The 20 Most Searched Startup Investors on Evalyze

A list of the 20 most searched investors globally. See what founders see on Google, and use Evalyze Investor Discovery to find the right investor faster.

Founders search for investors for two reasons:

- “Who invests in companies like mine?”

- “What does this investor actually invest in?”

Google gives founders pieces of the answer, old Medium posts, outdated LinkedIn info, or articles. An AI overview sometimes helps, sometimes confuses things.

Evalyze’s verified investor dataset highlights the investors whom founders research most during fundraising. Below is a list of the 20 most-searched investors, along with practical insights founders should consider when evaluating whether they’re the right match.

Shortcut Your Investor Research

Instead of digging through outdated articles and scattered profiles, you can search verified investors by stage, check size, sector, and geography, all in one place.

Build your investor list instantly with Evalyze Investor Discovery.

1. Alex Krizhevsky: VC Partner, Two Bear Capital (Israel)

Deep-learning pioneer behind AlexNet; invests $100K-$5M in AI, diagnostics, consumer internet, and SMB software.

Krizhevsky’s name trends because founders want investors who truly understand AI at a technical level. He’s highly relevant if you’re building foundational models, computer vision systems, applied AI workflows, or diagnostic algorithms where scientific rigor matters. If your advantage depends on model performance, he’s one of the strongest early-stage fits.

2. Napoleon Ta: Partner, Founders Fund (US)

Large-scale investor in AI and insurance; deploys $500K-$150M across breakout companies like Rippling, Persona, Kavak.

Ta is widely researched because he sits at the intersection of AI, insurance, and crypto, three sectors with extremely high founder activity. His portfolio shows a pattern: he invests in companies with strong technical depth, large market potential, and early signs of momentum. Although he can invest at pre-seed, founders should be aware that his most successful bets (Rippling, Persona, Kavak) were high-velocity companies with clear product differentiation.

3. Wouter Gort: Partner, Hummingbird Ventures (Netherlands)

Invests $500K-$15M from Seed to Series B across SaaS, marketplaces, health IT, biotech, Web3/blockchain, consumer health, fintech, and hardware. Joined Hummingbird after innovation roles at Philips and DSM.

Wouter is frequently researched because Hummingbird backs high-potential companies across SaaS, marketplaces, biotech, consumer health, and hardware. He’s a strong match for founders building scalable, technically differentiated products with early traction.

Teams showing product-market fit, technical depth, or strong market pull tend to align well with his Seed-Series B investment focus.

4. Pranav Giridhar: Angel Investor, US

Pre-seed/Seed angel writing $10K-$100K checks in AI, GovTech, Health IT, consumer health, enterprise, cloud infrastructure, and early B2B software.

Pranav attracts early-stage founders because he invests when most institutional funds are still watching. His focus on GovTech, AI, and Health IT shows a preference for mission-driven, infrastructure-heavy products over purely consumer ideas.

He’s a strong fit for founders seeking a first institutional-style angel who understands technical complexity and can help validate an early product before approaching larger funds.

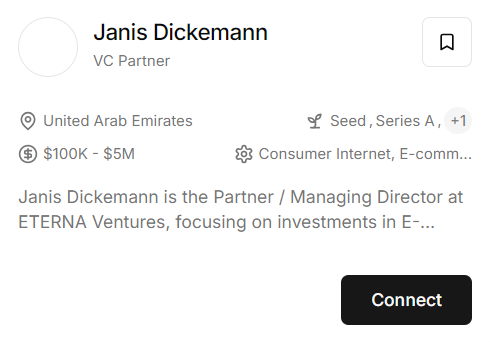

5. Janis Dickemann: Managing Director, ETERNA Ventures (UAE)

Invests $100K-$5M in E-commerce, consumer internet, and marketing tech, with a specific model focused on scaling performance-marketing-driven companies.

Janis is widely researched in MENA and South Asia because ETERNA invests equity directly into scaling proven performance marketing. She’s especially relevant for e-commerce, consumer internet, and marketing-tech startups with strong acquisition channels and clear unit economics.

Founders with existing traction who want to accelerate paid growth rather than follow a traditional VC path often find her model uniquely aligned with revenue-driven scale.

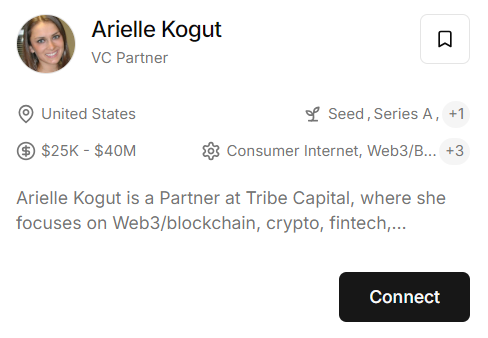

6. Arielle Kogut: Partner, Tribe Capital (US)

Invests $25K-$40M from Seed to Series B in Web3, blockchain, crypto, fintech, consumer internet, and enterprise software. Based in NYC + San Francisco.

Founders frequently research Arielle because Tribe Capital is known for backing companies in highly technical and high-velocity markets such as crypto, fintech, and enterprise software. Her range from $25K to $40M means she can participate early and continue through later stages. She is a strong fit for founders building in markets where data, product performance, and ecosystem participation matter.

If you’re building in Web3, crypto infrastructure, or enterprise software with a clear technical edge, she aligns well with those categories.

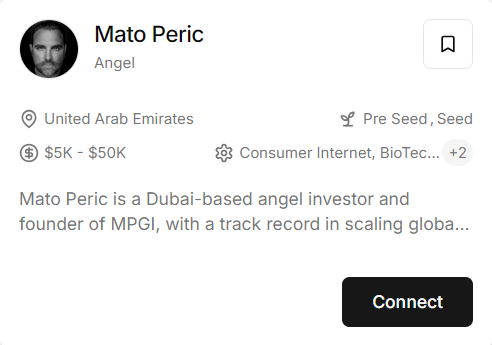

7. Mato Peric: Angel Investor, UAE

Writes $5K-$50K checks in enterprise software, consumer internet, biotech, and healthtech across pre-seed and seed.

Mato’s angel activity attracts founders because he brings operational experience from scaling global tech businesses. His investments span enterprise, consumer, biotech, and healthtech, all categories where early guidance matters.

He is a strong match for founders at the earliest stages who want an investor who can offer practical input and strategic advice while helping shape core go-to-market or product decisions.

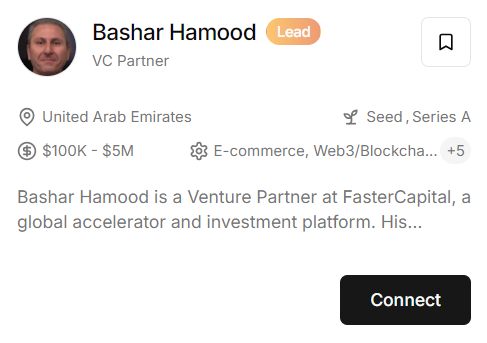

8. Bashar Hamood: Venture Partner, FasterCapital (UAE)

Seed to Series A investor with $100K-$5M checks across SMB software, fintech, e-commerce, Web3, media/content, education, and entertainment.

Bashar is widely searched because FasterCapital operates a global accelerator-style model combined with direct investment. His sector coverage, SMB software, fintech, Web3, e-commerce, and education, makes him relevant to a wide range of early-stage teams.

Founders who want access to both funding and structured support often find his profile appealing, especially those in emerging markets or companies looking to scale distribution quickly.

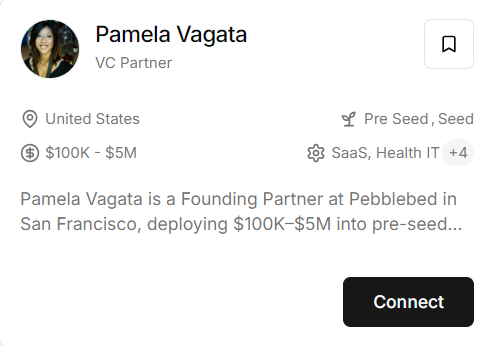

9. Pamela Vagata: Founding Partner, Pebblebed (US)

Invests $100K-$5M at pre-seed and seed in biotech, developer tools, pharmaceuticals, health IT, and therapeutics. Former founding engineer at OpenAI.

Pamela is frequently researched by founders building technical or research-based products because she combines deep engineering experience with venture investing. Her focus areas, biotech, developer tools, health IT, and therapeutics, make her especially relevant for companies where technical architecture or scientific rigor is central.

She is a strong fit for founders building products that require technical evaluation, complex systems thinking, or deep domain expertise.

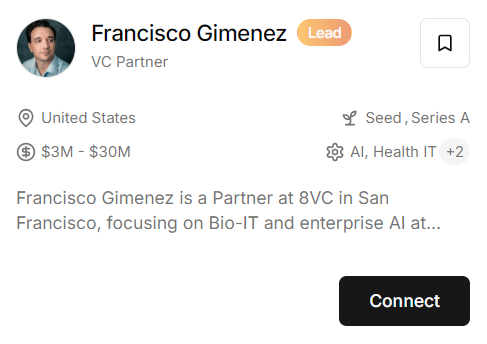

10. Francisco Gimenez: Partner, 8VC (US)

Invests $3M-$30M in Bio-IT, biotech, health IT, and enterprise AI. Portfolio includes Unlearn.AI, Flywheel.io, Sirona Medical, and Latus Bio.

Francisco appears frequently in founder searches because he sits at the intersection of biology, data, and enterprise AI fields, experiencing strong momentum. His investments show a clear pattern: computational biology, data-driven life sciences, and enterprise AI infrastructure.

He is an excellent match for founders building Bio-IT, technical biotech tooling, or AI-native platforms that require deep domain understanding and substantial early investment.

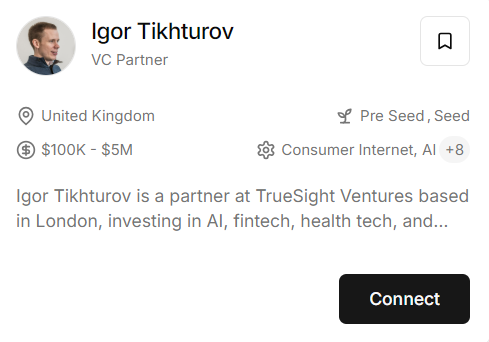

11. Igor Tikhturov: Partner, TrueSight Ventures (UK)

Invests $100K-$5M at pre-seed and seed across AI, fintech, marketplaces, consumer internet, digital health, education, marketing tech, and privacy/security.

Early-stage European founders widely research Igor because TrueSight invests actively at pre-seed and seed across AI, fintech, marketplaces, digital health, and privacy/security. He’s a strong match for technical teams building software-driven products with early customer validation or initial traction.

His focus on early-stage companies makes him most relevant to founders raising pre-seed or seed funding with a clear problem thesis and a defined product direction.

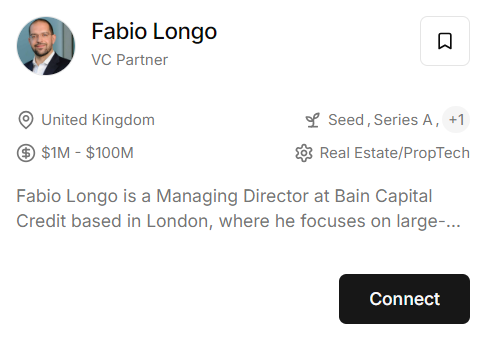

12. Fabio Longo: Managing Director, Bain Capital Credit (UK)

Invests $1M-$100M across PropTech and real estate technology, from Seed to Series B, with a sweet spot around $25M.

Fabio is often sought by founders operating in PropTech and real estate innovation because Bain Capital participates in large, sophisticated funding rounds. His check size and sector focus make him an excellent match for startups building infrastructure-heavy real estate technology, enterprise-grade property tools, or solutions targeting institutional adoption.

Founders with capital-intensive roadmaps, long sales cycles, or enterprise integration requirements tend to align best with his investment strategy.

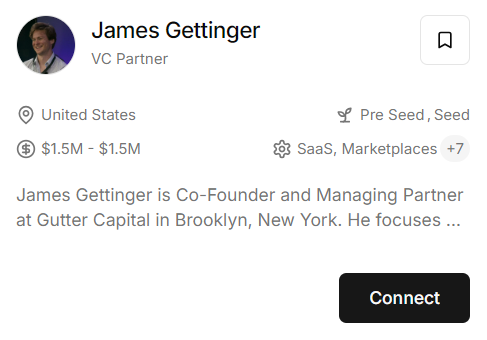

13. James Gettinger: Managing Partner, Gutter Capital (US)

Invests ~$1.5M at Pre-seed and Seed across climate tech, mobility, health IT, digital health, education, impact, and early-stage SaaS.

Mission-driven founders often research James because Gutter Capital backs early-stage companies solving systemic problems in climate, transportation, education, health, and impact. His focus on pre-seed and seed makes him a strong fit for teams with a clear mission, early product validation, and measurable impact goals. Founders tackling climate challenges or essential infrastructure typically align well with his profile.

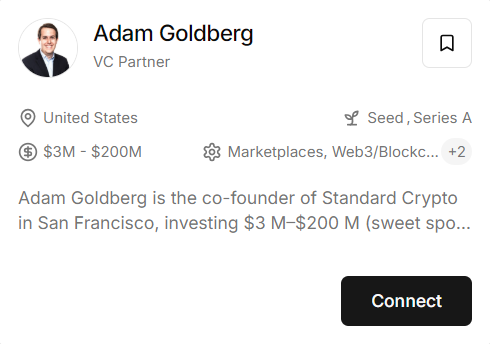

14. Adam Goldberg: Co-founder, Standard Crypto (US)

Invests $3M-$200M in Web3, blockchain infrastructure, crypto-native businesses, and enterprise marketplaces. Known for protocol-level investing; sweet spot $15M.

Adam is widely researched in the Web3 space because Standard Crypto invests in both token and equity rounds across blockchain infrastructure and crypto-native marketplaces. His seed and Series A focus, paired with large check sizes, makes him ideal for founders building L1/L2 infrastructure, decentralized protocols, cryptographic primitives, or enterprise blockchain applications.

Teams developing scalable, technical crypto products or ecosystem-level tools typically align well with his profile.

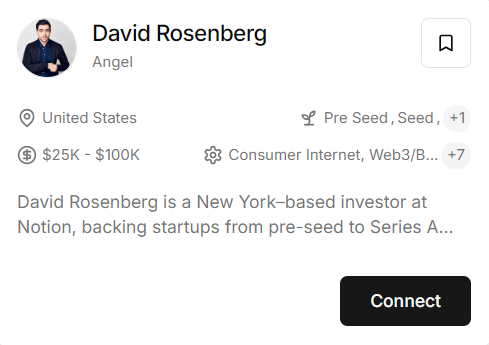

15. David Rosenberg: Angel Investor, Notion (US)

Writes $25K-$100K checks across consumer internet, AR/VR, media/content, social networks, entertainment, Web3, travel, and wellness. Active from Pre-seed to Series A.

David is widely sought by consumer-tech and creative founders thanks to his portfolio in AR/VR, media, creator tools, and Web3. He’s a strong fit for teams building social apps, virtual experiences, gaming layers, or community-driven platforms. Founders with culturally resonant products, strong storytelling, or early community traction tend to align best with his investment style.

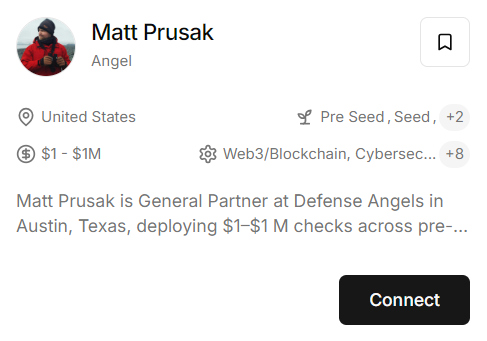

16. Matt Prusak: General Partner, Defense Angels (US)

Invests $1-$1M from Pre-seed to Series B in GovTech, cybersecurity, robotics, hardware, medical devices, energy tech, space, material science, and construction tech.

Frontier-tech founders frequently research Matt because Defense Angels backs companies building deep, technical, and often dual-use technologies. His focus spans robotics, GovTech, cybersecurity, energy systems, and aerospace sectors, where founders benefit from investors who understand long development cycles and government contracting.

Strong fit for teams developing complex hardware or defense-adjacent technologies needing both capital and technical guidance.

17. Christine Esserman: Partner, Accel (US)

Deploys $15M-$70M across Series A-B in SaaS, consumer internet, cloud infrastructure, and enterprise software.

Christine is widely researched by founders preparing for large Series A or B rounds because Accel is known for scaling globally competitive SaaS and consumer platforms. Her check size and sector focus make her ideal for founders with strong traction, clear product-market fit, and enterprise or consumer products ready for major expansion. Best aligned with teams entering high-growth mode.

18. Achal Upadhyaya: Managing Partner, Interlagos Capital (US)

Invests $4M-$40M from Pre-seed to Series B in hardware-focused companies, including robotics, sensors, and industrial systems. Based in Los Angeles.

Achal is a go-to investor for hardware founders because Interlagos Capital focuses exclusively on deep hardware, robotics, and physical systems. His experience across early and growth stages makes him well-suited for companies that require significant engineering development and high capital intensity. Ideal for founders building complex hardware products with long-term defensibility.

19. Hesham Zreik: Founder & CEO, FasterCapital (UAE)

Invests $100K-$5M at Seed and Series A in e-commerce, SMB software, fintech, Web3, media/content, education, entertainment, and sports.

Hesham is highly sought across MENA and beyond because FasterCapital supports a large global portfolio through accelerator-style programs and capital. His investment activity spans many digital sectors, making him relevant for founders in consumer, fintech, SMB tools, and Web3. Strong fit for founders seeking a combination of funding, operational support, and access to FasterCapital’s large network.

20. Joshua Awad: Founding Partner, eGateway Capital (US)

Invests $2.5M-$10M in Series A/B across marketplaces, e-commerce, SaaS, fintech, mobility, supply chain tech, payments, advertising, and consumer internet.

Joshua is frequently researched by founders preparing for Series A/B in commerce, fintech, mobility, and SaaS. eGateway Capital focuses on scaling operationally intensive businesses, making him a strong fit for teams with traction, measurable economics, and readiness for rapid expansion. Ideal for founders building platforms in payments, marketplaces, or transportation tech.

Investor Comparison Table

| # | Investor | Region | Stages | Check Size | Key Focus |

|---|---|---|---|---|---|

| 1 | Alex Krizhevsky | Israel | Seed-A | 100K-5M | AI, Consumer |

| 2 | Napoleon Ta | US | Pre-seed-B | 500K-150M | AI, Insurance |

| 3 | Wouter Gort | Netherlands | Seed-B | 500K-15M | SaaS, Web3 |

| 4 | Pranav Giridhar | US | Pre-seed-Seed | 10K-100K | GovTech, AI |

| 5 | Janis Dickemann | UAE | Seed-B | 100K-5M | E-commerce |

| 6 | Arielle Kogut | US | Seed-B | 25K-40M | Web3, FinTech |

| 7 | Mato Peric | UAE | Pre-seed-Seed | 5K-50K | Consumer, Health |

| 8 | Bashar Hamood | UAE | Seed-A | 100K-5M | SMB SaaS, FinTech |

| 9 | Pamela Vagata | US | Pre-seed-Seed | 100K-5M | BioTech, DevTools |

| 10 | Francisco Gimenez | US | Seed-A | 3M-30M | Bio-IT, AI |

| 11 | Igor Tikhturov | UK | Pre-seed-Seed | 100K-5M | AI, FinTech |

| 12 | Fabio Longo | UK | Seed-B | 1M-100M | PropTech |

| 13 | James Gettinger | US | Pre-seed-Seed | ~1.5M | Climate, SaaS |

| 14 | Adam Goldberg | US | Seed-A | 3M-200M | Web3 |

| 15 | David Rosenberg | US | Pre-seed-A | 25K-100K | Consumer, AR/VR |

| 16 | Matt Prusak | US | Pre-seed-B | 1-1M | GovTech, Space |

| 17 | Christine Esserman | US | A-B | 15M-70M | SaaS, Consumer |

| 18 | Achal Upadhyaya | US | Pre-seed-B | 4M-40M | Hardware |

| 19 | Hesham Zreik | UAE | Seed-A | 100K-5M | E-commerce, FinTech |

| 20 | Joshua Awad | US | A-B | 2.5M-10M | FinTech, SaaS |

Must Read: How to Use Evalyze Investor Discovery

Find the Right Investors Faster

This list gives you a clear picture of the most-searched investors in the ecosystem, but the real advantage comes from building a targeted investor pipeline that aligns with your stage, sector, and traction.

Evalyze gives you two pathways to do exactly that:

1. Manual Investor Discovery

Perfect if you want full control. Filter thousands of verified investors by check size, geography, sector, and investment stage to build your own shortlist in minutes.

2. AI-Matched Investor Discovery

Ideal when speed matters. Upload your deck (or answer a few questions) and let Evalyze’s AI scan your startup, match it to the most relevant investors, and generate a personalized outreach list instantly.

Whether you want precision or speed, both tools help you shorten your fundraising cycle and focus on conversations that actually move the needle.

More Articles

How to Use Evalyze Investor Discovery

Learn how to use Evalyze’s new Investor Discovery tool to search, filter, and shortlist investors without AI.

November 11, 2025

15 Down-Market Fundraising Plays for 2025-2026

Proven fundraising tactics for founders to survive, adapt, and raise smarter through the 2025-2026 market downturn.

October 22, 2025