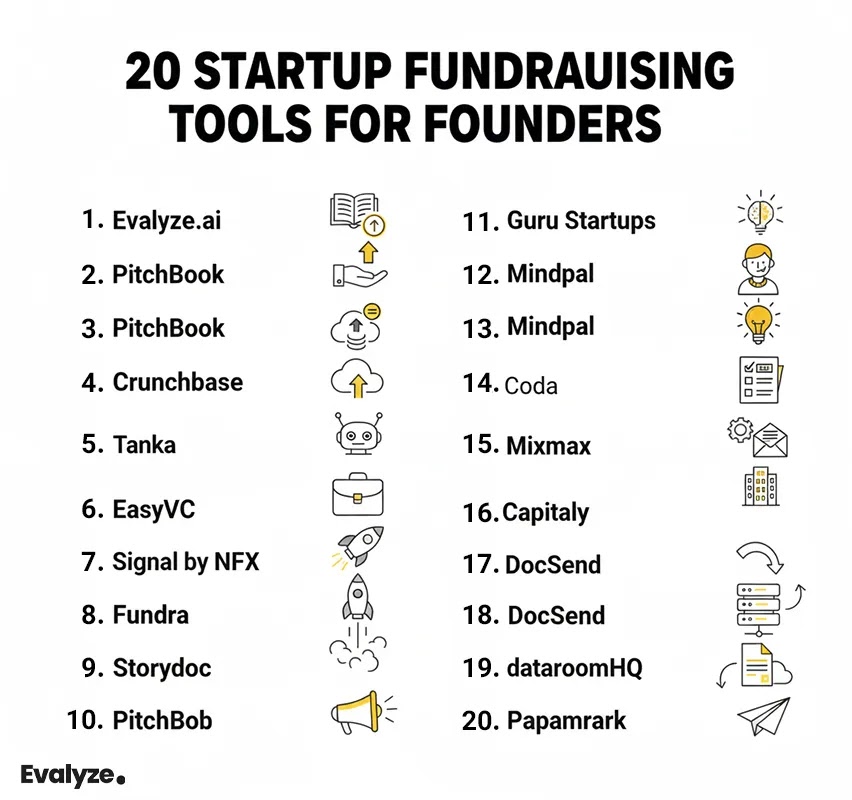

20 AI Fundraising Tools for Startups

A founder-friendly guide to 20 AI tools for investor matching, pitch decks, outreach, and data rooms, plus a practical workflow to use them.

Founders don't struggle with "finding tools." They struggle with turning tools into momentum.

Most fundraising pain looks like one of these:

- You're meeting "investors," but they're the wrong type (stage mismatch, thesis mismatch, geography mismatch).

- Your deck is unclear in the exact places investors use to say no (traction logic, business model clarity, "why now").

- You're doing outreach, but you can't tell what's working because everything lives in scattered docs, inbox threads, and half-updated spreadsheets.

A useful AI stack solves this with a clean sequence:

Prepare → Target → Reach → Track → Close

Below is a list of 20 tools across those steps, plus a workflow you can actually follow.

Key Takeaways

- "AI fundraising tools" should reduce search, story, follow-up, or diligence costs; otherwise, skip them.

- Investor matching is only useful when it's anchored to your actual stage, category, and round shape.

- Deck tools are best used before outreach, not after you've burned warm intros.

- Engagement analytics (DocSend/Papermark) are most valuable when you already have a clean next-step process.

What "AI fundraising tools" should do (so you don't buy noise)

A fundraising tool is worth paying for if it reduces one of these four costs:

- Search cost: finding investors who actually invest in startups like yours

- Story cost: turning your deck into a crisp, investor-readable case

- Follow-up cost: keeping outreach consistent without becoming a robot

- Diligence cost: answering investor questions fast with clean documentation

If a tool doesn't reduce one of those costs, it's probably just an expensive place to store anxiety.

Category 1: Investor Matching & Discovery

These help you answer: "Who invests in something like us, at our stage, right now?"

1) Evalyze.ai

Use it when you want to match angels/investors based on your startup info and sanity-check your deck before outreach. Evalyze's own overview frames it as investor matching, deck upload/assessment, and campaign-style organization.

Best for: founders who want fewer, higher-fit conversations (instead of blasting lists).

2) PitchBook

PitchBook positions itself as a deep investment data platform used for investor discovery and market activity tracking (and promotes AI capabilities inside its research workflows).

Use it: if you're doing serious investor research and care about historical patterns and firm activity signals.

3) Crunchbase

Crunchbase is widely used to filter companies and investors and track funding activity; it also offers AI-driven discovery and insights within the product experience.

Use it: when you want fast list-building + ecosystem context for a sector.

4) CapitalReach ai

CapitalReach describes an all-in-one approach combining AI matching, outreach, and a pipeline (positioned explicitly as "AI-powered matching + automated outreach + CRM pipeline").

Best for: founders who want a single workspace for early targeting + sending.

5) Tanka AI Fundraise Agent

Tanka markets a "fundraise agent" concept: identifying prospects, optimizing decks, and automating pipelines, blending AI with human-guided support.

Best for: founders who want a guided process, not just a database.

6) EasyVC

EasyVC explicitly pitches AI-based investor matching plus LinkedIn outreach automation and "warm intros through founders."

Reality check: anything that automates LinkedIn actions should be used carefully (account restrictions are real).

7) Fundra

Fundra positions itself around investor discovery, activity signals, warm intro paths, and outreach tools (and mentions verified contact details).

Best for: founders who believe warm intros are the game (often correct).

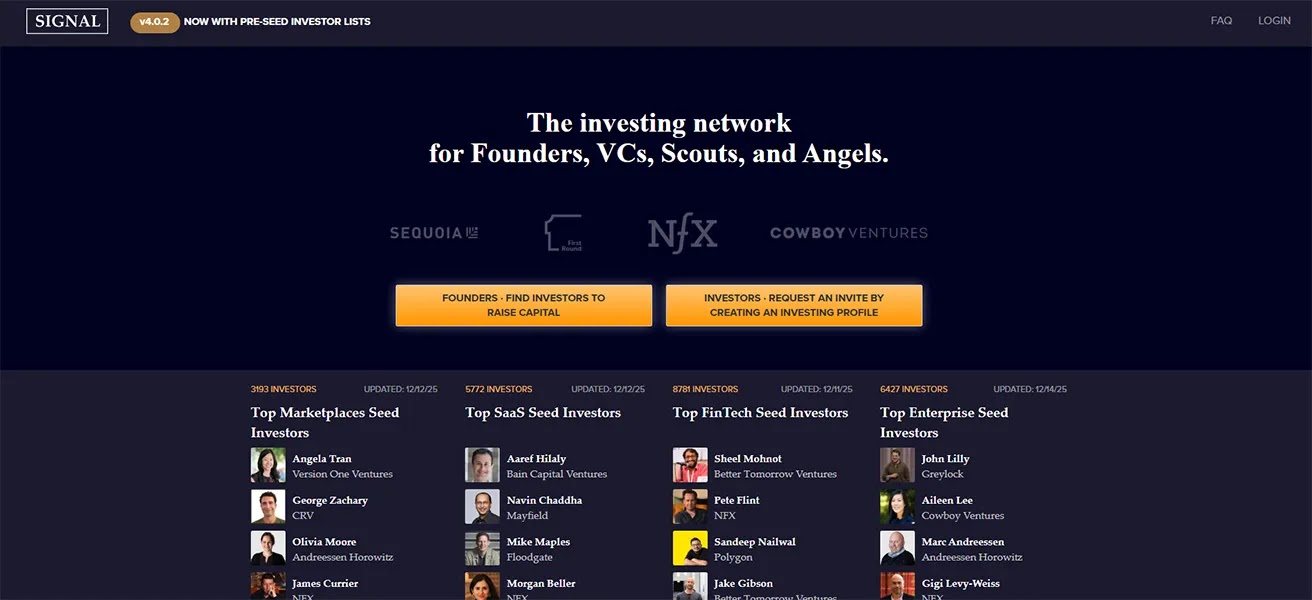

8) Signal by NFX

Signal is positioned as a matchmaking-style platform that connects startups and investors through structured profiles.

Category 2: Pitch Deck & Storytelling

These help you answer: "Is my story investor-readable in 3 minutes?"

9) Storydoc

Storydoc markets interactive pitch decks and presentations, built to be more engaging than static slides.

Best for: founders who want a more product-like experience than "PDF + hope."

10) PitchBob

PitchBob positions itself as an AI pitch deck/startup document generator.

Best for: early drafts, structure scaffolding, and getting unstuck.

11) Guru Startups

Guru Startups claims multi-point pitch deck analysis (50+ dimensions) and frames it as "AI-powered pitch deck analysis."

Best for: stress-testing narrative and diligence-style questions early.

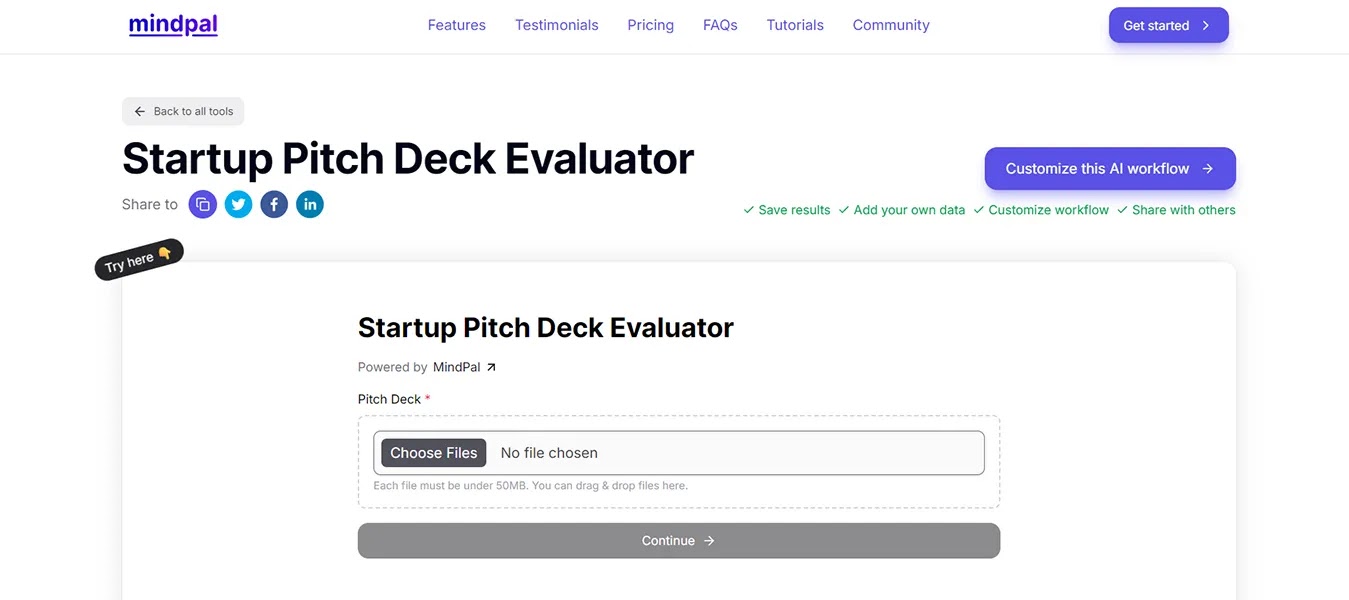

12) Mindpal

Workflow-based AI tools for pitch decks, including a Startup Pitch Deck Evaluator and "Business Idea Evaluation from Pitch Deck." Useful for founders who want structured feedback or benchmarking.

Category 3: Outreach & Email Automation

These help you answer: "Can I run a clean process without losing my mind?"

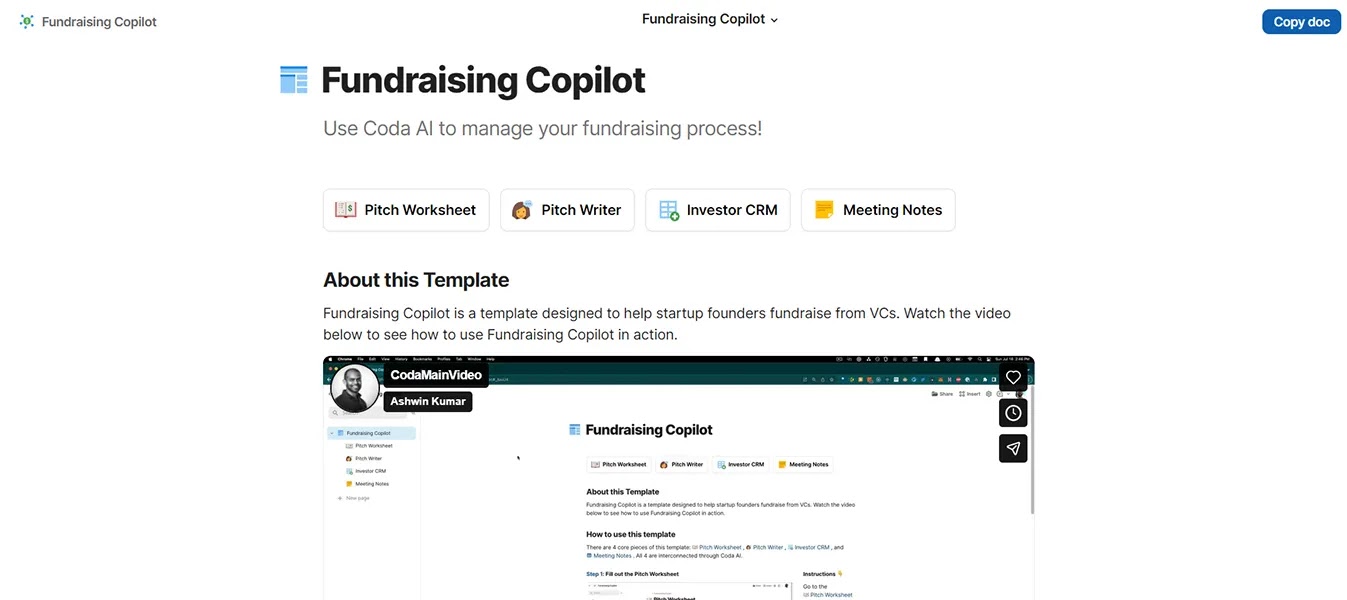

13) Coda "Fundraising Copilot" template

A practical fundraising workspace template that helps founders run an investor CRM, draft pitch notes/emails with AI, and keep meeting notes + next steps organized in one place. (Better than a prompt library because it's an actual operating system for the round.)

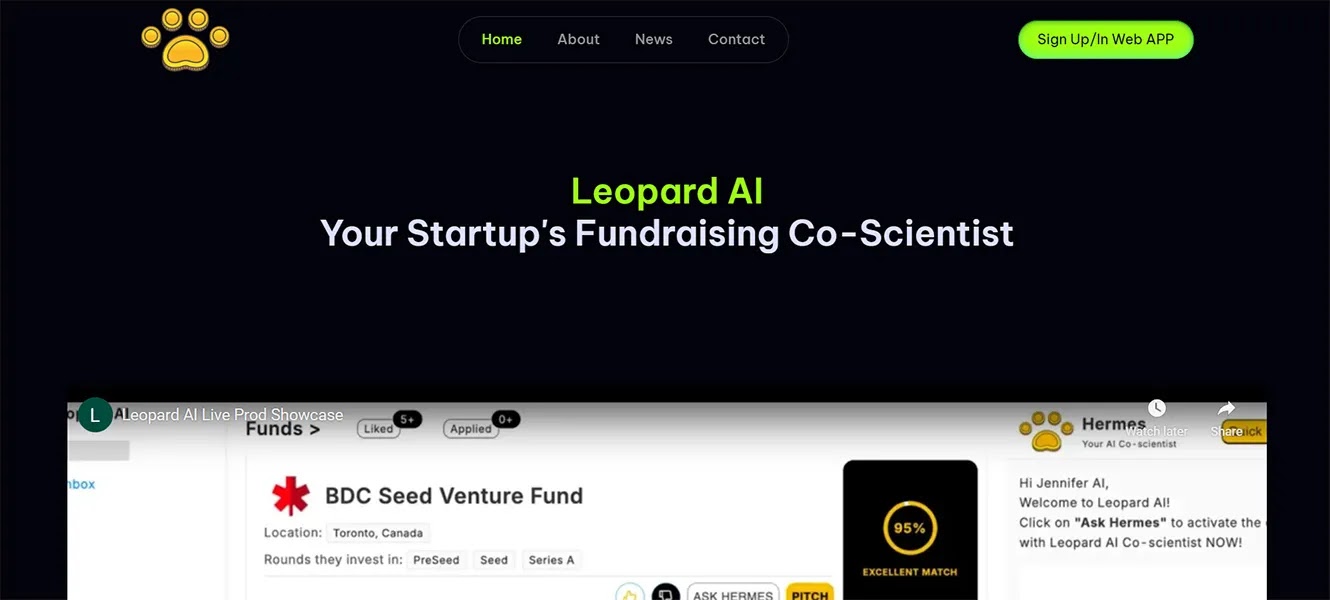

14) Leopard AI (fundraising)

Leopard AI is described in fundraising roundups as an outreach/research copilot; there's also a Leopard AI site describing itself as a platform for founders.

15) Mixmax

Mixmax is a well-known email productivity tool (for tracking, scheduling, and sequences) used for outbound workflows.

16) Capitaly (AI fundraising CRM angle)

Capitaly publishes guidance around AI recommendations inside fundraising CRM workflows. Treat as useful for workflow ideas; verify product capabilities if you're buying software.

Category 4: Data Rooms & Due Diligence

These help you answer: "Can investors get answers fast without chaos?"

17) DocSend

DocSend is widely used for secure deck sharing and engagement analytics (who viewed, what they viewed, when).

18) dataroomHQ

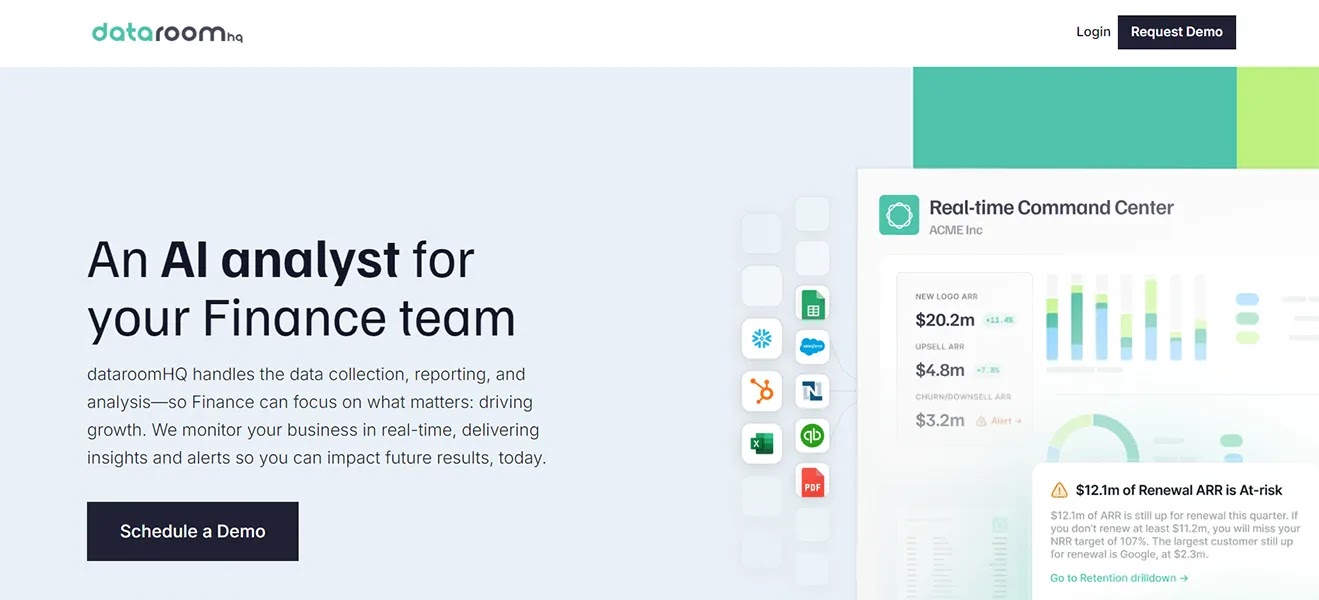

Despite the name, dataroomHQ positions itself more around automated reporting + insights for finance teams; it's also been covered as a company that helps investors evaluate companies and helps companies report/analyze metrics.

19) Humata ai

Humata markets "ask questions of your documents" workflows, practical when diligence is document-heavy and time is short.

20) Papermark

Papermark is positioned as a DocSend-style document-sharing + data-room tool, with analytics and strong "control/branding" vibes; it's also described in community comparisons as a common alternative that founders consider.

How To Use AI Tools For Fundraising

Step 1: Prepare (deck clarity before outreach)

- Run your deck through a deck feedback tool (or Evalyze) to catch the predictable "no" triggers: unclear traction logic, fuzzy business model, weak why-now.

- Output you want: a deck that makes the next meeting obvious, not "a pretty narrative."

Step 2: Target (fit > volume)

- Build a list by stage + sector + check size + geography.

- Use Evalyze-style matching (startup info → investor shortlist), so your outreach starts from relevance, not hope.

Step 3: Outreach (process beats heroics)

- Use sequencing tools (like Mixmax) to keep follow-ups consistent.

- Keep personalization: reference one relevant portfolio pattern or thesis angle, not a 200-word AI paragraph.

Step 4: Track (one source of truth)

- You need one pipeline view: who's in, what stage, last touch, next step, and blocking question.

- If your system can't answer "who do I follow up with today?" in 10 seconds, it's not a system.

Step 5: Close (diligence without scrambling)

- Use DocSend/Papermark-style sharing and analytics so you can follow up with timing signals.

- Use document Q&A (Humata) when diligence gets dense.

Where Evalyze fits

Two moments kill most rounds:

- Deck confusion early → investors quietly pass

- Bad targeting → you spend weeks pitching investors who never invest in your shape of company

Evalyze.ai is designed around those two moments: pitch deck assessment + angel/investor matching based on your startup info, so you start with a tighter story and a more relevant shortlist.