Startup Stages Explained: A Practical Guide from Idea to Scale-Up

Master the 6 startup stages from Idea to Scale-Up. Learn how to de-risk your business and what "proof" investors want from Pre-Seed to Series D+.

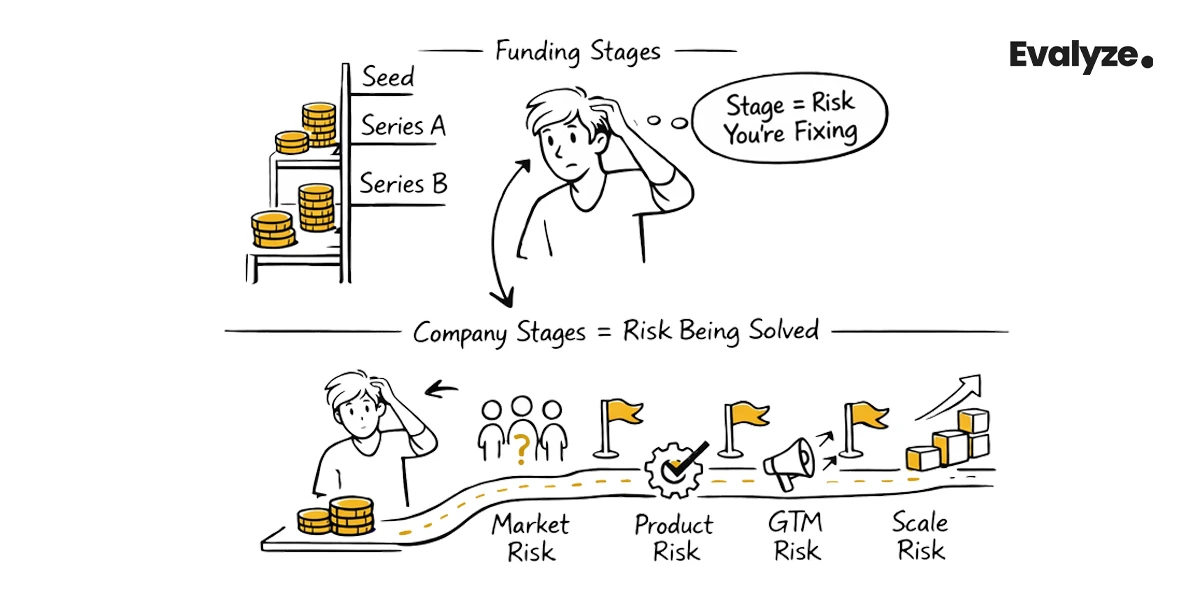

Many founders confuse money raised with real progress. Just because you closed a Seed round, it doesn't mean you are finished with the Idea phase.

Think of startup stages as a map to help you find and fix your biggest risks:

- Market Risk: Do people actually want this?

- Product Risk: Does the solution actually work?

- GTM (Go-To-Market) Risk: Can we sell this to many people repeatedly?

This guide explains the gap between building a business and raising money. You will learn exactly what to build, who to hire, and what proof investors are looking for.

What Are Startup Stages?

Many founders get confused because funding stages and company stages are not always the same.

- Funding Stages: These tell people how much money you raised.

- Company Stages: These tell people which risk you are currently trying to remove.

Sometimes a company raises a Series A (a large investment) but is still struggling to find PMF (Product-Market Fit). Other companies have high revenue and happy customers without ever taking money from investors.

The Simple Rule: Stage = The Risk You Are Fixing

To find your real stage, ask: What is the biggest thing I need to prove right now?

- Before you have customers: You are fixing Market Risk. (Does this problem matter to anyone?)

- Once you have customers: You are fixing Product Risk. (Does our solution solve the problem?)

- Once the product works: You are fixing GTM Risk. (Can we sell this to many people in a repeatable way?)

- Once you sell reliably: You are fixing Scale Risk. (Can we grow much bigger without the company breaking?)

Startup Stage 1: Idea & Problem Exploration

In this stage, your only job is to prove that the problem is real, frequent, and painful enough that people will pay to fix it.

Most founders fail because they build a product nobody wants. This usually happens because they skipped this step. At this stage, you are a researcher, not a builder.

Your Primary Goal: Understand the Pain

You are looking for an Ideal Customer Profile (ICP) who is doing a specific task and feels a specific frustration.

- The Strategy: Talk to 20-40 potential customers.

- The Rule: Do not "pitch" your idea. Just listen.

- The Signal: Look for patterns. If five people say, "I do this manually every week, and it drives me crazy," you have found your "gold."

What "Progress" Looks Like?

Progress is not a working app yet. It is:

- A Problem Narrative: A clear story explaining the pain in 5 minutes.

- Competitor Knowledge: Knowing the top 3 ways people solve the problem now and why those ways suck.

- The "Why Now?": A clear reason why customers are ready to switch to something new today.

Pro Tip: Create a "non-solution" landing page. Describe the problem and the fix. If nobody clicks "Sign Up," your messaging is wrong. It is better to learn this now before you spend money on coding.

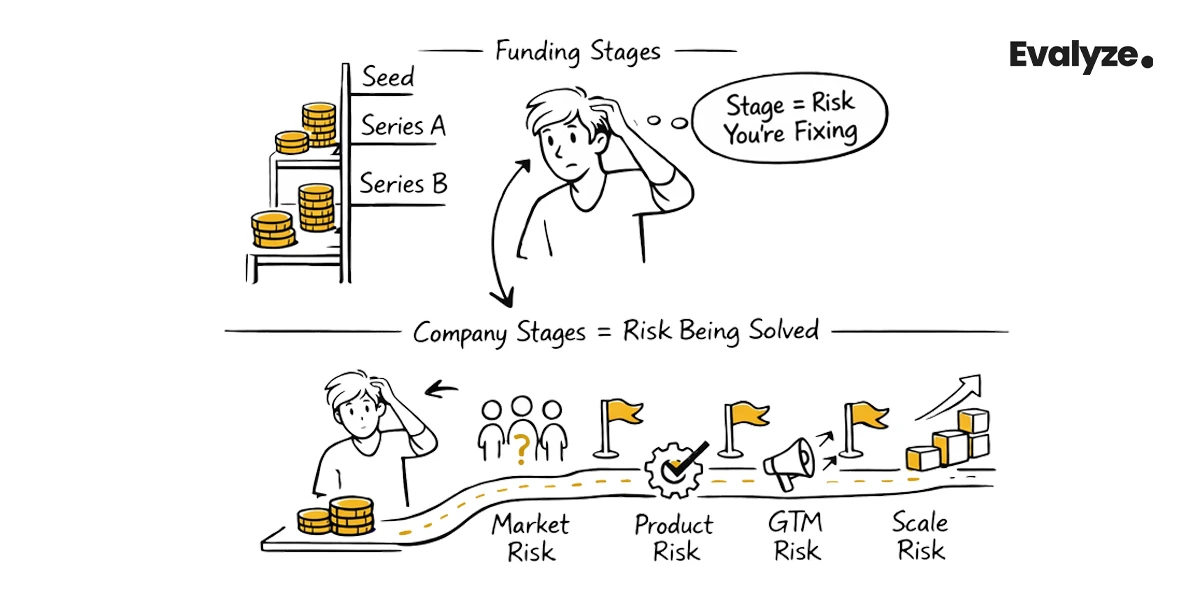

Startup Stage 2: Validation & Pre-Seed Stage

In this stage, you move from "talking" to "testing." Your goal is to prove that people don't just like your idea, they will actually use it, pay for it, or change their habits for it.

There is a huge difference between a person saying "That's a cool idea" and "I need this right now." You are looking for the second person.

Your Primary Goal: Find the Pull

You need to see real signals that the market is pulling the product out of you.

- Proof to Collect: Look for LOIs (Letter of Intent), sign-ups for a pilot program, or a waitlist where people give you their data.

- The Pricing Test: Don't wait to talk about money. Ask potential customers what they would pay before you build the product. If they can’t give you a number, the problem might not be painful enough.

- Avoid the Trap: Do not build a "perfect" product yet. It is much cheaper to learn how people buy by using simple prototypes or manual services.

Pre-Seed Fundraising: What Investors Want

The pre-seed stage is often the first time you raise money from outsiders. Investors (like those at Antler) usually look for three things:

- The Team: Do the founders have the skills or experience to win?

- The Wedge: Is there a very specific, small part of the problem you can solve perfectly first?

- Early Traction: Are there signals (like landing page clicks or pilot sign-ups) that people want this?

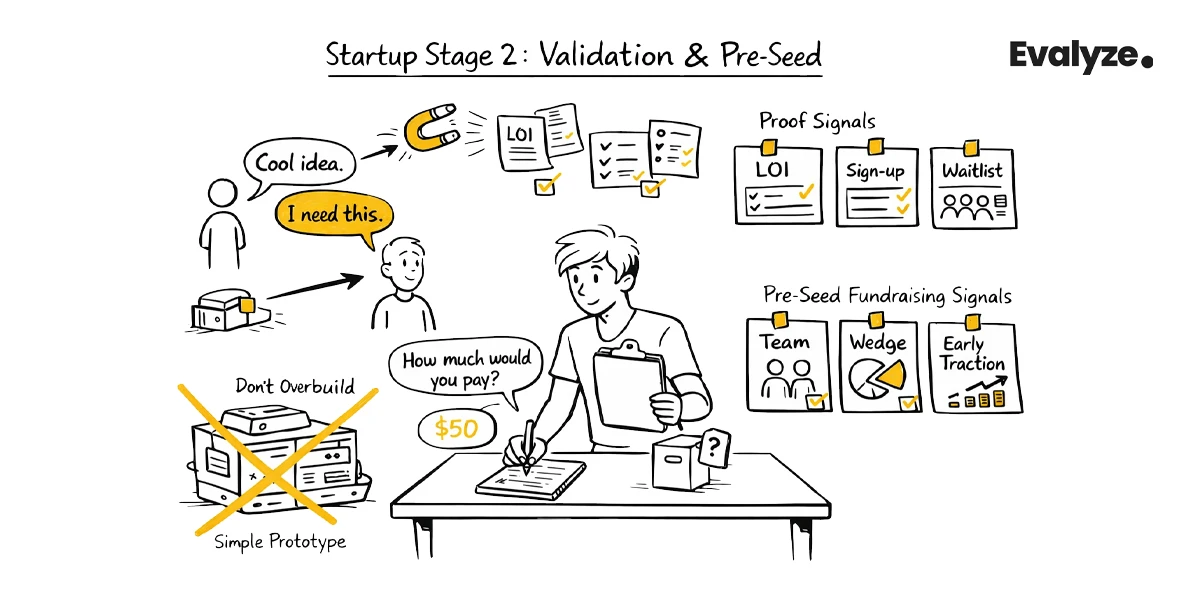

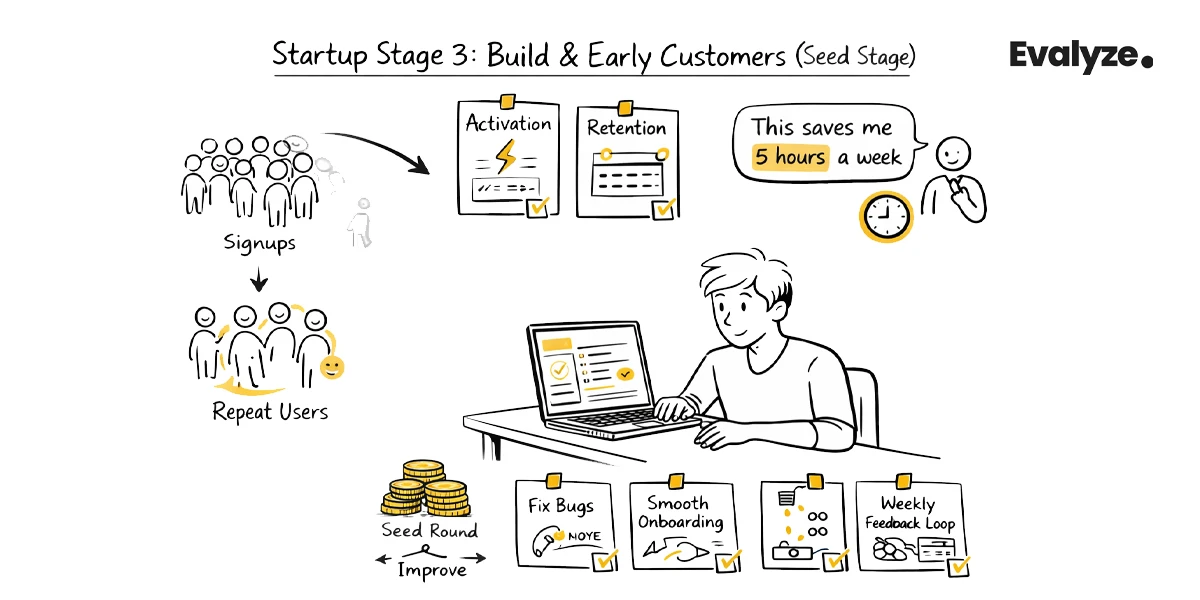

Startup Stage 3: Build and Early Customers (Seed Stage)

In this stage, you finally build your MVP (Minimum Viable Product). Your goal is to prove that your product works well enough for people to use it again and again.

Many founders think raising a Seed round means they have succeeded. In reality, it just means investors believe you can succeed. The real proof still comes from your users.

Your Primary Goal: Find Repeat Users

It doesn't matter if 1,000 people sign up if they all leave the next day. You are looking for Retention.

- The MVP Rule: Build the smallest version of your product that provides real value. It shouldn't just be a pretty demo; it must solve a real problem.

- What to Measure: Focus on Activation (Did they understand the product immediately?) and Retention (Did they come back?).

- Qualitative ROI (Return on Investment): Talk to every single customer. If they say your product saves them 5 hours a week, you have found "Return on Investment."

Seed Round Use: From Maybe to Repeatable

According to Y Combinator, seed money should not be used to grow as fast as possible. Instead, use it to:

- Make the product stable (fix the bugs).

- Create a smooth onboarding process so new users don't get confused.

- Build a feedback loop so you can learn from customers and improve the product every week.

Not sure if you are ready for the next stage?

Before you send your pitch deck to investors, let AI be your first critic. Evalyze.ai gives you an instant Investor Readiness Score based on the stage you are in.

- Pre-Seed Founders: See if your "Problem/Solution" narrative is strong enough.

- Seed Founders: Check if your retention and traction data look professional.

Startup Stage 4: Early Growth and Scaling Foundations (Series A Stage)

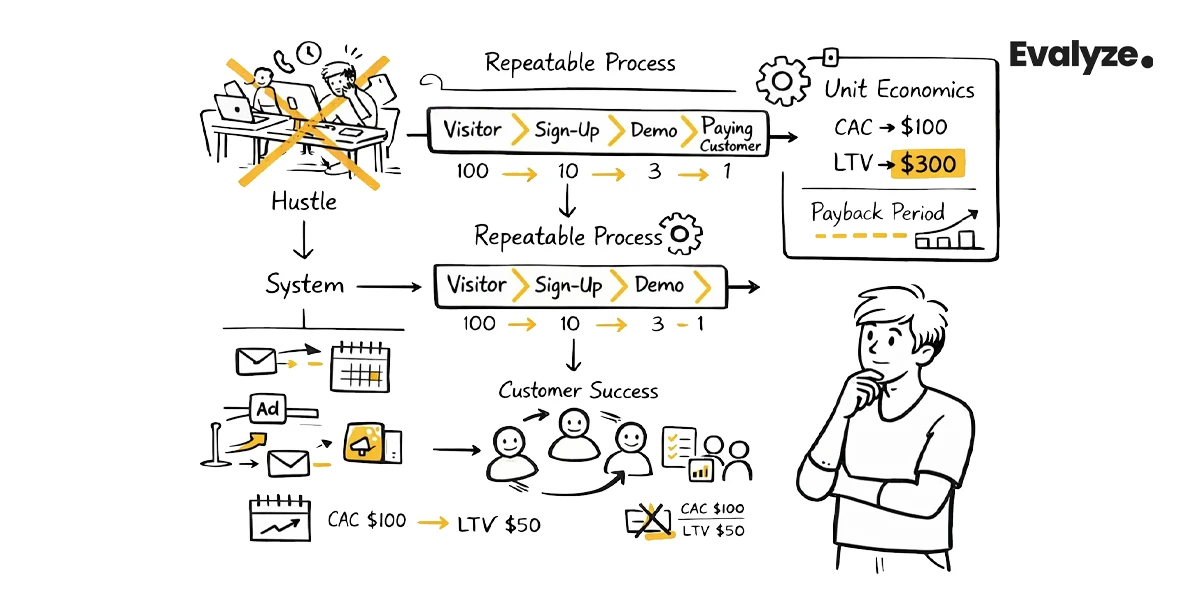

In this stage, you move from hustle to systems. Your goal is to prove you have a repeatable way to get customers.

In the beginning, founders can close deals by working 20 hours a day. At the Series A stage, the business must work even when the founders are not in the room.

Your Primary Goal: Build the Sales Machine

You need a clear process for how a stranger becomes a paying customer.

- The Predictability Test: You should have at least one acquisition channel (like LinkedIn ads or cold outreach) that brings in customers every month without heroics.

- Sales Discipline: You need to know your conversion rates. If 100 people visit your site, how many sign up? If 10 people sign up, how many pay?

- Customer Success: You need a process to keep customers happy that doesn't require the CEO to personally fix every problem.

Why Unit Economics Matter Now

You don't need to be profitable yet, but you must prove the math works. Investors will look at the relationship between CAC (Customer Acquisition Cost) and LTV (Lifetime Value).

- If it costs you $100 to find a customer, but they only pay you $50 before leaving, growing bigger will only lose you more money.

- You need to show that as you grow, your "payback period" (how long it takes to earn back the money you spent on marketing) is getting shorter.

Read this next: How to Find Angel Investors for Your Startup

Startup Stage 5: Growth Stage: Series B and C

In this stage, you have already proven that your "engine" works. Now, your goal is to push the accelerator and grow revenue fast without breaking the company.

The risk is no longer about whether people want your product.

The new risk is operational: Can your team and your systems handle growing 3x or 5x faster?

Your Primary Goal: Scale Efficiently

You are turning a successful startup into a dominant market leader.

- Stable Retention: You need to show that your cohorts (groups of users) are staying long-term. If people leave as fast as they join, you cannot scale.

- Predictable Pipeline: You should be able to predict your sales for the next 3 to 6 months with high accuracy.

- Category Leadership: By Series C, you want to prove you are the #1 or #2 player in your industry.

Two Big Mistakes at This Stage

- Distraction: Trying to start new marketing channels before the first one is fully finished. It is better to master one channel than be okay at five.

- Hiring Too Fast: If you hire 50 people but don't have a plan to train them, your older employees will spend all their time teaching instead of working. This actually slows the company down.

From the founder toolkit: How to Build an Investor List Based on Your Startup

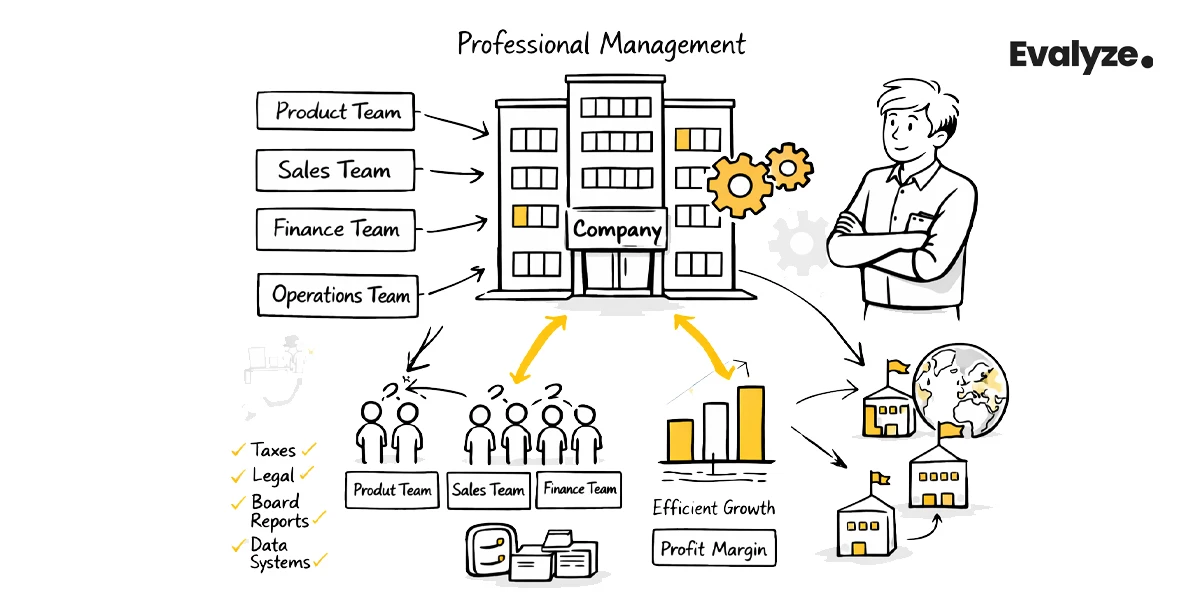

Startup Stage 6: Scale-Up (Series D+) and Late-Stage Startup Operations

In this stage, your product and sales are working well. Now, your goal is to prove that the company is a durable machine that can run without the founders being involved in every small decision.

The challenge is no longer about surviving. It is about maturity and building systems that work for hundreds or thousands of employees.

Your Primary Goal: Professional Management & Efficiency

You are preparing the company to become a permanent, independent business or to be sold.

- Multi-Team Execution: When you have 200+ employees, you need a clear structure. You must define how teams talk to each other and how decisions are made.

- Margin Improvement: Investors now look for Efficient Growth. They want to see that as you get bigger, your costs per customer go down and your profit stays healthy.

- Audit Readiness: Your finance and data systems must be "clean." This means having perfect records for taxes, legal rules, and board meetings.

- Going Global: Many companies at this stage expand to new countries. Each new market is like a "mini-startup" that needs its own local plan.

Why Process Matters Now

At Series D, the "move fast and break things" style starts to become dangerous. You need:

- Governance: A clear way for the Board of Directors to oversee the company.

- Data Room Hygiene: Keeping all your legal and financial documents organized so you are always ready for a big deal.

Built for founders: Best Platforms to Find Investors for Startups

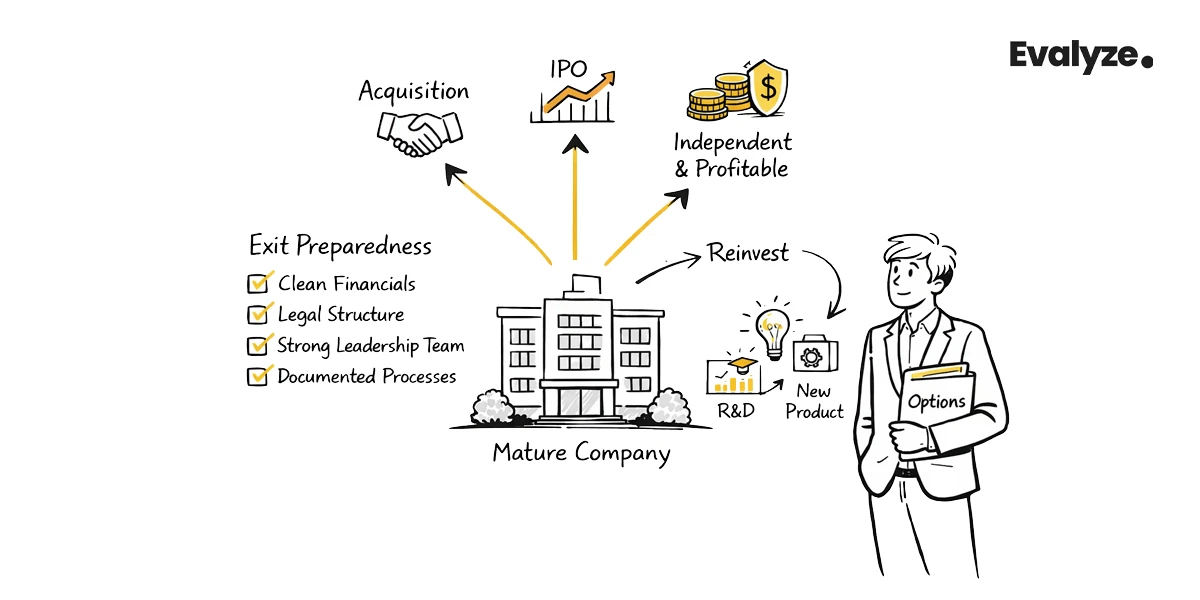

Maturity, Exit, or Renewal (Exit Stage Startup)

In this final stage, you are no longer a startup. You are a mature business. Your goal is to maximize your options: whether that is selling the company, going public, or staying independent and profitable.

An "exit" is not just a lucky event. It is something you prepare for by building a company that is easy to buy or ready for the stock market.

Your Primary Goal: Strategic Options

You need to decide which path is right for your business:

- Acquisition: Selling your company to a larger corporation (like Google or Salesforce).

- IPO (Initial Public Offering): Offering shares of your company to the general public on the stock market.

- Profitable Independence: Choosing not to sell, but running the company using its own profits.

- Renewal: Finding a new problem to solve or a new market to enter so the company can start a new growth cycle.

How to Be Exit-Ready

If you want a high price for your company, you must fix these areas:

- Clean Financials: Your books must be perfect. Buyers will check every dollar you spent.

- Diversification: Do not rely on a single or two large customers. If one customer provides 40% of your revenue, your company is considered "high risk."

- Durable Growth: You must prove that your company will keep growing even after the founders leave.

Too useful to skip: How to Use Evalyze Investor Discovery

Quick Startup Stage Diagnostic: Where Are You Really?

Forget about how much money is in your bank account. To find your true startup stage, look at your progress in these four areas.

The Rule: Your actual stage is the lowest category where you still have a gap. For example, if you have a great product but no way to find customers, you are still in the early stages.

| Category | Idea / Pre-Seed | Seed Stage | Series A (Growth) | Series D+ (Scale) |

|---|---|---|---|---|

| Customers | None / Interviews | Pilots & Early Payers | Repeatable Sales | Mass Market / Global |

| Product | Concept / Mockup | MVP | Stable v1.0 | Scalable Platform |

| GTM | Founder-led / Manual | Small & Repeatable | Multiple Channels | Multiple Regions |

| Operations | Founder does all | First Team Hires | Proven Processes | Metrics & Systems |

How to Use This Diagnostic

- Identify the Gap: If you have 50 paying customers (Series A) but your product crashes every day (Seed), you are still at the Seed Stage. You must fix the product risk before you try to scale.

- Be Honest about GTM: If the founders are still the only ones who can close a sale, you haven't reached the Growth Stage yet, even if you have high revenue.

- Check Your Ops (Operations): If the company stops working when the CEO goes on vacation, you are still founder-led and not yet a "Scale-up."

Startup Stages vs. Funding Rounds

It is important to remember that these are not strict rules. Some companies skip rounds, some never take money from Venture Capital, and others raise money at the wrong stage.

However, this table shows how your business progress usually maps to the money you raise.

A must-read for founders: When’s the Right Time to Seek Funding?

The Startup Mapping Table

| Company Stage | Typical Round | Primary Risk | Founder Focus | Ready When... |

|---|---|---|---|---|

| Idea / Exploration | Pre-seed or none | Market | Finding the pain | You can explain the problem clearly |

| Validation | Pre-Seed | Demand | Pricing & "Pull" | People are waiting to buy |

| Build / Early Customers | Seed | Product | Retention | Customers keep coming back |

| Early Growth | Series A | GTM | Repeatable Sales | You have a "Sales Machine" |

| Growth | Series B / C | Scale | Efficiency | You can grow without breaking |

| Scale-Up | Series D+ | Organizational | Process & Margin | The company runs without you |

| Maturity / Exit | Late-stage / Exit | Strategic | Options | You are ready to sell or go public |

A Simpler Way to Group Stages

Investors (like SVB) often use even simpler labels to group these stages:

- Early-Stage: Everything from the Idea to your first paying customers.

- Venture-Funded / Growth: When you are scaling a proven sales model.

- Late-Stage: When you are a large, mature company preparing for an exit.

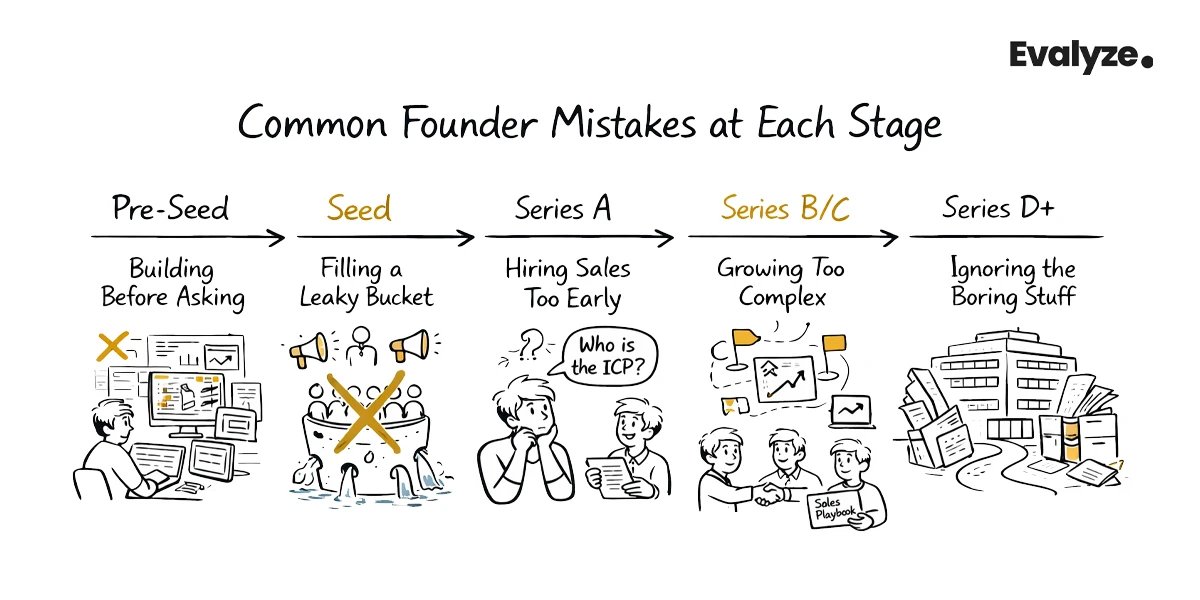

Common Founder Mistakes at Each Stage

Building a startup is hard, and most mistakes happen because founders try to do the right thing at the wrong time. Here are the most common traps and how to avoid them.

The Pre-Seed Mistake: Building Before Asking

- The Problem: You build a great tool, but then you find out your users don't have the money to buy it, or their boss won't let them.

- The Fix: Talk to the "Buyer," not just the "User." Make sure the person with the problem also has the budget to pay for it.

The Seed Mistake: Filling a Leaky Bucket

- The Problem: You spend money on ads to get new users, but those users leave after one day (Churn).

- The Fix: Focus on Retention first. Don't try to grow fast until you prove that people want to stay and use your product long-term.

The Series A Mistake: Hiring Sales Too Early

- The Problem: Founders hire a sales team because they are tired of selling. But if the "message" or the ICP (Ideal Customer Profile) is not clear, the sales team will fail.

- The Fix: The founders must close the first 10-20 deals themselves to create a sales playbook that actually works.

The Series B/C Mistake: Growing Too Complex

- The Problem: You launch in 5 countries and 3 new languages all at once. Suddenly, you can't tell which part of the business is actually making money.

- The Fix: Scale one thing at a time. Make sure you have the Analytics to see exactly which channel is working before adding another one.

The Series D+ Mistake: Ignoring the Boring Stuff

- The Problem: The company is huge, but the legal and financial records are a mess. This can kill a deal to sell the company (Exit).

- The Fix: Build Governance (rules and oversight) and clean financial systems before you actually need them for a big audit.

No matter which stage you are in, from your first Pre-Seed check to a scaling Series A, finding the right partner is the hardest part.

Evalyze.ai removes the guesswork by matching you with over 10,000+ VCs and Angels who actually invest in your industry and stage.

Use Evalyze to:

- Find Matches: Get a list of investors who specifically fund companies at your stage.

- Predict Success: See your chances of getting into top accelerators like Y Combinator.

- Automate Outreach: Spend less time on spreadsheets and more time building your business.

FAQ

1. What are the three stages of a startup?

The simplest breakdown is early-stage (finding product-market fit), growth-stage (scaling what works), and late-stage (operational maturity and exit preparation). These map loosely to pre-seed through seed, Series A through B/C, and Series D onward.

2. What are the stages of startups by funding round?

Seed covers early product and customer work. Series A is about proving a repeatable go-to-market. Series B and C are about scaling revenue efficiently. Series D and above are typically about organizational maturity, international expansion, or pre-exit positioning.

3. Is pre-seed the same as seed?

No, and the distinction matters. Pre-seed funding typically comes before you have significant product or traction. The proof standard is lower, and the check sizes are smaller. Seed funding assumes you've done enough validation to start building in earnest and acquiring early customers. Conflating the two leads founders to think they're further along than they are.

4. Can you skip a funding round?

Yes, and it happens regularly. Funding rounds aren't mandatory milestones; they're one way of financing a company. Some companies grow from seed directly to Series B because they hit strong metrics without needing a Series A raise. Others never take institutional VC at all. The round labels matter less than the underlying company progress they're supposed to represent.

More Articles

How Much Money to Raise at the Seed Stage

Learn how much money to raise at the seed stage using a clear, step-by-step process based on milestones, runway, costs, and risk.

February 9, 2026

How Much Money Do You Need To Raise At The Pre-Seed Stage?

Learn how to calculate your pre-seed funding ask using runway, burn rate, milestones, and market benchmarks.

February 7, 2026