Best Startup Hubs & Ecosystems for Fundraising

Find the hubs where investors respond and where you can actually build.

Scrolling "best startup cities" lists is not always a practical way to find funding.

Founders don't move to a city because it's cool. They move (or incorporate) because the ecosystem makes two hard things easier:

- Getting your first real checks (angels/seed), and

- Staying alive long enough (visa + programmes + runway) to reach traction.

This guide gives you a decision tool: a practical scoring framework you can reuse, a map of "government support signals," and the simplest way to locate real angel networks (not "random rich people on LinkedIn"). Rankings can help, but only if you use them as a filter, not as a verdict.

Key Takeaways

- A "best startup hub" is not a vibe; it's a mix of angel access, legal/government pathways, and execution speed.

- Use rankings as a shortlist tool, then validate with real conversations and investor responsiveness.

- Government programmes (visas, startup permits, national startup initiatives) are strong signals of ecosystem maturity, but rules change, so verify.

- Your smartest move is to turn "cities" into investor lists and test responses. Evalyze can help you do that faster and more systematically.

What makes a startup hub "good" (a scoring model you can reuse)

Most lists quietly optimize for one metric: total funding, number of unicorns, or "startup buzz." That's fine if you're writing a report. It's not fine if you're choosing where you'll spend your next 18 months of life.

Some startup city rankings are more useful than others because they show how they scored each city on multiple factors, provide a clear scale (for example, 1-10), and include a combined total, rather than pretending that one magic number captures an entire ecosystem.

Here's a founder-friendly model you can use in any city or country.

The 7 factors to score any city/country

Copy/paste this checklist and rate each factor 1-5 (or 1-10 if you're feeling spicy):

- Angel density & seed activity: Can you find angels and seed investors who actually invest in your stage?

(Signals: active angel groups, syndicates, seed funds, frequent demo days.) - Government pathways: Can you legally live/build there?

(Signals: founder visa routes, startup permits, endorsing bodies, work eligibility for founders and key hires.) - Non-dilutive support: Can you get money that doesn't dilute you early?

(Signals: grants, public programmes, equity-free accelerators, university R&D support.) - Talent + hiring speed: How quickly can you hire engineering, sales, and domain experts without burning months?

- Customer proximity: Are your buyers nearby or at least in the same time zone and travel network?

- Cost + runway: How long can your current cash survive there (rent, salaries, taxes, admin overhead)?

- Community surface area: How many "collision opportunities" exist?

(Events, accelerators, repeat founders, operator density, warm intro culture.)

Definitions

- Angel network: organized angel groups/syndicates that invest early and run a repeatable process.

- Government support: visa/programme/grant pathways that reduce risk, time, and operational friction.

Founder's favourite: The 20 Most Searched Startup Investors on Evalyze

Use ecosystem rankings wisely

Two rankings can disagree without either being "wrong." They're just measuring different things.

Start wide, then go deep.

First, use a global list with lots of city coverage to get 10 candidates. Then sanity-check your top 3 using a report that publishes its methodology, what datasets it pulls from, how it removes duplicates, and how it measures ecosystem strength.

Rule that saves founders from bad decisions:

Rankings are a filter, not a decision. Use them to produce a shortlist, then validate with real investor and founder conversations.

Don't miss: How to Use Evalyze Investor Discovery

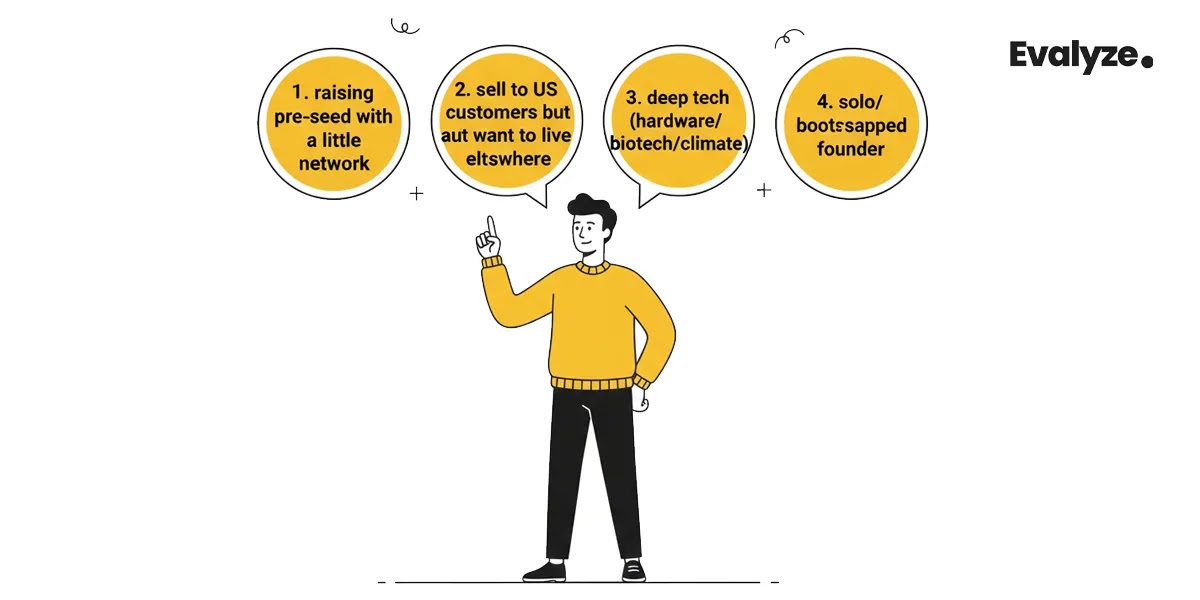

Quick picks by the founder's goal

The right hub depends less on the city's "startup brand" and more on your constraints. Here are common founder situations and what to prioritize.

If you're raising pre-seed with a little network

Your biggest enemy isn't competition. It's silence.

Choose hubs with:

- Visible angel groups and regular pitch events (high meeting velocity),

- Lots of accelerators/incubators (more structured intros),

- And a culture of "founder-to-founder" sharing.

The magic metric here is warm intro density: how many people are one intro away from someone who invests.

Practical move: In your shortlist hubs, try to book 5 founder coffees in a week. If you can't, intros will be slow.

If you sell to US customers but want to live elsewhere

You don't need to live in the US to sell to the US, but you do need:

- Overlapping working hours,

- Cheap-ish flights,

- And investor reach (for later rounds).

A hub can be "top-ranked" and still be wrong if you're constantly awake at 2 a.m. to run demos. Score customer proximity and travel friction higher than local hype.

If you're deep tech (hardware/biotech/climate)

Deep tech usually needs:

- Universities/labs,

- Patient capital,

- And often public programmes.

In your scoring model, weight non-dilutive support and talent higher than "number of startups." City rankings that reward raw startup counts can understate the strength of deep-tech hubs.

If you're a solo/bootstrapped founder

You're optimizing for runway and execution speed, not prestige.

Pick places with:

- Lower burn,

- Remote-first communities,

- And easy admin setup.

A slightly "smaller" ecosystem can beat a famous one if it gives you 6 more months of survival.

Too useful to skip: How to Build an Investor List Based on Your Startup

Government support map (founder visas + national programmes)

This section is not immigration advice. It's an ecosystem signal map; countries that built founder-friendly pathways tend to have a more intentional startup infrastructure.

Founder visa/startup pathways worth knowing

1. Canada: Start-up Visa Program

Canada's Start-up Visa requires pitching to a designated organization, securing support, and meeting language and settlement funds requirements.

2. France: French Tech Visa (Founders)

France's French Tech Visa is aimed at non-EU/EEA/Swiss founders building an innovative project in France.

3. UK: Innovator Founder visa

The UK route requires an endorsement by an approved endorsing body. GOV.UK also states the visa duration is 3 years, and typical decision times are ~3 weeks outside the UK and ~8 weeks inside the UK (fees vary by applying/extending/switching).

Also useful: the UK explicitly notes the old "Start-up visa" is closed and points founders toward Innovator Founder.

4. Estonia: Startup Visa

Estonia positions its Startup Visa as a pathway for non-EU founders to grow a scalable startup in Estonia (and to help startups hire non-EU talent).

5. Finland: Startup Permit

Finland's model is nicely structured. Business Finland evaluates your startup's growth potential and issues an Eligibility Statement, which you attach to your residence permit application.

6. Singapore: Startup SG

Startup SG is framed as national support for startups at all stages, providing access to resources such as talent, funding, and networks. Enterprise Singapore describes components such as Startup SG Accelerator and shared infrastructure.

If you want a "density signal," Enterprise Singapore also describes the Startup SG Network ecosystem, which scales thousands of startups and hundreds of VCs/incubators/accelerators.

7. Chile: Start-Up Chile

Start-Up Chile is widely referenced as a government-backed programme launched in 2010 to help turn Chile into a regional innovation hub. Their application pages emphasize looking for tech-based, innovative, scalable, high-impact startups.

Reality check (read this before you plan your life around a programme):

- Always verify the programme rules change on the official pages.

- Processing times vary widely by route and season.

Explore more: 11 Fundraising Myths That Are Holding Your Startup Back

Where the angels are (and how to find them)

"Angels in Berlin" is not a plan. You need names, groups, processes, and fit.

Start with directories (fastest way to locate angel groups)

- US: Angel Capital Association's directory helps you find ACA members (including angel groups and accredited platforms).

- Europe: EBAN's membership directory is a practical starting point for discovering early-stage investors across Europe.

- Canada: NACO describes its membership as a national network that includes prominent individual investors, angel networks, early-stage funds, and innovation hubs.

Then shortlist by thesis + stage (because angels are not generic)

Before you chase intros, filter angels by:

- Stage (pre-seed vs seed),

- Sector (fintech ≠ climate ≠ devtools),

- Check size (a $5k angel and a $250k angel behave very differently),

- Geography preference (some angels only invest locally),

- Speed (some groups meet monthly; others meet weekly).

Build your target investor list for a hub (in minutes)

Once you pick a hub (say, "London" or "Toronto"), the next step is to build a tight, hub-specific list of angels and seed funds that invest in your stage and category.

That's exactly where Evalyze.ai helps: turn "this city has angels" into "here are 40 investors who invest in startups like mine", then export that list into your outreach workflow.

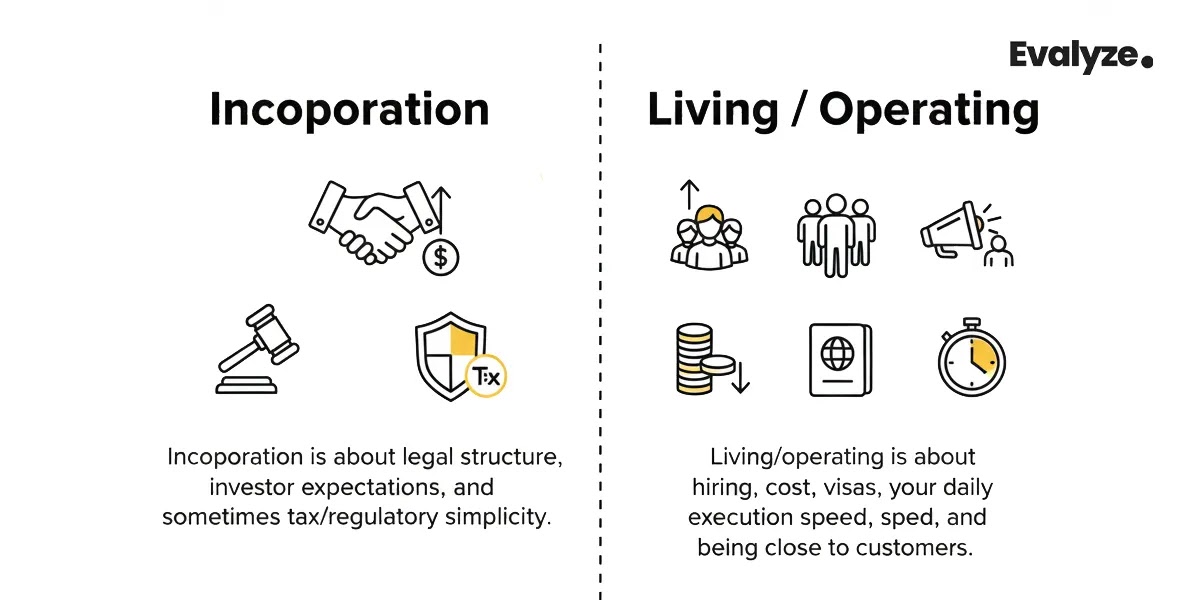

Incorporate vs live: the question founders keep asking

This comes up constantly in founder forums for a reason: you can build in one place and incorporate in another, but it's a trade.

- Incorporation is about legal structure, investor expectations, and sometimes tax/regulatory simplicity.

- Living/operating is about hiring, cost, visas, your daily execution speed, and being close to customers.

Mini decision rule:

- If the investors you're targeting require a specific jurisdiction, incorporate there.

- If your biggest bottleneck is hiring, runway, or legal permission to live/work, choose where execution is easiest, even if you incorporate elsewhere.

Keep learning: +30 Best Platforms to Launch Your Startup

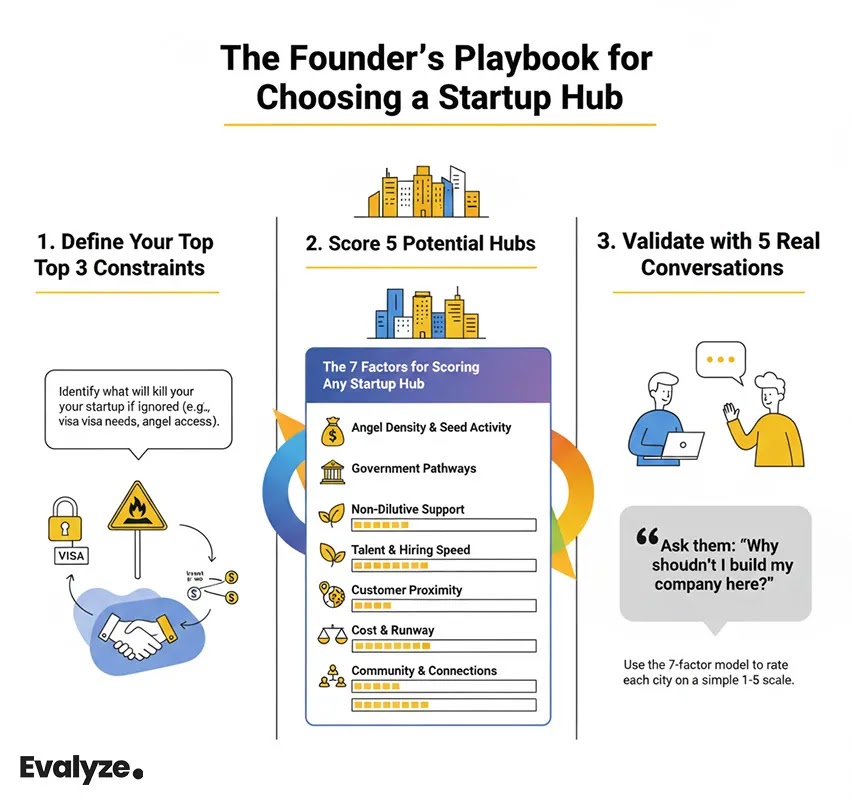

A simple hub decision worksheet

Here's a process that takes a weekend and saves you months.

Step 1: Pick your top 3 constraints

Choose the constraints that will actually kill your startup if ignored:

- "Need a founder visa pathway."

- "Must be near enterprise buyers."

- "Must keep burn low."

- "Need deep-tech grants/labs."

- "Need fast intros to angels."

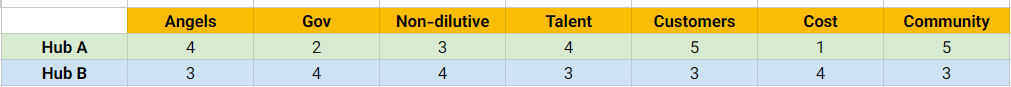

Step 2: Score 5 hubs using the 7-factor model

Don't overthink. Give each hub a score of 1-5 for each factor.

You'll usually see a pattern: one hub wins on money and community, another wins on runway and visas.

Step 3: Validate with 5 real conversations

Talk to:

- 2 founders (same stage as you),

- 1 operator (sales leader, PM, CTO, your hiring market),

- 1 angel (or angel group lead),

- 1 accelerator/incubator person.

Ask one question that reveals the truth fast:

"If you were me, what would make you not build here?"

Validate a hub by investor fit + deck readiness

After you shortlist a few hubs, test fit, not hype. For each hub, define your startup profile, then use Evalyze.ai to find matching angels and build a hub-specific shortlist. Run your deck through Evalyze to catch weak spots before outreach.

Now "best city" means:

Where you have the best investor match and a ready-to-pitch deck.

FAQ

1) How long should I "try" a city before deciding it's not working?

Give it 8-12 weeks of focused effort, not 8-12 months of vague networking. Your goal in that window is measurable: meet 15-25 relevant people (founders, angels, operators) and secure at least 5 serious conversations with investors. If you can't generate momentum with structured effort, the hub may be a mismatch or your positioning needs work.

2) What's a red flag that a hub is mostly hype (not funding)?

If everything is events but nobody can name recent seed checks, it's a warning sign. Other red flags: investors only show up for "hot" sectors, founders complain about long feedback loops, and most capital comes from outside the hub (meaning local money is thin).

3) How do I know whether a hub is strong for my sector (SaaS vs fintech vs climate)?

Look for sector-specific density, not generic startup density. A good, quick test: can you find:

(a) 10 startups in your category,

(b) 10 operators who've worked in that category, and

(c) 10 investors who list it as a focus, all local-ish. If one of those groups is missing, your "ecosystem" will feel like pushing a car uphill.

4) If I'm remote-first, do I even need to move to a startup hub?

Not always. If your customers and team are distributed, you can "hub-hop" instead: spend 2-4 weeks per quarter in a hub that maximizes intros and partnerships, while keeping your base where the runway is longest. Hubs are most useful for relationship compression, getting months of meetings into weeks.

5) What should I prepare before I start meeting angels in a new hub?

Have a "meeting kit" ready:

- A one-sentence description (problem + buyer + outcome),

- A 2-minute story (why now + traction),

- A tight deck (or memo) that answers obvious objections,

- And a clear ask (round size, use of funds, timeline).

You don't want your first 10 meetings to be practice.

6) Should I pick a hub based on "how many VCs are there"?

Early on, angel activity matters more than VC logos. Many hubs have plenty of VCs but few fast-moving pre-seed investors. Use "VC count" as a later-stage signal; use angel groups + seed funds as your near-term signal.