How to Use Evalyze Investor Discovery

Learn how to use Evalyze’s new Investor Discovery tool to search, filter, and shortlist investors without AI.

Evalyze’s new Investor Discovery feature gives founders a fast, manual way to search through thousands of investor profiles without relying on AI matching. Whether you’re pre-seed or scaling past Series A, this feature helps you filter and shortlist investors aligned with your startup’s stage, industry, and funding goals.

Let’s walk through exactly how it works.

Key Takeaways

- Investor Discovery gives founders direct access to a large database of investors.

- You can filter by stage, location, cheque size, industry, and investor type.

- Clicking “Connect” opens full investor contact details.

- Use bookmarks to create your own shortlist.

- The feature is available to all Evalyze users, with no region limits and no file uploads.

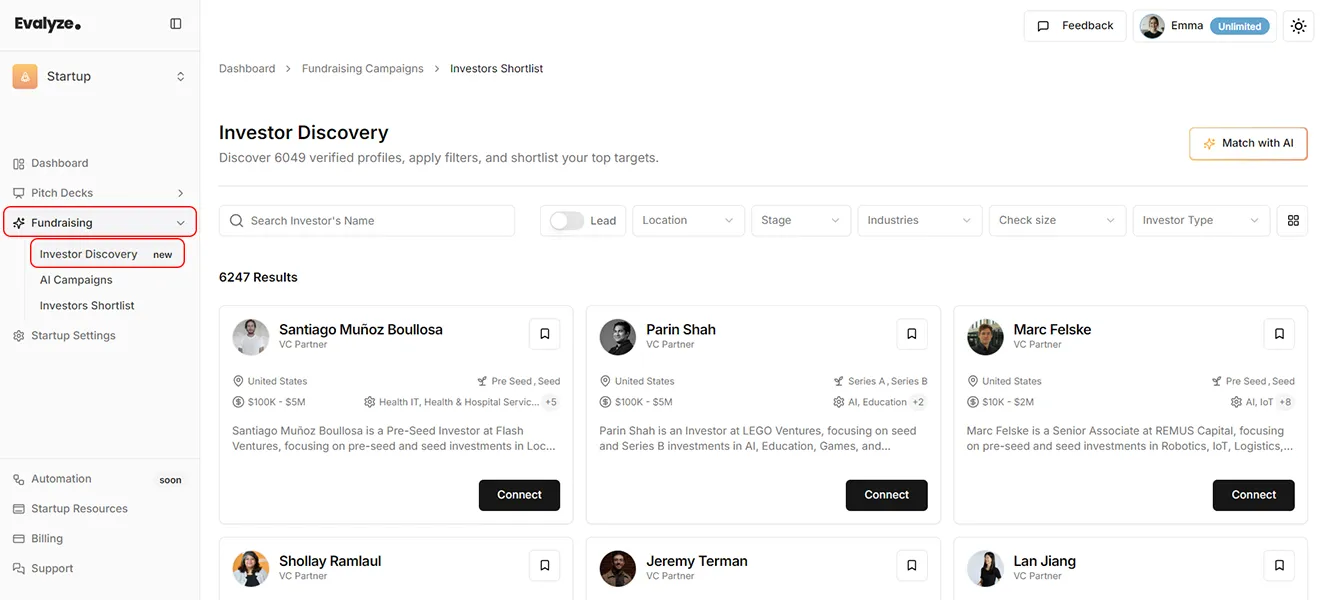

Step 1: Access the Investor Discovery tool

Once you’re logged into your Evalyze account, look at the left sidebar.

Navigate to:

Fundraising → Investor Discovery

You’ll see the new section labeled “Investor Discovery (new)” under Fundraising. Click it to open the full database view.

You’ll land on a clean interface listing over 10,000+ investor profiles, complete with names, locations, stages, cheque sizes, and focus industries.

Step 2: Explore the investor database

When the page loads, you’ll see a search bar and several filtering options across the top:

- Search Investor’s Name: Type a name to look up a specific investor or fund.

- Lead Toggle: Use this to focus only on lead investors (those who typically lead funding rounds).

- Location: Filter investors by region or country.

- Stage: Choose funding stages such as Pre-Seed, Seed, Series A, Series B, etc.

- Industries: Narrow results by sector (e.g., AI, Healthtech, Fintech, SaaS).

- Cheque Size: Define the average investment range you’re targeting (e.g., $10K–$2M, $100K–$5M).

- Investor Type: Select from VC, Angel, Accelerator, or Early Stage VC.

These filters can be used individually or combined for precision targeting.

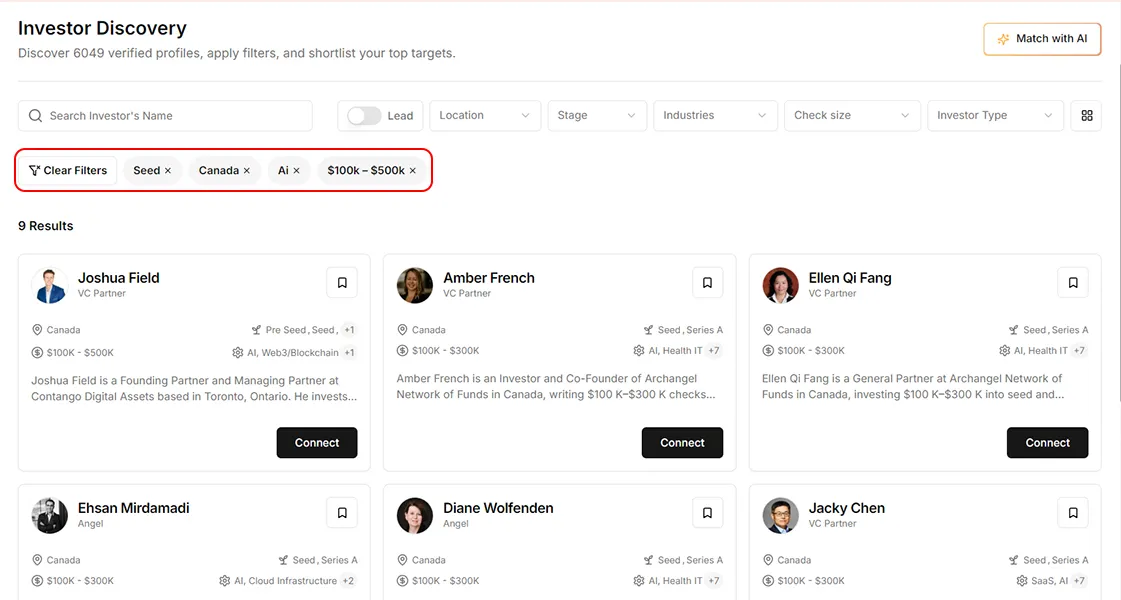

Example:

If you’re a seed-stage AI startup based in Canada, you could filter by:

Stage: Seed → Industry: AI → Cheque Size: $100K–$500K → Location: Canada

Your results will instantly update; no need to reload the page.

Step 3: Review investor profiles

Every investor in Evalyze Investor Discovery appears as a profile card that gives you a quick overview of who they are and what they invest in.

The card design makes it easy to scan multiple investors side by side and identify who fits your funding criteria before diving deeper.

When you find an investor that looks promising, click “Connect” to open a detailed profile modal like the one shown below for Amber French.

Here, you can view in the “General Info” tab:

- Focus Areas

- Investment Stage

- Cheque Size

- About Investor

“Contact Links” tab:

Website | LinkedIn | Twitter | Crunchbase | Signal

This combination of card and detail view lets you move from broad exploration to targeted research, helping you spot your best-fit investors faster.

Step 4: Bookmark investors to build your shortlist

As you browse, you can save investors for later by clicking the bookmark icon in the top-right corner of each card.

Every bookmarked investor is automatically added to your Investor Shortlist, your personal list of high-potential targets for outreach.

Where to find your shortlist:

Go to Fundraising → Investors Shortlist in the sidebar.

From there, you can revisit profiles, update your notes, and prepare for future campaigns.

Best Practices for Using Investor Discovery

Here are a few tips to make the most of this feature:

Refine filters gradually. Start broad to get a sense of the investor landscape, then layer filters as you go.

Use “Cheque Size” strategically. Matching your funding ask to investors’ average check range increases your response rate.

Keep a balanced shortlist. Include a mix of angels, VCs, and accelerators. Diversity helps at the early stages.

Review profiles monthly. The database updates regularly with new investors.

Bookmark with intent. Only save investors that match your stage, sector, and funding goals to keep your shortlist focused.

Find Your Perfect Match

Explore verified investors now and build your shortlist.

No pitch deck required.

FAQ

1. Can I use Investor Discovery without uploading a pitch deck?

Yes, this feature is designed for manual search and doesn’t require any uploads.

2. How accurate are the investor details?

Evalyze’s database includes over 10,000 investor profiles, regularly updated to maintain reliability and relevance.

3. What’s the difference between Investor Discovery and AI Matching?

Investor Discovery is a manual search tool for founders who want full control over filters. AI Investor Matching automatically finds top investors based on your pitch deck and startup data.

4. Are there regional limits?

No, the database is global, featuring investors from North America, Europe, Asia, and beyond.

5. How many investors can Free users see?

Free users can view up to 30 investor profiles per search.

6. What’s included in the Pro plan?

Pro users get unlimited investor visibility, meaning they can browse and filter through the entire verified database of 10,000+ investors without restrictions.

More Articles

How to Build an Investor List Based on Your Startup

Learn how to build an investor list with Evalyze.ai. Step-by-step guide to find matched investors, shortlist the best fit, and raise smarter.

September 22, 2025

How to Find Angel Investors for Your Startup

An actionable guide for startup founders to identify, target, and connect with angel investors who align with their stage, sector, and funding goals.

August 7, 2025