Pre-Seed Fundraising Checklist: Investor-Ready Signals

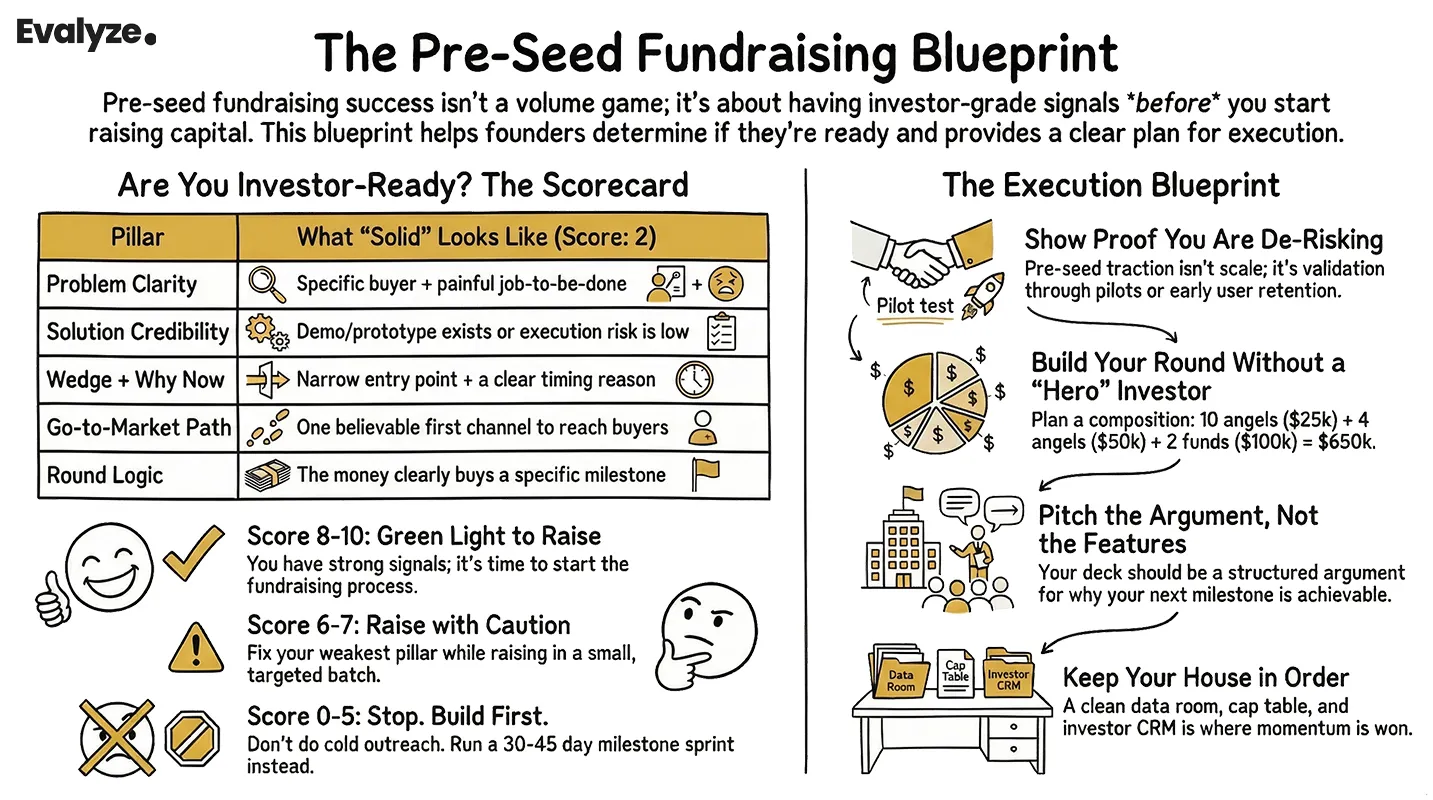

A practical pre-seed fundraising checklist, readiness scorecard, traction milestones, cheque sizes, investor types, SAFE terms, and pitch focus, plus a clean plan.

Pre-seed fails less because "the market is tough" and more because founders raise before they have investor-grade signals.

Here's the clean definition: pre-seed is the earliest outside capital, often before revenue, used to turn an idea into proof (prototype, validation, early users).

This pre-seed fundraising checklist is a decision tool. It answers five questions:

- Am I ready to raise now?

- What traction matters for my model?

- What cheque sizes are realistic?

- Who invests at pre-seed?

- What should I emphasize in the pitch?

Key Takeaways

- Pre-seed is a signal filter, not a volume game.

- Use a /10 readiness scorecard to decide whether to raise now or wait for a milestone sprint.

- Traction = de-risking (pick milestones that match your model).

- Build the round with a cheque-size composition, not a single hero investor.

- Keep your cap table, data room, and investor CRM clean. This is where momentum dies.

1) Readiness Assessment

Score each pillar: 0 = weak, 1 = partial, 2 = solid

Total: 10

| Pillar | What "2/2" looks like |

|---|---|

| Problem clarity | Specific buyer + painful job-to-be-done + clear stakes |

| Solution credibility | Demo/prototype exists, or credible execution reduces build risk |

| Wedge + why now | Narrow entry point + timing reason (regulation, cost shift, platform change, behaviour change) |

| Go-to-market path | One believable first channel + why you can reach buyers efficiently |

| Round logic | The money buys a milestone; you can say what changes in 90 days |

Interpretation

- 8-10: Raise now.

- 6-7: Raise in a small batch while you fix one weak pillar.

- 0-5: Don’t run cold outreach yet. Run a milestone sprint first.

Pro Tip:

If you scored 0-5, write a 30-45-day sprint plan with one output per weak pillar (e.g., "3 LOIs," "prototype benchmark," or "ICP + channel test"). Then re-score.

Must Read: When’s the Right Time to Seek Funding?

2) Traction Milestones That Count (Pick 2-3 That Fit Your Model)

At pre-seed, traction is not "scale." It's de-risking.

The pre-seed goal is to build a prototype, validate the idea, and prove that founders can often execute on SAFEs or convertible notes because valuations are hard this early.

Traction Milestones That Count.webp)

B2B SaaS (sales-led)

Good milestones:

- Design partners with success criteria (not vague interest)

- Pilot with a champion + scope + timeline

- Early usage pattern (repeated use by the target role)

PLG / self-serve SaaS

Good milestones:

- A clear activation ("aha") event

- Retention by cohort (direction matters, even on small n)

- One channel that repeatedly brings qualified users

Marketplace

Good milestones:

- One side is solved in a narrow niche (supply or demand)

- Repeat behaviour (repeat listings/orders/bookings)

- Evidence expansion won't break unit economics

Deep tech / biotech / hardware

Good milestones:

- Technical risk reduction (prototype, benchmark, validation step)

- A credible plan to the next de-risk milestone (often more valuable than early revenue)

Example:

A B2B founder stops pitching AI for operations and pitches reducing manual reconciliation for mid-market clinics. They run 20 interviews, get 4 LOIs, ship a narrow demo, and convert 2 LOIs into a pilot. That's a fundable story because it's measurable.

Worth bookmarking: How Venture Capitalists Really Think

3) Typical Cheque Sizes, Round Size Reality, and SAFEs

Stripe frames pre-seed rounds of a few hundred thousand to a million dollars, often done via SAFEs or convertible notes. Stripe also cites a median pre-seed SAFE raise amount of about $700,000 in 2025.

Carta's U.S.-based dataset (Q3 2025) shows startups raised $965M across 5,660 instruments (SAFEs + convertible notes), and that most pre-seed fundraises occur on post-money SAFEs.

-Typical-Cheque-Sizes.webp)

How to build the round

Don't plan around one hero cheque. Plan a composition that still closes without it.

Example composition:

- 10 angels at $25K

- 4 angels at $50K

- 2 micro funds at $100K

That's $650K without needing a single "save-the-round" investor.

Explore more: How to Build an Investor List Based on Your Startup

Dilution, valuation cap, and why post-money matters

Pre-seed terms are where founders accidentally lose future flexibility. Stripe notes it's not unusual to give up 10%-20% at pre-seed, even when using SAFEs/notes.

You don't need to guess dilution. With a post-money SAFE, you can model it directly: If you raise $500K on a $5M post-money valuation cap, that's roughly 10% ownership sold (500K/5M).

4) Who Invests at Pre-Seed

Different investor types filter for different signals. Most wasted fundraising happens when you pitch the right story to the wrong filter.

-Who-Invests-at-Pre-Seed.webp)

- Angels / operators: founder credibility, insight, speed, early customer pull.

- Angel groups / syndicates: a clear champion + a story that's easy to share.

- Pre-seed funds / micro-VCs: "Will this become seed-ready with this money?"

- Accelerators: velocity + clarity + coachability (plus a network effect).

Time-saving rule: If you can't write a "why this investor" note in one sentence, don't send the first email.

Popular on Evalyze: How to Find Angel Investors for Your Startup

5) Pitch Focus Points: What To Emphasize

Your pre-seed pitch deck is not a feature tour. It's a structured argument that your next milestone is likely to happen.

-Pitch-Focus-Points.webp)

The pitch hierarchy

- Insight + why now

- Wedge (who you start with and why you win there)

- Proof (your best 1–2 signals)

- GTM plan (first channel + why it's credible)

- Economics (pricing logic; show you understand the business)

- Use of funds (what this round buys + timeline)

- Team (founder–market fit, specific)

Cut unless it's firm

- Bloated TAM slides

- Generic competitor grids

- Feature lists that don't map to a buyer's pain

You might also like: What Is a Pitch Deck?

6) The Investor Materials Checklist

Investors may move fast at pre-seed, but they still expect basic diligence readiness.

-The-Investor-Materials-Checklist.webp)

Pre-seed data room checklist (starter set)

- Incorporation docs + cap table (clean, current)

- Founder equity split, vesting, IP assignment (signed)

- Product demo + roadmap to the next milestone

- Traction evidence (LOIs, pilot scope, cohort retention snapshot, benchmarks)

- SAFE/convertible templates + key terms (cap, discount if any)

Investor CRM minimum viable fields

- Investor type (angel / micro-VC / fund), stage focus, cheque size

- "Why them?" note

- Current stage (contacted / meeting / DD / soft commit / committed)

- Next action date + owner (so nothing rots)

This is the unsexy part that quietly wins rounds.

Before you go: Startup Due Diligence: The Complete Founder’s Guide

Where Evalyze.ai fits

Once your signals are real, the bottleneck is usually clarity + targeting + iteration.

Evalyze.ai helps with three things:

- Pitch deck analysis: find weak signals, missing logic, and investor-style objections fast

- AI investor matching: build a stage-fit list (so you stop pitching seed funds that don't do pre-seed)

- Pitch deck coach: tighten narrative + structure with guided feedback

Use it to sanity-check readiness and sharpen your deck before you go wide.

FAQ

1. What is a pre-seed round?

Pre-seed is the earliest outside capital, often before revenue, used to build a prototype and validate the idea.

2. SAFE vs convertible note at pre-seed: what's common?

Most pre-seed fundraises occur on post-money SAFEs, with notes also used.

3. How much dilution happens in early rounds?

It varies. It's not unusual to give up 10%-20% at the pre-seed stage. For priced seed rounds, Carta reports median seed dilution around 20.1% (Q1 2024).

More Articles

How to Build an Investor Funnel + Template

Set up a founder-friendly investor funnel, CRM stages, lead segmentation, follow-ups, and conversion tracking, plus spreadsheet + Notion templates.

December 28, 2025

Fundraising Automation for Startups

What to automate in fundraising (CRM, follow-ups, data rooms) and what not to. A trust-first playbook that won’t look like a bot farm.

December 25, 2025