How to Build an Investor Funnel + Template

Set up a founder-friendly investor funnel, CRM stages, lead segmentation, follow-ups, and conversion tracking, plus spreadsheet + Notion templates.

Fundraising gets messy when your “pipeline” is a bunch of browser tabs + vibes.

The goal is one system where you can answer: who’s worth contacting next, what’s blocking progress, and what your conversion rate looks like from intro → meeting → partner track.

What Is an Investor/Investment Funnel?

An investor funnel (also called an investment funnel) is a sequence of states an investor moves through, with clear exit criteria for each state, and it’s totally measurable.

A useful funnel has two layers:

- Fit layer: Should we even contact them?

- Process layer: What happened after we contacted them?

Example: if “Meeting booked” includes coffee chats and partner calls, your metrics will lie. You’ll think your funnel is healthy, while your “real meetings” are quietly stuck at zero.

Set Up an Investor CRM for Your Investor Pipeline in 30 Minutes

1. Choose one source of truth

Pick one place. Commit.

- If it lives in DMs and email threads, it doesn’t exist.

- If you’re early, a spreadsheet or Notion is enough.

- If you already run sales ops in HubSpot, you can mirror the same logic there using pipeline stages.

2. Define your investor pipeline stages

Use stages that force clean decisions. Here’s a set:

- Prospect (Unqualified): You found them, no fit check yet

- Qualified (Fit Confirmed): stage/sector/geo/check size match

- Contacted: first message sent (date required)

- Engaged: replied/asked for deck/intro accepted (reply/action required)

- Meeting 1: first real call happened (date required)

- Partner Track: moved beyond initial call (partner/IC/DD steps)

- Closed: Yes, committed/wired

- Closed: No, explicit no

- Parked: “later” with a reason + next check-in date

Non-negotiable: “Engaged” requires a response. Opens, likes, “seen,” and “my friend knows them” are not engagement. If you allow that drift, your funnel conversion rate becomes fantasy math.

3. Add reason codes for a real funnel report example

Reason codes are the difference between “we talked to 80 investors” and “we learned something useful.”

Use a short list you’ll actually apply:

- No fit: stage / geography / sector mismatch

- Not now: timing / already allocated

- Need more: traction / unclear positioning

- Didn’t respond: (separate from “No”)

Later, this becomes a real funnel report example: not only where you drop off, but why.

Don’t miss: Best Startup Hubs & Ecosystems for Fundraising

Investor Pipeline Segmentation: How to Segment Leads

The 4 segments that actually matter in a venture capital funnel

Segmentation isn’t bureaucracy. It’s how you protect your time.

- Core Fit (highest priority): stage + sector + check size match

- Edge Fit (worth testing): one mismatch but strategically valuable

- Network Leverage (best intro path): strong warm intro route

- Brand/PR Only (low priority): interesting name, weak fit

This keeps your outreach from turning into a celebrity scavenger hunt.

Fit score rubric for your investment process funnel

Give yourself a scoring rubric you can explain to a co-founder in 10 seconds.

Example 0-10 scoring:

- Stage match (0-3)

- Sector match (0-3)

- Check size match (0-2)

- Geo + thesis alignment (0-2)

Rule: below 6/10 goes to Edge Fit or Do Not Contact (Now). Not because they’re “bad” investors, but your round needs focus.

You might also like: 20 AI Fundraising Tools for Startups

Follow-ups Inside Your Investor Funnel

Follow-up cadence for an investor relations funnel

A follow-up should not be “just bumping this.” It should be “here’s what changed.”

Suggested cadence:

- Day 0: initial outreach (one clear ask: call or permission to send deck)

- Day 4-5: follow-up #1 (add one new data point: traction, milestone, customer signal)

- Day 10-12: follow-up #2 (“closing loop should I park this?”)

- Day 21+: only for a strong fit or warm intro path

This cadence does something important: it creates a natural “yes / no / later” fork, instead of infinite limbo.

Track “next action date” to keep the investor pipeline moving

This is the real engine of your CRM. Every active investor row must have:

- Next action date

- Next action type (follow-up, send deck, update, intro request)

If it’s blank, it’s dead weight. Blank rows are how founders end up “fundraising” while nothing is actually happening.

One-line context notes

Your future self will thank you for writing one line after every interaction:

- “Asked for deck.”

- “Wants metrics for Q1”

- “Intro via Sara, pending”

That single line prevents you from rereading a 17-email thread just to remember what you promised.

Worth bookmarking: 7 Investor Follow-Up Emails

Funnel Conversion Rate Tracking

Pick a small set and keep it consistent:

- Qualified → Contacted

- Contacted → Engaged (reply rate)

- Engaged → Meeting 1 (meeting rate)

- Meeting 1 → Partner Track

- Partner Track → Closed Yes

These conversion points map to decisions you can actually influence: list quality, message clarity, deck clarity, and follow-up discipline.

Funnel conversion rate formulas

Use formulas that are boring and truthful:

- Reply rate = Engaged / Contacted

- Meeting rate = Meeting 1 / Engaged

- Partner rate = Partner Track / Meeting 1

- Close rate = Closed Yes / Partner Track

- Time-to-next-step = median days per stage

Time metrics matter because funnels can “look fine” while silently stalling. A pipeline with 20 “active” investors is meaningless if 15 haven’t been touched in 18 days.

Weekly funnel report example (10 minutes) + quarterly investor report backbone

Once a week, write a six-line update:

- New qualified added

- New contacted

- New engaged

- Meetings held

- Moved to partner track

- Closed yes/no + top stall reason code

This is also raw material for a quarterly investor report later: it captures momentum, decisions, and learnings without reconstructing history from memory.

Founder's favourite: AI-Powered Investor Outreach: What Works and What Doesn't

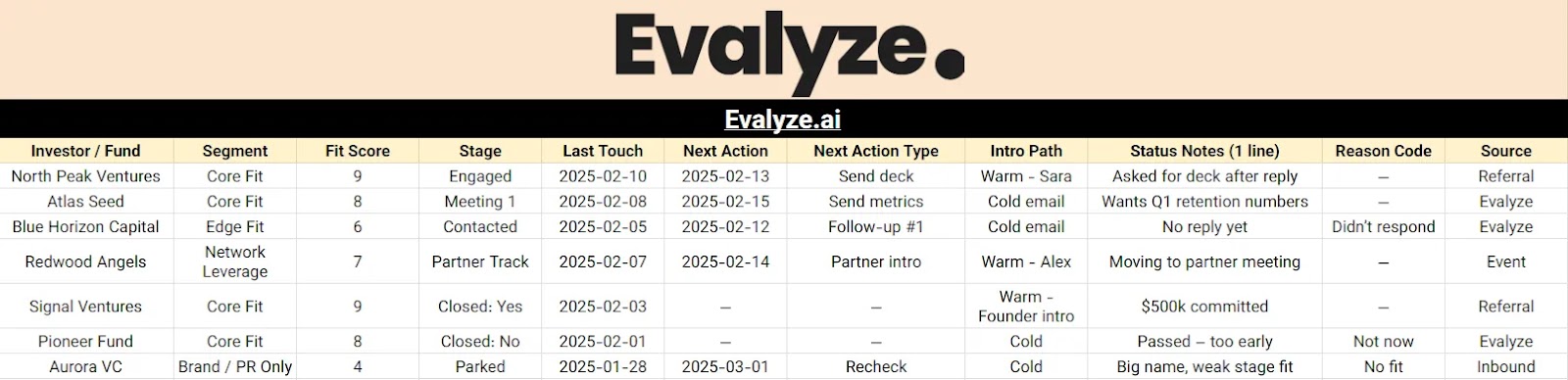

Investor Funnel Template

Investment funnel template spreadsheet (tabs + columns)

Tab 1: Investors (master)

- Investor / Fund

- Segment

- Fit score

- Stage

- Last touch date

- Next action date

- Next action type

- Intro path

- Status notes (1 line)

- Reason code (if No/Parked)

- Source (Evalyze / referral / event / inbound)

Tab 2: Metrics

- Count by stage

- Conversion rates

- Median days between stages

- Stuck list (active + overdue)

Tab 3: Outreach log (optional)

- Date / investor / message type / outcome

Tip: In Tab 2, you can create an investment funnel chart by counting each stage and graphing the results. The chart is not the goal; the definitions are.

Investor funnel template in Notion

Notion works well because you can create multiple views over the same database (actions today, stalled, core fit only).

Properties:

- Stage, Segment, Fit Score

- Last touch, Next action, Next action type

- Intro path, Reason code, Notes

Views:

- Today’s Next Actions

- Stuck This Week

- Core Fit Only

- Closed No (with reasons)

Where Evalyze.ai Helps in the Investor Funnel

Evalyze investor matching to build a fit-first investor pipeline

.jpg)

List-building is where founders waste weeks. Evalyze.ai investor matching helps you start with a fit-first investor pipeline by filtering investors by stage, sector, and check size, then exporting that list into your CRM with clean fields (investor, notes, segment starter).

Practical tip: Treat Evalyze output as Prospect until you run your quick fit score pass. That keeps your CRM honest.

Evalyze pitch deck analysis to lift funnel conversion rates before scaling outreach

.jpg)

If your deck is unclear, scaling outreach just spreads confusion faster.

Evalyze.ai pitch deck analysis helps you spot what’s not landing (positioning gaps, narrative jumps, metrics that raise questions) before you push Contacted volume. The goal isn’t perfection, it’s removing the “wait, what do they actually do?” moments that kill Engaged → Meeting 1.

Workflow:

- Run the deck through Evalyze

- Fix the top clarity issues

- Then scale Contacted outreach

Close the loop: reason codes → deck fixes → re-check with Evalyze

Your CRM will tell you what to fix if you let it.

- Tag no’s by reason code (“unclear ICP”, “pricing unclear”, “market too broad”)

- Look for patterns across 10–20 outcomes

- Update the deck (or your narrative) to address the pattern

- Re-check with Evalyze to sanity-check the improvement

This is how your funnel gets better without sending more messages.

Venture Capital Funnel Mistakes That Break Your Metrics

1. Engaged includes opens → engaged = reply/action only

Email opens are noisy (privacy features, preview panes, accidental opens). If you treat opens as “engagement,” your reply rate looks great while your meeting rate stays flat.

Count Engaged only when the investor does something observable: replies, asks for the deck, accepts an intro, or proposes a time.

2. No next action dates → every active row has a next step

A pipeline without next actions is just a list. “Active” should mean there’s a scheduled move: follow-up, send materials, intro request, or update.

If an investor has no next action date, they’re not in the funnel; they’re in storage.

3. Chasing Edge Fit because famous → protect Core Fit time

Big-name funds can be strategically useful, but they can also hijack your calendar while your highest-probability investors wait.

If you don’t ring-fence time for Core Fit, your funnel gets top-heavy: lots of “Contacted,” very little “Partner Track.”

4. Tracking counts only → track time-in-stage too

Counts tell you volume. Time tells you the truth. A funnel can look “healthy” (many investors at each stage) while it’s actually stalled (no one moves for 2-3 weeks).

Track median days per stage and create a “stuck” view (e.g., last touch > 7 days for active stages) so delays show up immediately.

Before you go: What Is Venture Capital?

FAQ

1. What’s a “good” funnel conversion rate for an investor funnel?

Use your baseline first. Before you benchmark, lock your stage definitions and reason codes so the numbers mean something.

2. Spreadsheet vs Notion for an investor funnel template: what’s better?

Use what you’ll maintain daily. A “worse” tool that stays updated beats a perfect tool you abandon.

3. How many investors should be active in an investor pipeline at once?

Small enough that each follow-up stays specific and memory-based. If you can’t explain “why this investor” in one sentence, you’re over capacity.

More Articles

When’s the Right Time to Seek Funding? (And the 3 Questions to Ask First)

How to know if your startup is truly investor-ready and avoid costly mistakes.

July 26, 2025

5 ChatGPT Prompts That Help Founders Raise Funding Faster

Five targeted ChatGPT prompts to streamline your startup’s fundraising by crafting compelling pitch decks, emails, and investor messaging.

July 23, 2025