Micro VCs vs. Traditional VCs: Which Is Right for Early-Stage Founders?

A practical founder guide to choosing micro VCs vs traditional VC funds, check size, speed, follow-on support, and a simple decision worksheet.

Founders usually ask this question when something feels off in fundraising: you're getting meetings, but not momentum. Or you're getting interest, but the round math doesn't work. Or you're talking to "VCs" who sound like they're investing in a different universe.

So let's make this concrete and founder-usable: the goal isn't to label investors correctly. The goal is to choose the kind of investor who helps you get the next proof point (traction, product, distribution, regulatory clearance, etc.) without turning your cap table into modern art.

Key Takeaways

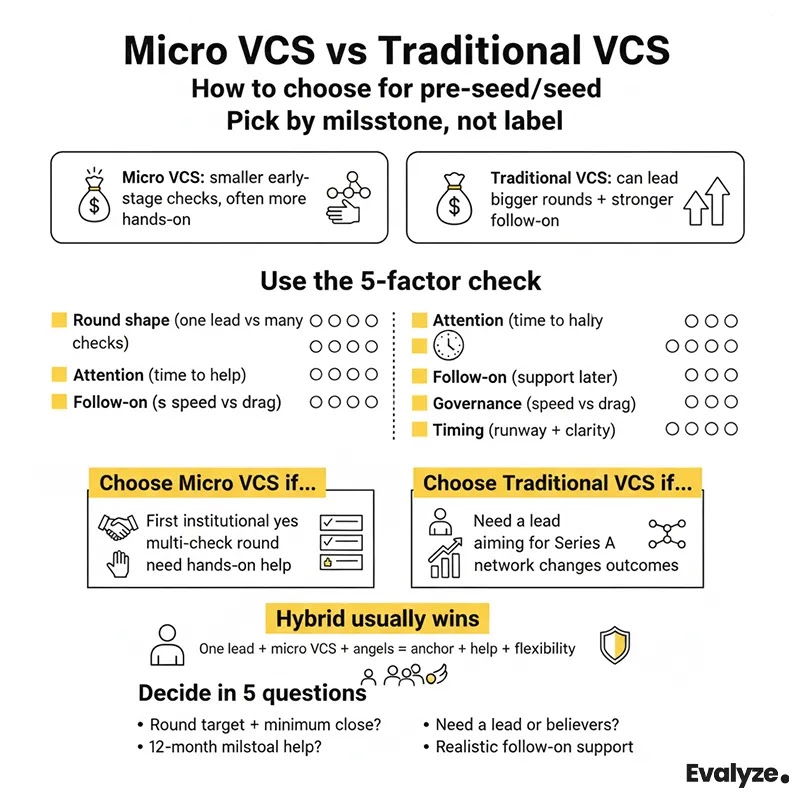

- Choose investors based on the round shape and the next milestone, not labels.

- Micro VCs often shine on early conviction and founder attention; traditional funds shine on leading larger rounds and follow-on capacity.

- Assume fundraising timelines can stretch; plan milestones and runway accordingly.

- Before outreach, tighten the deck and target investors by fit. Evalyze supports both.

Micro VCs vs Traditional VCs: Key Differences

Micro VCs are generally described as early-stage investors who write smaller seed checks, often in the $25K to $500K range, and commonly run smaller funds (often under ~$50M).

Traditional VC funds (in founder-speak) usually refer to larger firms that can lead larger rounds, do deeper follow-ons, and often participate from seed through later stages. Venture rounds are commonly discussed as a progression from:

pre-seed → seed → Series A → Series B → Series C+

where each step implies a different maturity level and risk profile.

You might also like: How Venture Capitalists Really Think

How to Choose Micro VC or Traditional VC for Pre-Seed & Seed

1) Round shape: can they lead what you're raising?

A micro VC may be perfect if your round can be built from multiple smaller checks and you don't require one "big lead" to set terms and pull the rest of the round together.

A traditional VC (or larger seed fund) becomes more relevant when:

- You're raising a larger seed (or seed extension) and want one lead to anchor the round, or

- You need a firm that can credibly support a fast Series A path with follow-on capital.

Founder reality: if your target is "$2-3M seed, close in 6-8 weeks," the kind of lead matters as much as the lead itself.

2) Attention: Who actually has time for you?

Early rounds are where you're most likely to need hands-on help: framing the wedge, fixing the go-to-market story, turning "cool tech" into "obvious buyer value," and sharpening the milestones.

Micro VCs often win here because their model and brand are built around being close to early-stage execution. Traditional funds can be incredibly helpful too, but you need to sanity-check partner bandwidth (some firms are built for later-stage scaling, not pre-product chaos).

A simple test: ask what they did for the last 2 seed-stage companies they backed. If the answer is vague, the "platform support" you're imagining might be imaginary.

3) Follow-on power: Can they keep supporting you?

This is the most misunderstood part.

Even a supportive investor can become a problem if they can't follow on when you need it because:

- You may need bridge capital,

- You may need them to defend your round internally (or signal externally),

- Or you may need pro-rata participation to avoid weird optics.

This doesn't mean "avoid micro VCs." It means: know what kind of support is realistic and design your investor mix accordingly (micro VC + angels + maybe a larger seed lead, depending on your round).

4) Governance expectations (a polite word for "how involved are they?")

Many VC firms expect some say in decision-making and may ask for governance rights, sometimes including a board seat, especially as you move into institutional rounds.

At seed, this can be healthy (experienced guidance) or heavy (decision drag). What you want is not "hands off" or "hands on." You want fast decisions and clear ownership.

5) Market timing: Fundraising cycles are not always fast anymore

If you've felt that rounds take longer than the stories you heard in 2021, you're not imagining things. In a major 2024 market recap, the time between rounds hit decade highs, with later rounds often stretching past two years, a proxy for stricter capital availability and "prove more with less" expectations.

Why this matters to your micro vs. traditional decision:

- If timelines stretch, follow-on capacity and round strategy matter more.

- If capital concentrates in fewer winners, your pitch deck and positioning must be painfully clear.

Founder's favorite: How to Find Angel Investors for Your Startup

Round Strategy: Lead Investor, Check Size, and Follow-On Support

Choose micro VCs when…

- You need your first institutional "yes" and want someone comfortable with messy early-stage ambiguity.

- Your round works as a collection of smaller checks, and you're optimizing for speed.

- You want an investor who will help you sharpen the story, not just grade it.

Choose traditional VC funds when…

- You're raising a round size where you need a credible lead to set terms and pull in others.

- Your plan requires significant follow-on capital (or a fast march to Series A).

- You need a firm whose name (and network) materially changes recruiting, distribution, or next-round access.

Use a hybrid when…

Most founders end up here. A common "clean" structure is:

- One lead with enough weight to anchor the round,

- Plus micro VCs and angels who add real operational leverage and optionality.

Keep learning: What Are Investors Looking For in Pitch Decks?

Pick the Right VC Type in 15 Minutes

Answer these in writing:

- What is my round target and minimum close?

If you "need $2M" but your plan works on $800K, you have more options than you think. - What must be true in 12 months?

Revenue milestone? Regulatory milestone? Retention? Enterprise pipeline? This determines investor fit more than your industry label. - Do I need a lead or just believers?

If you need a lead, prioritize investors who actually lead at your stage. - What kind of help is mission-critical?

Hiring? Intros to design partners? US enterprise sales? Technical recruiting? Partnerships? - What follow-on support is realistic?

Ask directly how they think about reserves and follow-ons (you're not asking for secrets, you're checking alignment).

Before you go: 5 Questions to Ask Before Saying Yes to an Investor

Evalyze: Deck Review + Angel Matching for Your Startup

Two moments in this decision are painfully easy to mess up:

1) You pitch too early with the wrong deck.

Evalyze's pitch deck analysis is designed to show what's unclear or missing from an investor's perspective, so you fix the "why now," traction logic, or business model fuzziness before you burn warm intros.

2) You talk to the wrong investors for your stage.

Evalyze investor matching is built around matching investors to your startup's stage, industry, and goals, so "micro VC vs traditional VC" becomes a practical list of people who actually invest in your kind of company.

Conclusion

Choosing between micro VCs vs traditional VC funds isn't a personality test. It's a round design. Start with your next 12-month milestone, then pick the investor type that can realistically lead (or support) the round size you need and still be helpful when things get messy. If you want the fastest clarity, tighten your pitch deck and build an investor shortlist that matches your stage and category; use Evalyze to save you weeks of wrong meetings.

FAQ

1. Can a micro VC lead a seed round?

Yes, often, especially if the round size fits their check and their fund strategy. The practical question is whether your round needs a single large anchor or can be built from multiple smaller commitments.

2. Will raising from micro VCs hurt my Series A chances?

Not inherently. What hurts Series A chances is unclear milestones, weak positioning, or a cap table that scares away future leads. Your goal is a clean story: who believed early, what they enabled, and what you proved next.

3. How many investors is "too many" at seed?

If coordination becomes a weekly tax, it's too much. A good rule is to keep governance simple and concentrate "decision ownership" (one lead or one tight core), while still having enough supporters for credibility and future flexibility.

4. Should I choose based on "brand name"?

Brand matters most when it changes something measurable: recruiting, enterprise access, or next-round trust. If it doesn't change execution speed, it's mostly decoration.

More Articles

5 Questions to Ask Before Saying Yes to an Investor

The right investor can fuel your vision or derail it; here’s how to tell the difference before you say yes.

October 5, 2025

How to Raise a Small Amount of Capital for Your Startup

Practical ways to raise $5K–$25K for your startup without taking a loan.

September 4, 2025