slides: problem, solution, market size, traction, business model, team, financials, ask) ☐ Financial model (3-year projections, revenue model, unit economics MRR, CAC, LTV) ☐ Cap table (current ownership breakdown, any existing SAFEs or convertible notes) ☐ One-pager / executive summary (for cold outreach, keep it to one page) ☐ Data room (a shared folder with all due diligence documents, ready to send)

- Your pitch deck is usually the first thing an investor sees. It needs to be clear, visually clean, and tell a compelling story in under 15 slides.

- Your financial model shows that you understand your business, even rough projections matter at the early stage.

- Your cap table tells investors how ownership is structured and how much dilution future rounds might bring.

- And your data room saves time during due diligence: have your incorporation documents, financials, contracts, and IP agreements ready to share.

The due diligence checklist for startups is longer than most founders expect. The earlier you start building it, the smoother your process will be.

What to read next: How Much Money to Raise at the Seed Stage?

💡 Is Your Pitch Deck Investor-Ready? Run it through Evalyze's Pitch Deck Analyzer and get instant, actionable feedback before you send it to a single investor.

Step 3: Validate Your Traction and Financials

Investors, especially at the seed stage, invest in traction. Before you start outreach, make sure you can speak confidently to the growth metrics that matter most for your business.

This is the part of the startup fundraising process that many early-stage founders underestimate.

Here are the key areas to cover:

- Revenue and growth: MRR (Monthly Recurring Revenue) or ARR (Annual Recurring Revenue), month-over-month growth rate, total revenue to date.

- Retention and engagement: Are users coming back? A high churn rate is a red flag.

- Product-market fit signals: Organic referrals, low CAC (Customer Acquisition Cost), strong retention, and user testimonials all point toward fit.

- Market size: Know your TAM (Total Addressable Market), SAM (Serviceable Addressable Market), and SOM (Serviceable Obtainable Market). Investors want to see a large, reachable opportunity.

- Startup valuation: Be ready to explain your valuation rationale. Common methods include comparable company analysis and revenue multiples. At early stages, traction often matters more than DCF models.

Traction Checklist ☐ Monthly recurring revenue (MRR) or clear path to revenue ☐ Retention rate and engagement data (DAU/MAU, session time, etc.) ☐ Customer acquisition cost (CAC) and lifetime value (LTV) ☐ Market size research (TAM/SAM/SOM) ☐ Startup valuation estimate with clear rationale

If you are pre-revenue, focus on qualitative evidence of product-market fit: user interviews, waitlist sign-ups, pilot agreements, or letters of intent from potential customers. These scalability and traction metrics tell a story even before the numbers are big.

Take the next step: Pre-Seed Fundraising Checklist

Step 4: Create Your Investor Outreach Strategy

Not every investor is the right fit for your startup. Stage, sector, geography, and fund size all matter. Sending the same generic pitch to 200 investors is one of the most common and costly mistakes early-stage founders make. A focused, researched investor outreach strategy will get you further than a broad, impersonal one.

Start by understanding the types of investors available to you:

- Angel investors: Individuals who invest their own money, often at the pre-seed or seed stage. Good for founders who need more than just capital, many angels offer mentorship and introductions.

- Venture capital (VC):** Firms that manage pooled funds and typically invest at seed, Series A, and beyond. They move slower but write larger cheques.

- Crowdfunding: Platforms like Wefunder or Republic let you raise from a broader pool of investors. Good for consumer-facing products with community appeal.

- Grants and government funding: Non-dilutive options worth exploring, especially in Canada. The NRC IRAP, SR&ED, and regional innovation programs are worth researching.

From the Evalyze library: Fundraising 101: How to Raise Your First Round

Once you know who you are targeting, build a list of 30 to 50 investors who are a genuine fit. Warm introductions through accelerators, advisors, or mutual connections consistently outperform cold outreach. If you are cold outreach, personalise every message by referencing their portfolio, their thesis, and why you are specifically right for them.

Investor Outreach Checklist ☐ Target list of 30–50 relevant investors (stage, sector, geography match) ☐ Warm intro strategy in place (LinkedIn, accelerators, advisors, alumni networks) ☐ Personalised outreach email + one-pager ready ☐ Pipeline tracker or CRM set up to manage conversations and follow-ups ☐ Investor research complete: know their portfolio, thesis, and recent deals

💡 Find Your Best-Fit Investors and Prep for Tough Questions Finding the right investors is half the battle. Evalyze's AI Investor Matching tool helps you identify the best-fit investors for your stage and sector. And when the meetings start, our AI Pitch Coach helps you prepare for the questions that actually get asked.

Step 5: Navigate the Fundraising Process

Once your materials are ready and your investor list is built, the fundraising process itself typically follows a predictable path.

Understanding each stage helps you manage your pipeline and set realistic expectations.

- Outreach and intro meeting: First contact usually a 30-minute call or video meeting. Your goal is to get a follow-up, not close the round.

- Follow-up and deeper diligence: If there is interest, the investor will ask more questions, request your data room, and potentially bring in other partners.

- Due diligence: A thorough review of your business financials, legal structure, cap table, team, and market. This is where your preparation pays off.

- Term sheet: If an investor wants to move forward, they will issue a term sheet outlining the deal structure. Key terms to understand: valuation, equity percentage, board seats, pro-rata rights, and any protective provisions.

- Closing: Legal documents are signed, and funds are wired. This step takes longer than most founders expect; plan for 4 to 8 weeks after a signed term sheet.

Free resource for you: 7 Investor Follow-Up Emails

Common deal structures you will encounter at the early stage:

- SAFEs (Simple Agreements for Future Equity): Common at pre-seed and seed. You raise money now; it converts to equity at a future priced round.

- Convertible notes: Similar to SAFEs but with a maturity date and interest rate.

- Priced equity rounds: You agree on a valuation now and issue shares accordingly. More common at Series A and beyond.

Watch out for significant equity dilution in early rounds, long close timelines, and terms that limit your flexibility in future fundraising. A fundraising timeline of 3 to 6 months for a seed round is realistic, though sometimes longer.

Keep learning: How to Build an Investor Funnel + Template

Bonus: Investor Questions Every Founder Should Prepare For

Even with a solid pitch and strong materials, investor meetings can catch you off guard.

Here are five questions you should be able to answer confidently every time:

- "What problem are you solving, and why now?"

Know your 'why now' answer cold. Market timing matters. - "What is your go-to-market strategy?"

Be specific. "We will use social media" is not a strategy. - "How will you use the funds?"

Tie your answer to milestones, not just categories like "marketing" or "hiring." - "Who else is in the round?"

Social proof matters. Be transparent about your current commitments. - "What does your cap table look like?" Know your numbers and be ready to explain any past financing.

Final Thoughts

Fundraising is a process, and preparation is what separates funded founders from the rest. The founders who close rounds are not necessarily the ones with the best ideas; they are the ones who show up prepared, know their numbers, and have done the work before the first meeting.

This startup fundraising checklist is a starting point. Every round is different, every investor is different, and your context will shape how each step plays out. But the fundamentals here apply across stages and sectors.

The best time to start preparing is before you need the money. If you are getting ready to raise, Evalyze can help you get investor-ready faster, from analyzing your pitch deck to matching you with the right investors and coaching you through the tough questions.

FAQ

More Articles

Pre-Seed Fundraising Checklist: Investor-Ready Signals

A practical pre-seed fundraising checklist, readiness scorecard, traction milestones, cheque sizes, investor types, SAFE terms, and pitch focus, plus a clean plan.

January 7, 2026

Fundraising Automation for Startups

What to automate in fundraising (CRM, follow-ups, data rooms) and what not to. A trust-first playbook that won’t look like a bot farm.

December 25, 2025