How to Build an Investor List Based on Your Startup

Learn how to build an investor list with Evalyze.ai. Step-by-step guide to find matched investors, shortlist the best fit, and raise smarter.

If you’re asking how to build an investor list, you’re already ahead. The fastest path is to combine a clear thesis (who should fund you and why) with a tool that filters thousands of investors by stage, geography, cheque size, traction, and industry.

Below is a simple workflow using Evalyze.ai to generate a precise, prioritized list.

Quick Overview:

- Sign up for Evalyze (free).

- Go to Fundraising → Campaign → + New Campaign.

- Complete the 6-step matching (stage, geography, round size, revenue, industries, short pitch).

- Click Find Investors.

- Review your matches and shortlist the best fit.

- Repeat with variations (e.g., different geos or round sizes) to create additional campaigns and widen your funnel.

Why start here?

A good investor list isn’t “everyone with a fund.” It’s a curated set of partners who:

- Invest at your stage (Pre-Seed, Seed, etc.)

- Write checks in your target range

- Actively invest in your industry and region

- Appreciate your traction level and story

Evalyze turns those criteria into matches so your outreach is warmer, tighter, and more likely to convert.

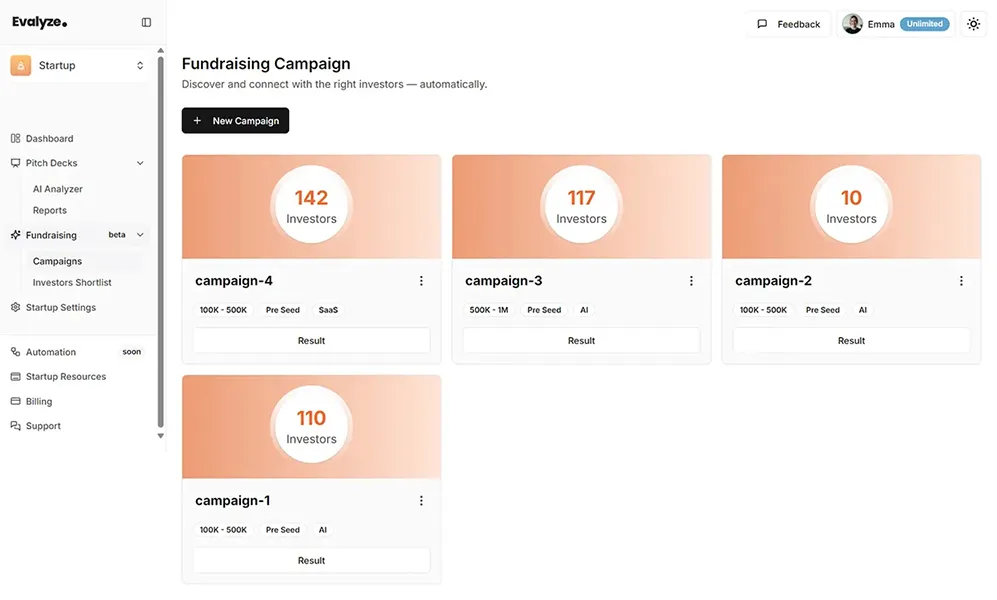

Step 1: Create your fundraising campaign

Path: Fundraising → Campaign (left sidebar) → + New Campaign

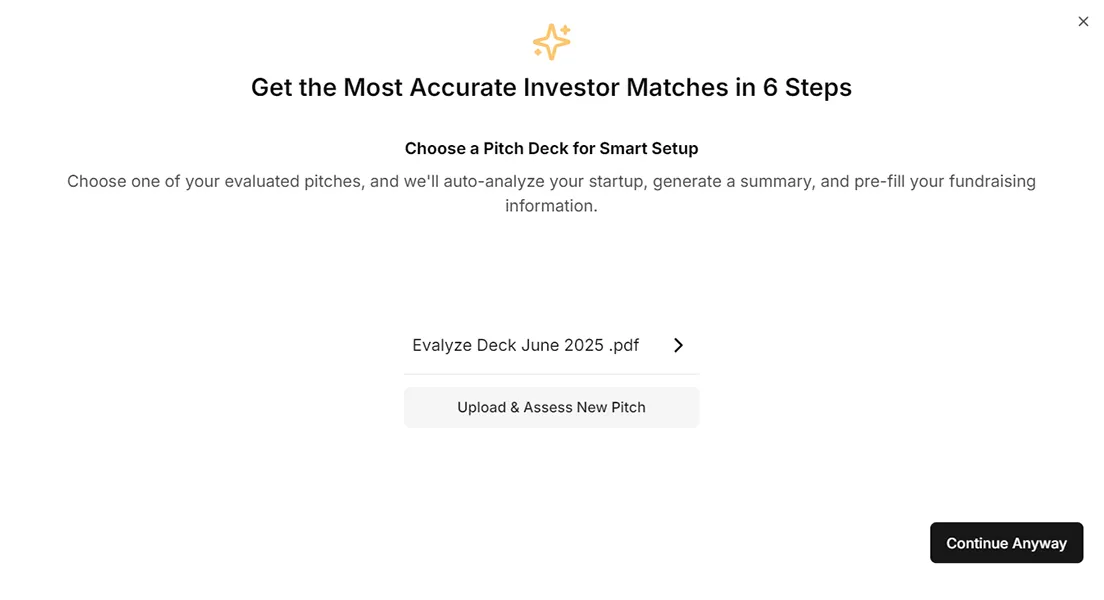

You’ll see a setup window: “Get the Most Accurate Investor Matches in 6 Steps.”

You can upload your pitch deck (recommended) or continue without it for now.

💡Pro tip: If your pitch deck is ready, upload it. Deck context helps refine matches and can improve response rates later.

Step 2: Complete the 6 matching questions

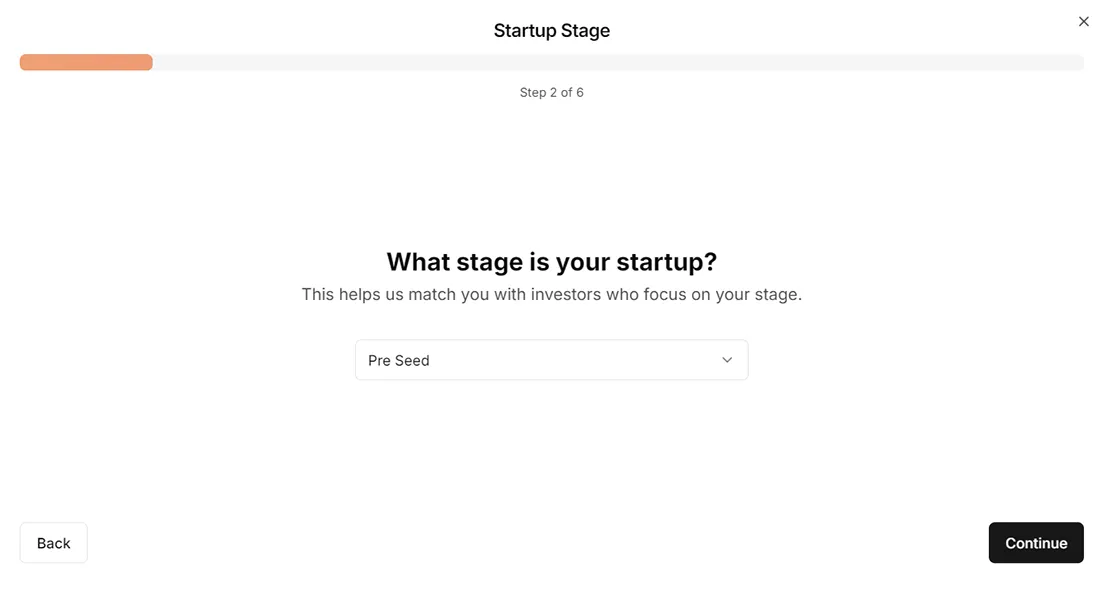

1) What stage is your startup?

Choose the nearest fit (e.g., Pre-Seed, Seed, etc.).

Why it matters: Partners specialize by stage. Picking the right one avoids “too early/too late” dead ends.

💡Tip: If you’re between stages, pick the earlier one and note traction in your short pitch.

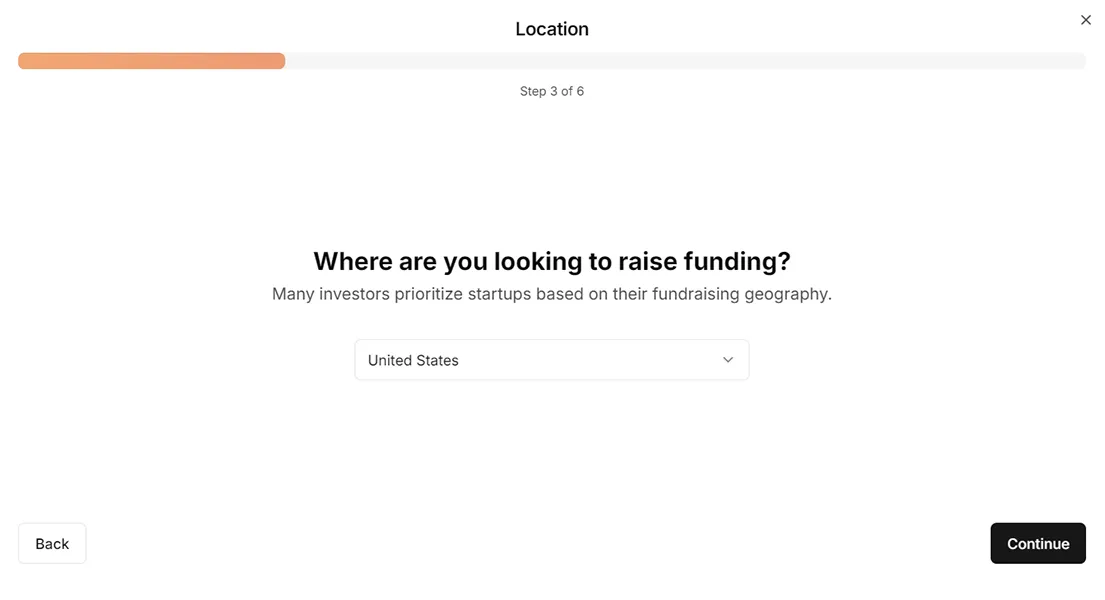

2) Where are you looking to raise funding?

Select your primary country/region.

Why it matters: Many funds prioritize local or region-focused deals for network effects and legal familiarity.

💡Tip: If you’re open to multiple regions, create one campaign per region for cleaner segmentation.

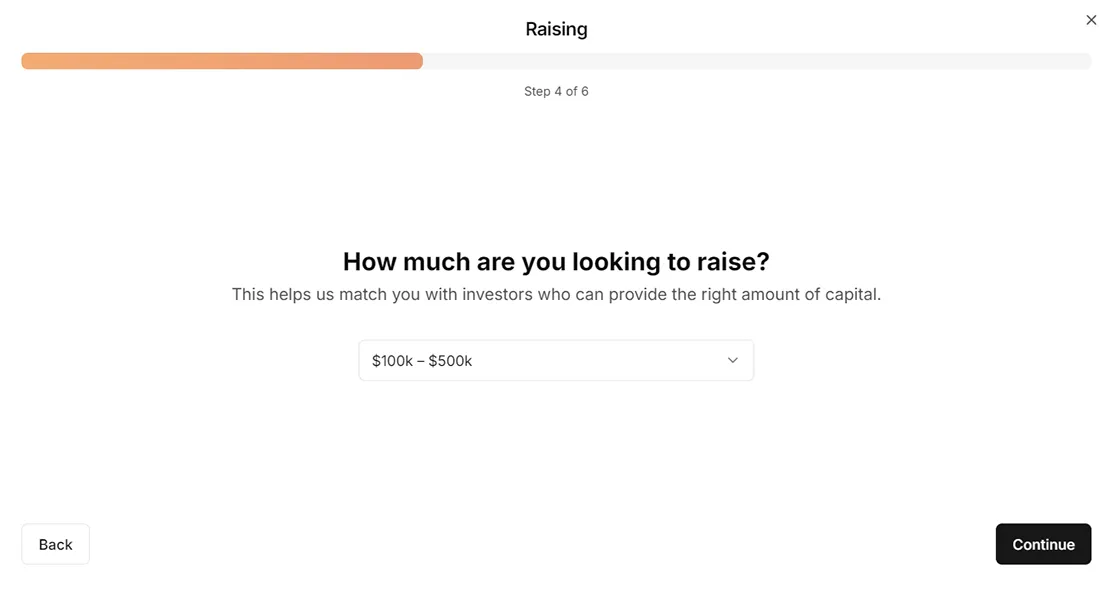

3) How much are you looking to raise?

Choose the round size (e.g., $100k–$500k, $500k–$1M, etc.).

Why it matters: Funds have target cheque sizes and ownership goals. Right-sized asks improve fit and speed.

💡Tip: If you’re flexible, run two campaigns (e.g., $500k–$1M and $1M–$2M) to see which investor pool looks stronger.

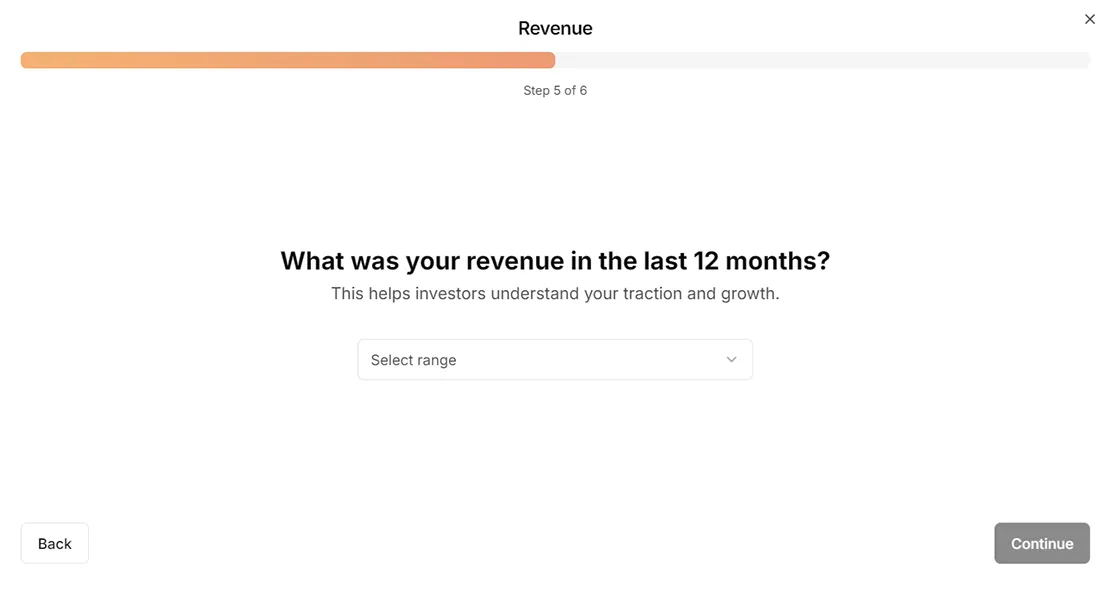

4) What was your revenue in the last 12 months?

Pick what’s true now (e.g., Pre-revenue, < $10k, $10k–$50k, …).

Why it matters: Traction signals stage readiness and narrows the investors who back your maturity level.

💡Tip: If you’re pre-revenue, mention proof points (waitlists, pilots, LOIs) in your short pitch.

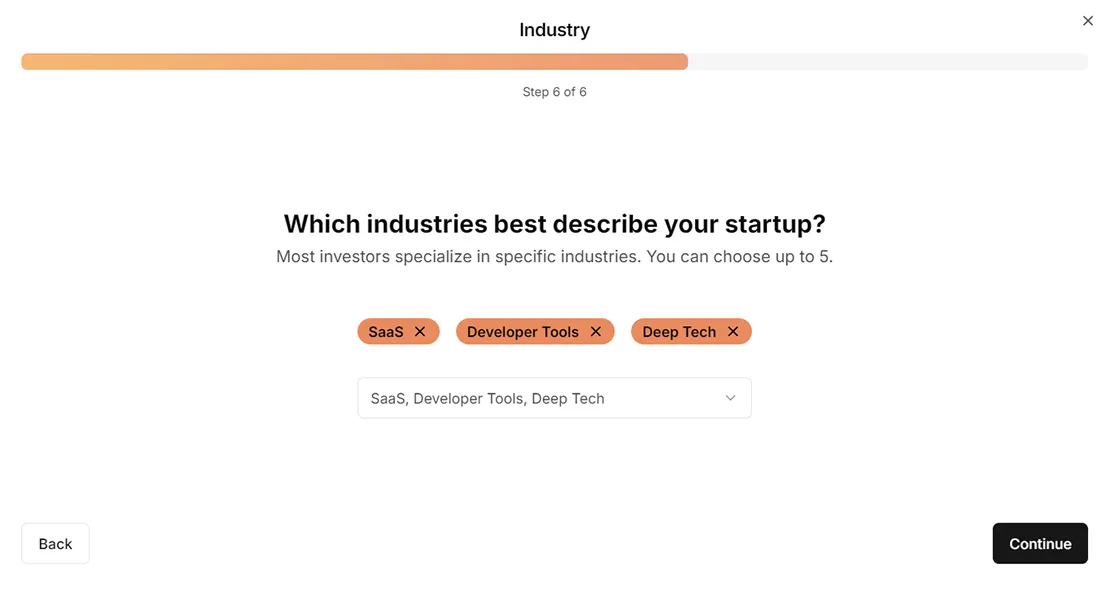

5) Which industries best describe your startup?

Choose up to 5 industries.

Why it matters: Most partners specialize. Clear categorization gets you in front of investors who “get” your market.

💡Tip: If your niche is more specific than the options (e.g., “Fintech payments compliance”), spell that out in the short pitch so investors immediately see the fit.

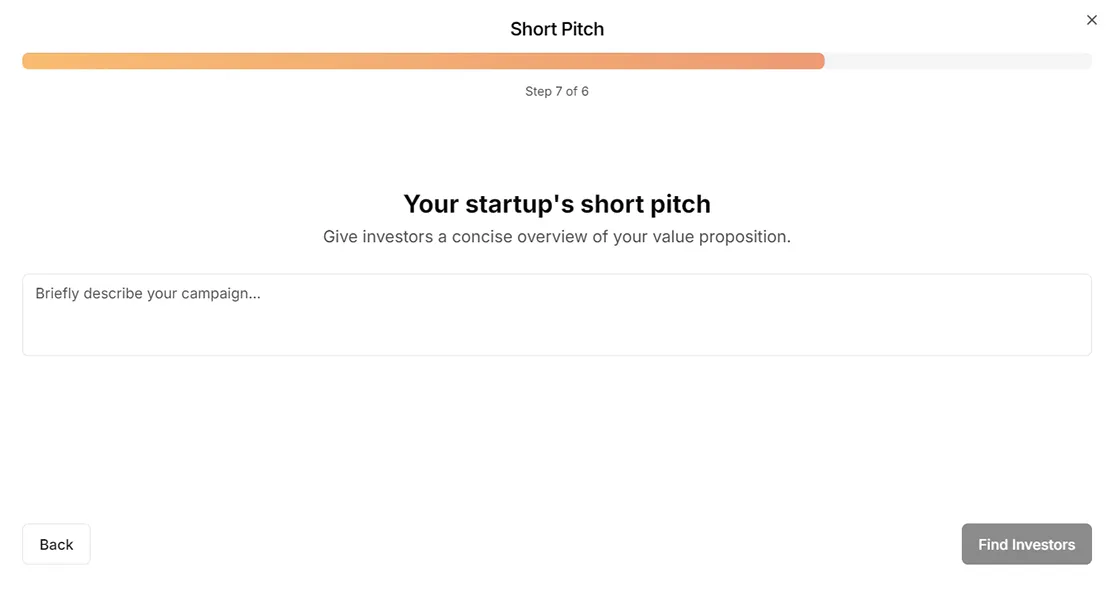

6) Write your short startup pitch

One crisp paragraph (3–5 lines):

- What you do (problem → solution)

- Who for (ICP/customer)

- Why now / edge (insight, tech, distribution)

- Proof (metrics, pilots, revenue)

- Ask (raising $X for Y milestones)

Example:

“Acme Health automates prior authorization for US specialty clinics. We reduce approvals from 12 days to 48 hours using payer-trained models and EHR integrations. In 6 months, 27 clinics onboarded; 92% physician NPS; $38k MRR. Raising $1.2M to expand integrations (Epic/Cerner), add three payers, and hit $120k MRR in 12 months.”

Step 3: Click Find Investors

Hit Find Investors and let Evalyze analyze your inputs. You’ll get a list tuned to your stage, geography, round size, revenue band, and industry tags.

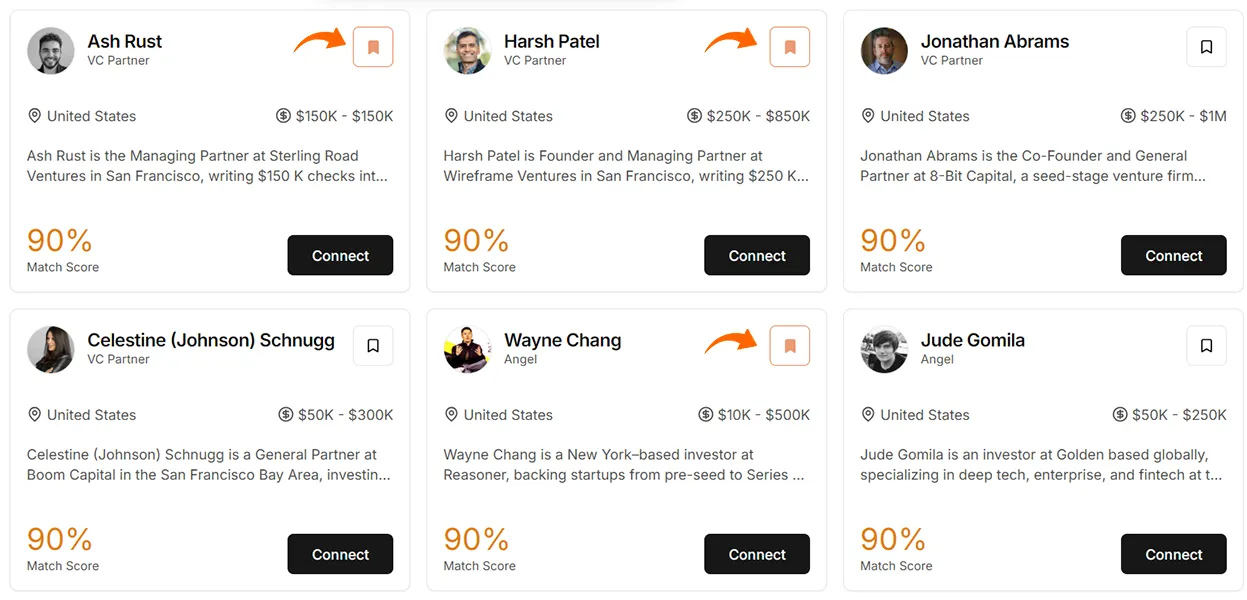

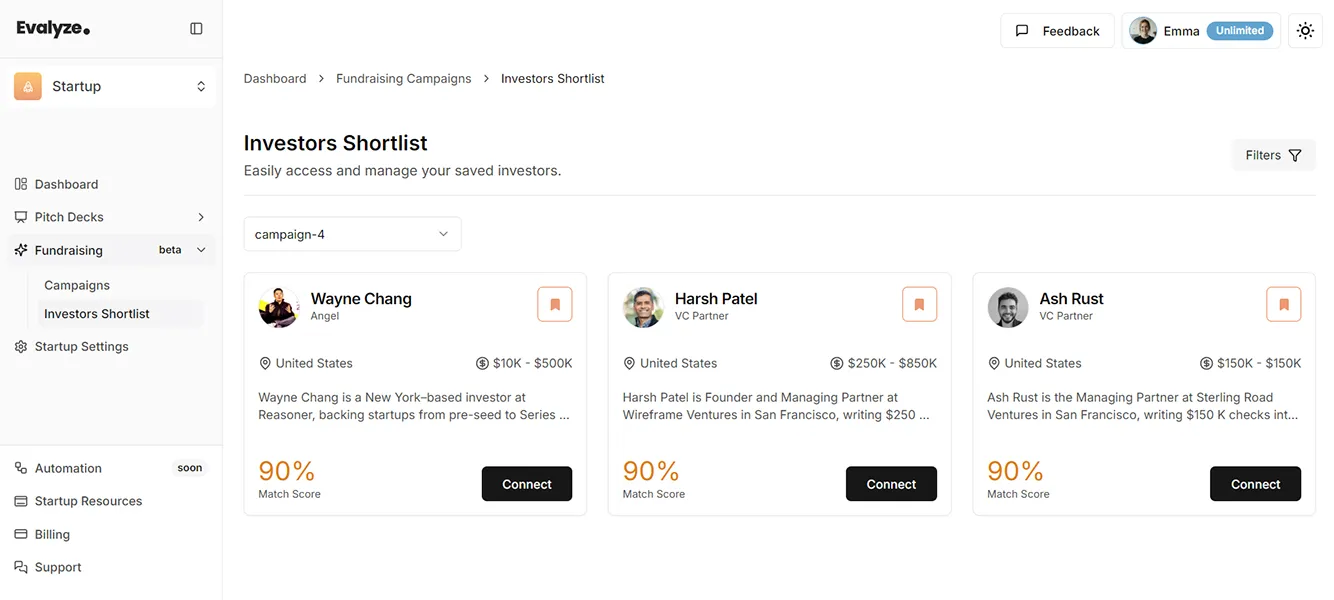

Step 4: Build Your Investor Shortlist

Once Evalyze shows you your matched investors, it’s time to curate your list of top prospects.

Simply click the bookmark icon on any profile you want to save. Those investors are instantly added to your Investor Shortlist, which you can access anytime from the left sidebar under Fundraising → Investor Shortlist.

Your shortlist is where things get strategic. Instead of drowning in hundreds of names, you now have a focused set of partners who match your stage, sector, and cheque size. This is the list you’ll actually work from when you start outreach.

Wrap-Up

If you’re serious about how to build an investor list, don’t start with a blank spreadsheet. Start with fit. Evalyze lets you create targeted campaigns, get matched investors in minutes, and shortlist the best fits, then iterate with variations to widen your funnel intelligently. Turn investor research into real conversations without the chaos.