Fundraising Automation for Startups

What to automate in fundraising (CRM, follow-ups, data rooms) and what not to. A trust-first playbook that won’t look like a bot farm.

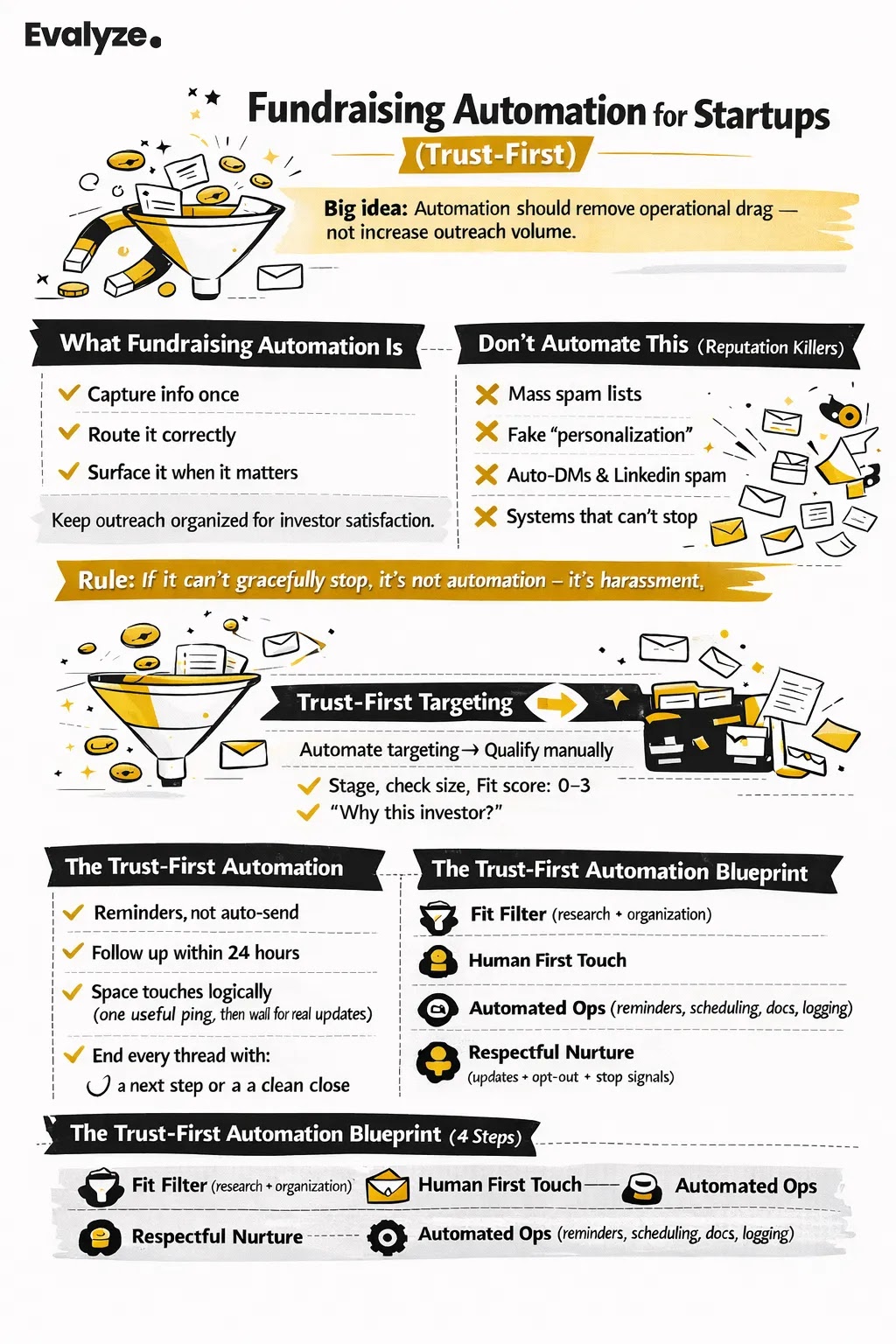

Investors fund clarity and confidence, and your process should reflect that. The point of fundraising automation for startups isn’t to send more messages; it’s to remove the operational drag that slows a round down: messy tracking, missed follow-ups, outdated docs, and inconsistent updates.

Key Takeaways

- Fundraising automation should remove operational drag, not increase outreach volume or replace judgment in investor conversations.

- Follow-ups should be prompted, not auto-sent, use reminders, and always end threads with a next step or a clean stop.

- Never automate fake personalization, first-touch messages, or social DM loops; build systems that can stop when signals say “no.”

What fundraising automation is (and what it isn’t)

Fundraising automation is a set of behind-the-scenes workflows that keep everything moving without you micromanaging every step. You capture information once, route it correctly, and surface it when it matters so your outreach stays organized, and your investor experience stays clean.

What to Automate in Fundraising

- Meeting + follow-up reminders so next steps don’t fall through.

- CRM hygiene (logging, tagging, stage tracking) so you always know where each conversation stands.

- Document and version-control so your data room link always points to the current files.

- Update drafting support so regular investor updates are consistent and timely.

What Not to Automate in Fundraising

- Mass outreach blasts to unqualified lists.

- “Personalization” that’s clearly synthetic and undermines credibility.

- Auto-DMs on social platforms that treat people like lead records.

Next read: 20 AI Fundraising Tools for Startups

Automate investor targeting (so you email fewer people)

You don’t win rounds by “reaching out to everyone.” You win by talking to the few investors who are already wired to understand your business. Automation helps you get ruthless about that.

Build a tight investor list automatically, then qualify manually

Pull the boring fields automatically from your CRM or database:

- Stage focus

- Typical cheque size

- Sectors

- Geography

- A quick snapshot of recent deals

Then add one manual checkpoint before outreach: a fit score (0-3) plus a short “why this investor” note.

No reason, no send. This single rule prevents list bloat, keeps your outreach defensible, and makes “no” decisions faster.

To build your fit-score list faster, Evalyze.ai filters investors by stage, sector, and cheque size, while you handle why and outreach.

Popular on Evalyze: How to Build an Investor List Based on Your Startup

Automate warm-intro routing

Warm intros aren’t magic; they’re logistics. Set a workflow like: Find mutual → Draft a 4–6 line intro request → Track who you asked and when → Nudge once → Close the loop

Make it easy for the connector: include your one-liner, why this specific investor, and the exact ask. If it’s a pass, log it and move on.

Automate the outreach infrastructure (the part investors never see, but always feel)

Most founders treat deliverability and compliance like “later” problems. Investors treat them like a competence signal. If your email lands in spam, looks spoofable, or can’t be unsubscribed from cleanly, you don’t just lose a reply, you lose credibility before you’ve even earned a “maybe.”

Email authentication and deliverability hygiene

Set up SPF, DKIM, and DMARC, and make sure the sending domain aligns with what’s in your “From” address. This reduces the risk of spoofing and makes you less likely to be filtered or rejected by inbox providers. Gmail explicitly calls out authentication requirements, especially for higher-volume senders.

Bake a pre-flight “deliverability checklist” into your workflow:

- Authentication records in place (SPF/DKIM/DMARC)

- Sending domain consistent across tools

- List hygiene (no scraped lists, no mystery contacts)

Anti-spam compliance

If your outreach counts as a commercial electronic message (CEM), CASL isn’t optional: you need consent (or a valid basis), clear identification, and a working unsubscribe mechanism, and you must honour unsubscribe requests within 10 business days.

Add a consent basis field in your CRM (express/implied/unknown) and block sends when it’s unknown. That one gate prevents “accidental spammer” mode.

Worth bookmarking: 7 Investor Follow-Up Emails

Automate follow-ups and scheduling

Follow-ups are where fundraising quietly dies, not because founders don’t care, but because the process leaks. The fix isn’t “more sequences.” It’s making sure nothing falls through while still sounding like a person.

Follow-up timing that doesn’t feel clingy

Use automatic reminders, not automatic sending. Follow up quickly after a meeting, ideally within 24 hours, and set expectations during the call (“I’ll send notes this afternoon” / “I’ll follow up tomorrow”). Hustle Fund explicitly recommends sending a follow-up ASAP and setting a clear timeline.

Then space touches logically (e.g., one helpful ping after a few days, then wait for a real update).

Meeting logistics + next steps

Automate the admin: calendar links, agendas, and the “promised items” pack (deck, memo, data room link).

The human part is adding a next step or close-out rule so every thread ends with either:

- A scheduled follow-up action (“Let’s book a partner meeting”), or

- A clean stop (“Sounds like not a fit, thank you, I’ll keep you posted on major milestones”).

Keep learning: AI-Powered Investor Outreach: What Works and What Doesn't

Automate your data room and document workflow

A data room is where “interesting” turns into “prove it.” The fastest way to stall a round is to make investors chase docs, wonder which file is current, or get a Dropbox link that feels like a junk drawer.

Data room readiness as an automated checklist

Set up a version-controlled structure (clear folders + naming conventions) and treat it like a product feature: always ready, always current.

Both Drooms and Visible’s checklists converge on the same core set of documents investors expect during diligence:

- Cap table

- Financial statements/model

- Legal/IP docs

- Contracts

- Traction/metrics

So build auto-reminders that flag what’s missing or stale before anyone asks.

Then use permissions and audit trails to share quickly without oversharing:

- Grant access by stage

- Track who viewed what

- And tighten the scope when a conversation cools off.

Investor-specific “packs”

Instead of dumping everything, auto-generate a small pack by stage:

- Pre-seed: deck + narrative memo + early traction proof

- Seed: KPIs + GTM notes + pipeline/retention snapshots

- Series A: unit economics + cohort detail + deeper legal/ops docs

It feels curated, and curation reads as competence.

Explore more: How to Adapt Your Pitch Deck for Virtual Investor Meetings

Automate investor updates (the “non-spam” way to stay top of mind)

Investor updates are the opposite of spam when they’re predictable, honest, and useful. Set a monthly or quarterly cadence and keep the format consistent with core metrics, wins, risks, and a short list of specific asks.

Automate the parts that shouldn’t require willpower:

- Pull KPIs (revenue/ARR, burn, runway, retention, whatever fits your business) into a draft

- Send to the right segments (active conversations vs met once vs “pass-but-friendly”)

- Track replies and route tasks (intros, hiring leads, customer referrals) to the right owner

Keep the ask human and concrete. “Intro to 2 fintech angels in Toronto” beats “Any help appreciated.”

Don’t miss: How to Use Evalyze Investor Discovery

What to NEVER Automate

Automation goes wrong the moment it tries to pretend to be human.

- Avoid “Fake” Personalization

Never generate forced compliments, such as mentioning a random city or saying “I loved your post” when you didn’t read it. It’s better to send nothing than to send something fake. - Don’t Automate the First Contact

Never fully automate the very first email you send to an investor. Keep your initial outreach short, honest, and real. Your only goal is to get a reply, not to write a long story. - Stop LinkedIn “Spam Loops”

Do not use tools that send mass direct messages and instant follow-ups on LinkedIn. It feels like tapping someone on the shoulder every 90 seconds. - Don’t ignore “Stop” Signals

If an investor does not open your emails, does not reply, or chooses to unsubscribe, you must stop immediately.

The Rule: If your system cannot gracefully stop when someone isn’t interested, it isn’t automation, it is harassment.

Too useful to skip: 5 Reasons Why Startups Fail at Fundraising

The Trust-First Automation Blueprint

This plan shows you how to use technology to grow your fundraising process while keeping investor trust.

- Step 1: The “Fit Filter” (Research)

Use automation to handle research and organization so you reach out only to true matches, not everyone. - Step 2: The Human First Touch (Connection)

Write the first message yourself. Keep it short and direct with one clear request. Your goal is to get a reply, not send a pitch essay. - Step 3: Automated Operations (Organization)

Let tools handle the paperwork: reminders, scheduling, sending documents, and logging notes. This keeps you consistent during busy weeks. - Step 4: Respectful Nurture (Follow-up)

Send updates and milestones, but always provide a clear opt-out path. If someone asks to be removed, honour that request immediately.

Evalyze.ai can surface investors that match your stage, sector, and cheque size, so you spend your time on the “why” and the outreach, not list-building.

FAQ

1. Is fundraising automation just email sequencing?

No. Sequencing is the smallest piece. The real leverage is clean CRM hygiene, fast diligence workflows, and follow-up discipline.

2. How do I automate without violating Canada's anti-spam expectations?

Treat CASL like product requirements: track the consent basis, clearly identify the sender, and include a working unsubscribe link; then, action unsubscribes within 10 business days.

3. Should I use AI to write investor emails?

Use AI to draft, shorten, and remove fluff. Don’t outsource your voice or send unedited “robot prose.” Investors fund founders, not templates.

4. What’s the safest thing to automate first?

A data room checklist + follow-up reminders. High value, low reputational risk, and it makes you look organized immediately.

More Articles

Micro VCs vs. Traditional VCs: Which Is Right for Early-Stage Founders?

A practical founder guide to choosing micro VCs vs traditional VC funds, check size, speed, follow-on support, and a simple decision worksheet.

December 16, 2025

Best Startup Hubs & Ecosystems for Fundraising

Find the hubs where investors respond and where you can actually build.

December 17, 2025