8 Small Business Grants in the US

A simple guide to US small business grants you can actually apply for.

If you're building a startup in the US, it can feel like "free money for small businesses" is a myth. Most search results are spam, and the real programs are buried in government pages that look like they were designed in 2003.

But grants do exist.

They show up in a few main places:

- Federal programs that support specific goals (rural development, exports, minority business support).

- State and city grants that quietly hand out $5k-$25k.

- Private and corporate grants that run contests or recurring programs.

This guide is for early-stage founders who want small but meaningful capital to extend their runway, not fantasy "$500k free money tomorrow."

US Federal & National Grant Programs You Should Know

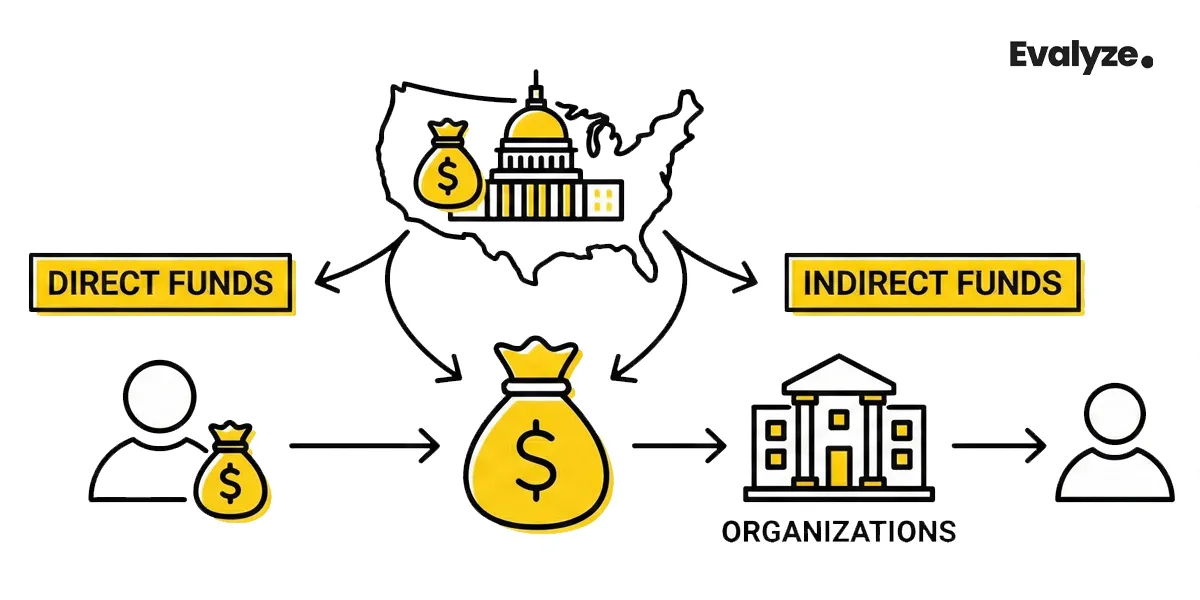

These are government programs. Some funds you receive directly; others fund organisations that then support you.

1. USDA - Rural Business Development Grants (RBDG)

Good if: You're in a rural community, or a local town, tribe, or nonprofit supports your startup.

- Who can apply directly:

Local governments, tribes, and nonprofits serving rural areas. The money is used to support small rural businesses (fewer than 50 employees and under $1M in revenue). - What it can fund:

Things like shared infrastructure, training, technical assistance, and other projects that clearly help rural small businesses. - Typical size:

Grants often land in the low- to mid-six-figure range, and USDA expected about $30M nationwide for FY 2025. There is no strict national cap per project, but priority usually goes to smaller, well-defined requests. - Status:

A recurring competitive grant program run by USDA Rural Development. Application windows and deadlines are announced in each funding notice, so you should always check the latest RBDG guidance on the USDA site for current details.

How to use it as a founder?

You usually don't apply as a startup founder. Instead, you:

- Check if your town, county, or regional nonprofit is using RBDG.

- Push for a project that directly benefits your business (shared maker space, training, incubator, etc.).

Treat this as indirect support that can still move the needle, even in a small rural community.

Founder's favourite: 30 US VCs For Early Stage Startups

2. SBA - State Trade Expansion Program (STEP)

Good if: You're a small business that's ready to explore exports (trade shows abroad, market entry, localisation).

- Who it's for:

US small businesses that want to start or grow exports can apply through state trade offices that get STEP money from the SBA. - What it funds:

Part of the cost includes international trade shows, missions, export marketing, translation, and in-market consultants. - Typical size:

States get grants of $100k-$900k each. That usually turns into a few thousand dollars per company for export activities. - Status:

An ongoing SBA program with competitive funding rounds for states and territories. Total STEP funding and project periods are set each fiscal year, so founders should check the current STEP page on sba.gov and their state trade office for up-to-date application windows and support amounts.

How to use it as a founder?

- Search:

"[Your State] STEP grant". - Find your state trade office or economic development agency.

- Look for export vouchers, trade mission support, or "STEP" on their page.

If you're already getting international leads, this is one of the easiest ways to subsidise your first serious export push.

Next read: How to Raise a Small Amount of Capital

3. MBDA Grants & Capital Readiness Support

The Minority Business Development Agency (MBDA) doesn't usually wire cash to founders. It funds organisations that support minority-owned businesses.

- Who it's for:

Minority-owned companies (Black, Latino, Asian, Indigenous, and other groups), plus accelerators, nonprofits, and universities that serve them. - What it actually funds:

- Technical assistance

- Capital-readiness programs

- Ecosystem building (centres that help you with investors, banks, and federal programs)

- Key program:

The MBDA Women's Entrepreneurship Program (WEP) funds organisations that deliver services to women entrepreneurs in underserved communities, such as coaching, capital-readiness support, and ecosystem programs. - Status:

An ongoing MBDA initiative delivered through competitive Notices of Funding Opportunity (NOFOs) to eligible organisations, not direct grants to founders. Funding levels and deadlines change by cycle, so organisations and founders should always check the latest WEP information on the official MBDA website.

How to use it as a founder?

- Go to the MBDA site and find your nearest MBDA Business Centre. They're the ones funded to help you.

- Ask specifically about:

- Investor and capital readiness programs

- Local microgrants or stipend programs

- Connections into banks, CDFIs, and angel networks

MBDA is more like a "support stack" for minority founders than a single cheque.

US Private & Corporate Grants That Actually Pay Out

These are smaller checks, but they're often more realistic for early-stage founders.

4. Amber Grant for Women (WomensNet)

Good if: You're a woman founder with a clear story and a simple, honest plan for how a small grant would help.

- Who it's for:

Women-owned businesses in the US and Canada, including very early-stage, some categories include nonprofits. - What it pays:

- Three $10,000 grants each month (Amber Grant, Startup Grant, and a rotating Business Category Grant).

- Three $50,000 year-end grants to selected monthly winners.

- How it works:

Short online application, basic questions about your business and use of funds, plus a small application fee. - 2025 status:

An ongoing monthly grant program run by WomensNet, with winners announced regularly and details published on the official Amber Grant website. Grant categories, amounts, and terms can change over time, so applicants should always review the current information on the official site before applying.

This is one of the few recurring, predictable grants for women founders. The odds are competitive, but the process is straightforward.

Don't miss: 20 Startup Fundraising Tools For Founders

5. NASE Growth Grants (National Association for the Self-Employed)

Good if: You're a US solopreneur or micro-business owner and okay with paying for membership.

- Who it's for:

NASE members in good standing running a small business or self-employed venture. - What it pays:

Up to $4,000 for specific growth needs like marketing, hiring, or equipment. - How it works:

You must be a member, explain your business, what you'll do with the funds, and how it will help you grow. Grants are awarded to four winners per quarter. - Status:

Active with ongoing quarterly review cycles.

Worth a look if you already value NASE's other member benefits and want a small, practical boost.

Keep learning: 11 Fundraising Myths

6. Comcast RISE & Similar Local Corporate Grants

Good if: You're in one of the cities they target and your business has a community impact.

- Who it's for:

Small businesses in specific US cities or regions, often with a focus on diversity, local impact, and historically underserved owners. - What it pays:

Selected businesses receive a support package that can include:- A cash grant (for example, $5,000 in some rounds)

- Business consultation

- Marketing/creative production

- Media schedule

- Technology makeover

- Education resources

(Exact mix and amounts vary by cohort.)

- Status:

A recurring corporate support program that opens applications for selected cities and regions in defined windows. The number of recipients and benefits change from round to round, so founders should always consult the official Comcast RISE website for the latest eligibility, locations, and deadlines.

Other corporates (Patagonia, Verizon, etc.) also run occasional local grant programs. These change often, so always verify the current year's terms.

US Demographic & Impact-Focused Programs

These programs target women, minority founders, and impact-driven businesses.

7. Cartier Women's Initiative

Good if: You're building a women-led, impact-driven venture and can handle a serious application.

- Who it's for:

Women-run and women-owned businesses from any country, including the US, that have a strong social or environmental impact. - What it pays:

Recent cycles offer:- $100,000 for top regional winners

- $60,000 for second place

- $30,000 for third place

Plus one year of leadership training, executive coaching, and access to a large global network.

- Cohort timing:

The Cartier Women's Initiative runs regular global award cycles, with applications opening once a year and deadlines typically in the first half of the year. Exact dates, regions, and award structure can change from one cohort to the next, so founders should always check the current application timeline and criteria on the official Cartier Women's Initiative website before applying.

This is not a quick form; it's closer to applying to an accelerator plus prize. But if you're already impact-focused, the mix of money + visibility is huge.

Explore more: Use AI for Fundraising

8. HerRise Microgrant (Women of Colour)

Good if: You're a woman of colour founder needing a small, fast grant.

- Who it's for:

For-profit US businesses that are at least 51% owned by women, with a focus on women of colour, and annual revenue under $1M. - What it pays:

A $1,000 microgrant each month to one selected business. - How it works:

- Simple online application with a short pitch

- Small application fee (around $10–$15)

- Deadline is usually the last day of each month, with winners announced the following month.

It won't extend the runway for a year, but it can pay for a small but critical step: branding, a small equipment purchase, or early marketing.

How to Search US State & City Grants Without Losing a Week

In practice, many of the most realistic $5k-$25k grants are local. They're also the hardest to find because nobody maintains a clean national list.

Typical state and city grant types

You'll see patterns like:

- Main Street/façade improvement grants: cash to improve your storefront or neighbourhood.

- Digitalisation and innovation grants: help small businesses adopt software, e-commerce, or tech.

- Manufacturing and climate/energy grants: support for equipment, efficiency, or clean-tech upgrades.

- Tourism or sector-specific programs: grants if you're in hospitality, culture, or other target industries.

These live in state departments of commerce, city economic development offices, and local business recovery sites.

Search method that actually works

Do this in a clean browser window:

- Search:

"[Your state] small business grants [Year] site:.gov""[Your city] small business grant","[Your city] business improvement grant"

- Check these places first:

- State Department of Commerce / Economic Development websites

- Governor's office "small business" pages

- Your local Small Business Development Centre (SBDC) or city economic development office

- Look for current deadlines, not blog posts:

- Ignore "Top 50 Grants" listicles from random blogs.

- Stick to URLs ending in .gov or official local orgs (chambers, SBDCs, CDFIs).

Treat this as an ongoing research habit, not a one-time search. These programs open, close, and mutate constantly.

How to Avoid Getting Scammed While Chasing Grants

When people get desperate for "free money," scammers move in. A few basic rules will save you a lot of pain.

How real government grants behave

- They are listed on .gov websites:

- grants.gov, usda.gov, sba.gov, mbda.gov, state.gov sites, etc.

- They do not:

- Guarantee awards

- Ask for big up-front fees

- Cold-DM you on social media, asking for your bank login

If you don't see the program on an official government site, don't trust it.

Warning signs of bad actors

Be very sceptical of:

- "Guaranteed government grant" or "no-rejection program" marketing

- Consultants who charge big fees before you win anything

- Sites that copy government logos but use non-.gov domains and poor English

- People asking for full SSN and banking info over email or DMs

What about fee-based private grants?

Some legit private grants (like the Amber Grant or HerRise Microgrant) charge small application fees.

Before you pay:

- Check the official site's history (domain age, past winners, press mentions).

- Look for recent coverage from reputable third-party sites that are not just affiliates.

If the brand is unknown, has no visible winners, and is heavily pushing urgency, skip it.

How to Apply Without Making It a Full-Time Job

Here's a simple, realistic process you can reuse for almost any grant on this list.

1. Decide on the project first

Don't start from "where is the money?" Start from:

- "We need $X for Y over the next Z months."

Examples:

- $8k to test exports at a specific EU trade fair → STEP or state export vouchers.

- $4k to run first proper marketing campaign → NASE, local grants, Amber/HerRise.

- $5k to upgrade a storefront or equipment → City or Main Street grants.

2. Match 1-3 programs, not 10

From this article and your state search, pick up to three that clearly fit:

- Rural? → RBDG (via local partners) + local rural grants.

- Export-ready? → STEP + state export voucher.

- Women of colour founder? → Amber + HerRise + local DEI-focused programs.

If you don't match the eligibility bullets, move on. Don't force it.

3. Read the eligibility + one past winner story

On each program:

- Read the "Who is eligible" section slowly.

- Check at least one recent winner's story (if public). Do they look like you? Or are they 20-year-old manufacturers?

If it's clearly wrong for your stage or sector, drop it.

4. Draft a short project brief

One page is enough:

- What do you want to do

- Why it matters

- How you'll spend the money

- What success looks like in 6-12 months

This becomes reusable copy for multiple applications.

5. Block 1–2 focused weeks

Instead of half-doing everything across three months:

- Pick a two-week window.

- Complete 1-3 applications end-to-end.

- Ask 1-2 people to proofread them for clarity.

6. Expect 1-3 months for decisions

Roughly:

- Private grants (Amber, HerRise, NASE): usually weeks, not months.

- State and local grants: 1-3 months.

- Federal programs: often longer, with multiple review stages.

Don't plan cash flow assuming anything hits fast.

Using Grants to Make Your Round Stronger, Not Replace It

Grants are not a substitute for revenue or a future round. They're a way to:

- Buy time to validate a risky idea * Hire earlier than you otherwise could * Prove demand in a new market (exports, new city, new customer segment)

A smart pattern for founders looks like this:

- Use grants and microgrants to fund specific proof points.

- Once you have real data, customers, export traction, retention, unit economics—

- Use Evalyze.ai to:

- Test your pitch deck with AI feedback

- Search for investors who match your stage, sector, and geography

More Articles

5 Canva Pitch Deck Templates Every SaaS Founder Should Know

Discover five of the best SaaS startup pitch deck templates on Canva. Reviewed for design, usability, and investor-readiness. Plus, see how to analyze your deck with Evalyze.ai before fundraising.

November 3, 2025

How to Adapt Your Pitch Deck for Virtual Investor Meetings

Practical tips to make your online pitch clear, engaging, and investor-ready from any screen.

November 1, 2025