What Is Venture Capital (And Who Are the People Behind It)?

A founder-friendly guide to understanding how venture capital works, who the key players are, and how to find the right investor fit.

For many founders, venture capital can feel a bit like trying to get into an exclusive club with no clear rules. Everyone talks about “getting funded,” but few explain who these investors really are, or how to find the ones that actually fit your startup.

This guide isn’t about chasing hype. It’s about helping you understand how venture capital actually works, what types of investors exist, and how to navigate the landscape with clarity, not confusion.

🔑 Key Takeaways

- Venture capital fuels fast startup growth in exchange for equity.

- Not all VCs are the same—fit matters more than fame.

- Most investors look for team, traction, and total market size.

- Targeted outreach beats mass emailing every time.

- Tools like Evalyze.ai make finding the right VC faster and smarter.

What Is Venture Capital? (And Why Founders Care)

Let’s keep it simple: venture capital is money that investors give to early-stage startups in exchange for ownership, usually in the form of shares. These investors are betting that your company will grow fast and become super valuable down the road.

Unlike a loan, you don’t have to pay this money back. But you do give up a piece of your company, and investors expect a return when you succeed, usually through an acquisition or IPO.

So… how is this different from other ways to raise money?

| Type of Funding | What It Means | When Founders Use It |

|---|---|---|

| 💳 Loans | You borrow money and pay it back (with interest) | For steady businesses with predictable cash flow |

| 👼 Angel Investors | Early believers who invest their own money | At the very beginning—friends, family, or angel networks |

| 🤝 Crowdfunding | Small amounts from lots of people | For products with strong consumer appeal |

| 💼 Venture Capital | Professional investors who fund risky, high-growth startups | To scale fast: product dev, team, marketing, launch |

Venture capital is popular because it gives founders the firepower to move fast, hire great people, build quickly, and go after a big market, without waiting years for revenue to catch up.

But it’s not for everyone. VC funding comes with expectations: fast growth, big milestones, and usually giving up some control.

Still, if you're chasing a big vision and need serious backing to get there, venture capital might be the right fuel.

Not sure if it’s too early (or too late) to raise?

Read When’s the Right Time to Seek Funding to find out what timing signals matter most.

How Venture Capital Works: The Basics

You’ve probably heard the phrase “venture capital investors” tossed around a lot, but who exactly are these people, and how does this system even work?

Let’s break it down without the finance-speak.

🏛️ First, what’s a VC firm made of?

A typical venture capital firm has two key groups:

-

Limited Partners (LPs): These are the folks with the money. Think pension funds, universities, or wealthy individuals. They invest into the fund but don’t make day-to-day decisions.

-

General Partners (GPs): These are the VC investors you meet. They decide which startups to back, sit on boards, and help portfolio companies grow.

💸 How do VCs make money?

-

They invest in startups in exchange for equity (shares).

-

If your startup grows and gets acquired or goes public, their shares become very valuable.

-

That’s called an exit, and it’s how VCs (and their LPs) make returns.

In short: they bet on you, hoping your win becomes their win.

Want to dive deeper into the mindset of investors?

Read How Venture Capitalists Really Think to understand what drives their decisions.

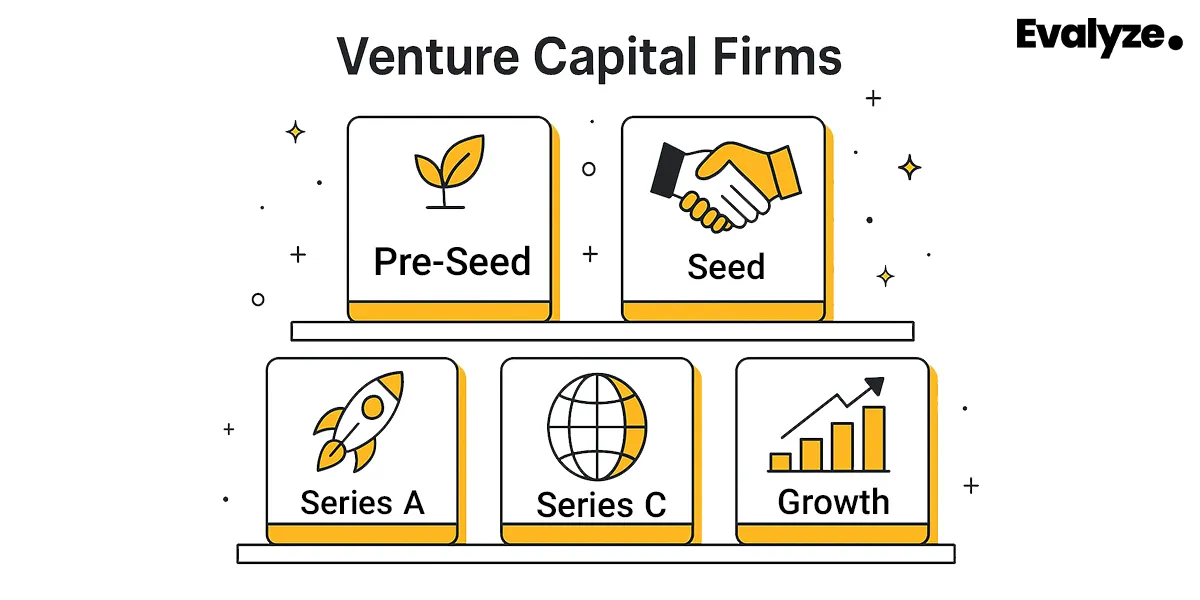

🪜 The Typical Stages of VC Funding

Most VC firms invest at specific stages. Here’s how the journey usually looks:

| Stage | What It Means | What VC Investors Look For |

|---|---|---|

| Pre-Seed | Just getting started | Strong team, big idea, maybe an MVP |

| Seed | Early traction, first users | Signs of product-market fit, early revenue |

| Series A | Scaling what works | Clear growth path, repeatable model |

| Series B+ | Growth mode | Larger rounds to fuel rapid expansion |

🎯 Quick takeaway:

Venture capital investors aren’t just writing checks. They’re managing other people’s money, placing bets on startups they believe can return 10x or more.

Want to get matched with VCs who actually fit your stage and sector?

👉 Upload your pitch deck to Evalyze.ai

And get smart investor matches in seconds.

Who Are the Venture Capitalists?

So who are these venture capital investors you keep hearing about? They’re not all the same, and understanding what makes them tick can save you time (and ghosted emails).

💡 What VC Investors Actually Look For

Most VC investors are looking for a specific mix:

-

Team: Are you scrappy, smart, and uniquely qualified to build this?

-

Traction: Do you have users, revenue, or something that proves people want what you’re building?

-

Market Size: Is the opportunity big enough to return 10x or more on their investment?

If your pitch nails all three, you’ve got their attention.

What actually grabs an investor’s attention?

Check out What Are Investors Looking For in Pitch Decks for a breakdown of must-have elements.

🏢 Types of VC Firms (and Why It Matters)

Not all VC firms are created equal. Here’s a quick rundown of the major types:

| Type | What They Focus On | Best For... |

|---|---|---|

| Early-Stage VCs | Pre-seed to Series A | Startups looking for their first institutional check |

| Growth VCs | Series B and beyond | Startups with proven models looking to scale |

| Corporate VCs | Backed by big companies | Strategic bets that align with a parent company’s vision |

| Micro-VCs / Solo GPs | Smaller funds, fewer partners | Niche or thesis-driven early-stage investments |

Free Resource: 18 Startup Programs to Launch Your Pre-Seed Journey

🎯 A Few Notable VC Investors You Might Recognize

To give you a head start, here are some well-known VC investors across the landscape:

-

Chris Sacca (Lowercase Capital) – Early backer of Twitter, Uber, Instagram

-

Aileen Lee (Cowboy Ventures) – Coined the term “unicorn” and invests early in breakout consumer startups

-

Frederic Court (Felix Capital) – Known for bets on digital lifestyle brands like Deliveroo and Farfetch

Angela Strange (a16z) – Focuses on fintech and infrastructure for startups

There are thousands more, but the key takeaway is this: different VCs have different goals, styles, and interests.

🔑 Your move:

Use Evalyze.ai to get matched with venture capital firms that align with your startup’s stage, sector, and location, no spreadsheets, no guesswork.

Top Venture Capital Firms Every Founder Should Know

There’s no shortage of venture capital firms out there, but not all of them are founder-friendly, early-stage focused, or even active in your sector. That’s why we’ve curated this quick-hit list of top VC firms worth knowing, especially if you're raising at the pre-seed to Series A stage.

| VC Firm | HQ | Stage Focus | What They’re Known For |

|---|---|---|---|

| Andreessen Horowitz (a16z) | California, US | Seed to Series B+ | Huge bets on crypto, AI, fintech, and SaaS. Portfolio includes Coinbase, Instacart, and Clubhouse. |

| Sequoia Capital | US & Global | All stages | One of the OGs. Backed Apple, Airbnb, WhatsApp, and Stripe. Very selective but high impact. |

| First Round Capital | US | Pre-seed & Seed | One of the best early-stage firms. Known for founder support and community. |

| Accel | US & Europe | Seed to Growth | Global player with a strong presence in Europe and India. Backed Facebook, Spotify, and Slack. |

| Index Ventures | London & SF | Seed to Growth | Very active in Europe. Portfolio includes Deliveroo, Revolut, and Notion. |

| Lightspeed Venture Partners | US, India, Israel | Seed to Series C | Known for backing Snap, Mulesoft, and more recently AI-first startups. |

| Kleiner Perkins | California, US | Seed to Series B | Deep history in Silicon Valley, now re-focused on early-stage innovation. |

| LocalGlobe | London, UK | Pre-seed & Seed | Strong UK focus. Backed Citymapper, Wise, Zoopla. Great for first-time founders. |

| Seedcamp | London, UK | Pre-seed & Seed | One of Europe’s most founder-friendly VC firms. Backed TransferWise, UiPath, Revolut. |

🎯 Pro Tip:

Research is good. Relevance is better.

Instead of cold-emailing 100 firms, start with the ones aligned to your startup’s stage and sector.

Try Evalyze.ai to find your top VC partners matches instantly, based on data, not guesswork.

How to Choose the Right VC Firm for Your Startup

Not all VC firms are a good fit, and that’s okay. The key is to find the ones who understand your space, believe in your stage, and feel like actual partners, not just people with checkbooks.

🧭 Here’s how to evaluate a VC before you pitch

-

Stage Fit: Do they invest at your current stage? (Pre-seed, Seed, etc.)

-

Sector Focus: Are they active in your industry, or are you outside their usual playbook?

-

Portfolio Style: Look at who they’ve backed before. Would your startup look at home in that group?

-

Partner Chemistry: This one’s underrated. If you can’t imagine getting on a Zoom with them during your worst week, think twice.

🗣️ VCs do their due diligence. You should too.

Want to speed up your fundraising process with AI?

Try these 5 ChatGPT Prompts That Help Founders Raise Funding Faster and start pitching smarter.

🕵️ Where to Find and Research VC Investors

You’ve got a few good options to start digging:

-

AngelList: Good for discovering early-stage investors.

-

Crunchbase: Great for seeing who invested in which startups, and when.

-

Evalyze.ai: Instantly match with relevant VC firms based on your startup’s stage, sector, and geography.

🎯 How to Stand Out When Reaching Out

Don’t just send the same cold email to 100 VCs. Here’s how to show you’ve done your homework:

-

Reference something from their blog, podcast, or portfolio.

-

Explain why your company aligns with their thesis.

-

Make the intro email short, specific, and confident.

💡 Bonus: if you include a link to your pitch deck, and even better if it’s already been reviewed.

Conclusion: Understand the Game Before You Play It

Raising capital is a big milestone, but here’s the truth most people won’t say out loud: getting money is the easy part. Finding the right investor, someone who gets your vision, sticks with you through the messy middle, and actually adds value, that’s where the real work is.

Approach your fundraising process like you would a key hire or co-founder. Be picky. Ask questions. Take your time. Because the investor you choose isn’t just backing your company, they’re joining your journey.

Ready to skip the spreadsheet and find your perfect VC match?

👉 Upload your pitch deck to Evalyze.ai and get investor matches that actually make sense for you.

More Articles

How to Create an Investor Campaign with Evalyze.ai

Simplify and Enhance Your Fundraising with AI-Driven Investor Matching.

July 10, 2025

How Long Does Fundraising Take?

Discover the typical timelines for raising startup funding and learn actionable strategies to accelerate your fundraising process.

June 9, 2025