Best Incubators for Tech Startups in the Seed Stage

A practical shortlist of incubators for tech startups in the seed stage, plus a quick fit checklist and what to prep to apply fast.

The gap between a prestigious incubator and one that actually delivers revenue is often wider than founders realize. At the seed stage, your primary goal is to trade a small amount of equity or time for a massive leap in credibility and distribution.

Below is a tactical shortlist of seed-stage tech incubators, categorized by their specific superpowers, whether that's deep-tech validation, enterprise sales access, or investor-ready narrative building.

Key Takeaway

- "Best" incubator = the one that accelerates your next 90 days, not the one with the loudest brand.

- Filter by stage fit, commitment, and cost of capital before you ever fill an application.

- A strong application is a signal-dense memo: the problem, the proof, and the following milestones.

- Use Evalyze to sharpen the deck and target investor fit, then reuse that clarity across applications.

Incubator vs Accelerator: The Difference That Matters

While the industry uses these labels interchangeably, the program's name matters far less than its structural impact on your cap table and calendar.

At the seed stage, you are evaluating liquidity versus leverage.

When reviewing a program, ignore the marketing copy and filter for these four mechanics:

- Stage-Agnostic vs. Cohort-Driven:

Does the program take raw ideas (Incubator) or require a Minimum Viable Product (MVP) and early evidence of product-market fit (Accelerator)? - The Time-to-Value Ratio:

Is this a flexible, multi-year support system (Incubator) or a high-intensity, 12-week sprint designed to force a "Demo Day" fundraising event (Accelerator)? - The Cost of Entry:

Evaluate the trade-off. Some offer zero-equity grants or university-backed resources, while others provide a "standard check" (e.g., $125k-$500k) in exchange for 5%-10% of your company. - Strategic Moats:

Does the program offer generic mentorship, or does it provide a specific moat? Look for deep-tech labs, regulatory "sandboxes" for health/fintech, or direct procurement pipelines to enterprise buyers.

Don’t Miss: 20 AI Fundraising Tools for Startups

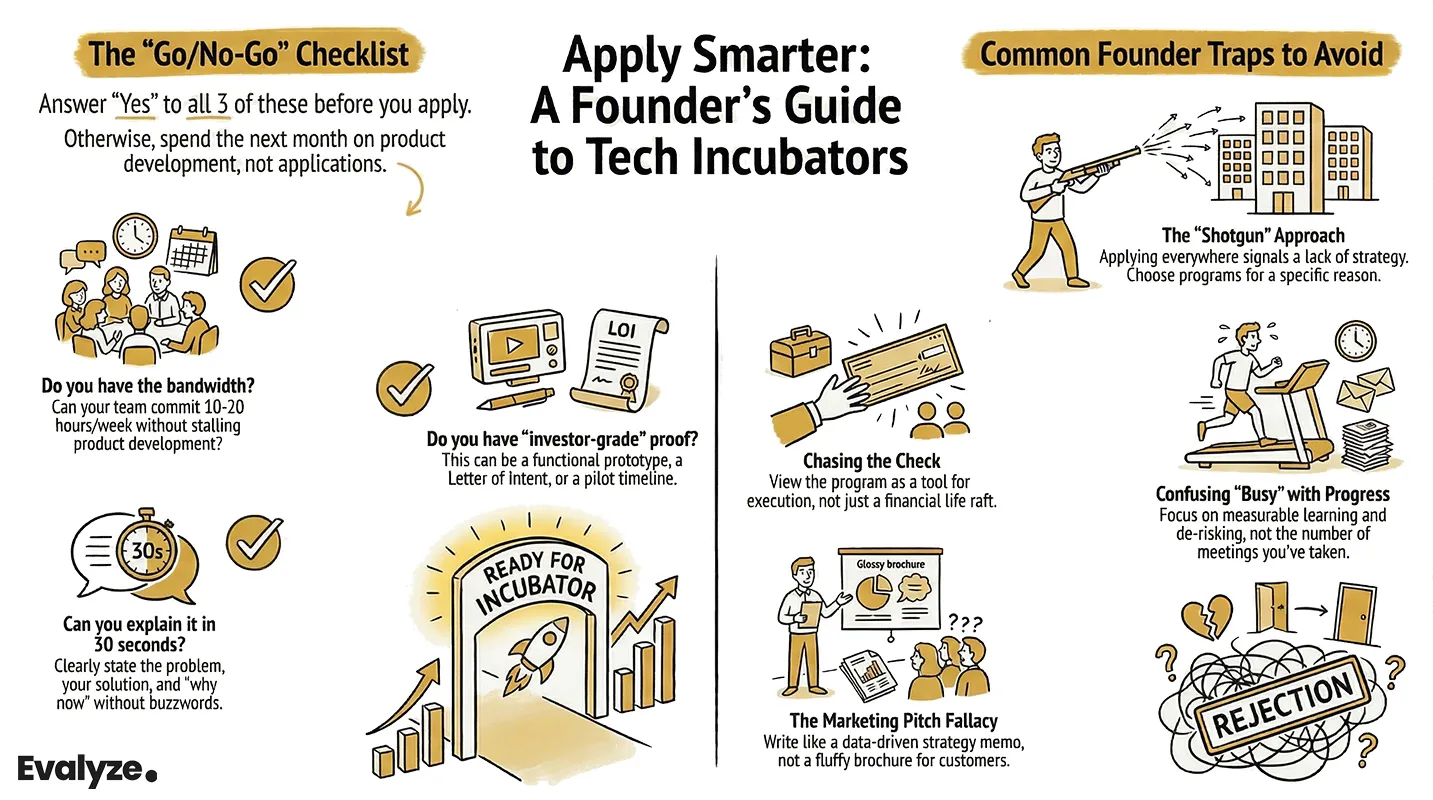

Strategic Fit Assessment: The "Go/No-Go" Checklist

Before burning operational cycles on a 20-page application, audit your startup against these six criteria.

If you cannot confidently answer "Yes" to at least four, you are likely better off spending the next month on product development than on applications.

- Operational Bandwidth: Can the founding team commit 10-20 hours a week to the program’s cadence (mentorship, sessions, travel) without stalling product development?

- ICP Definition: Have you narrowed your Ideal Customer Profile (ICP) enough to run high-velocity experiments, or are you still "boiling the ocean"?

- Signal Density: Do you have "investor-grade" proof? This doesn't require $1M in ARR; it requires a functional prototype, a Letter of Intent (LOI), a pilot timeline, or a validated technical benchmark.

- Narrative Clarity: Can you articulate the problem, the wedge, and the "why now" in under 30 seconds without relying on buzzwords like "disruptive" or "AI-powered"?

- Resource Gap Identification: Can you name exactly what this program solves specifically, capital, hiring, regulatory pathways, or distribution?

- Thematic Alignment: Does your startup sit in the program’s "sweet spot"? (e.g., Don't pitch a consumer app to a program built for B2B industrial manufacturing).

The Golden Rule:

Never optimize for acceptance. Optimize for outcomes. An acceptance letter from a program that doesn't solve your specific distribution or technical bottlenecks is just a high-cost distraction.

Next read: Best Startup Hubs & Ecosystems for Fundraising

Best incubators for tech startups in the seed stage

Incubators for tech startups from Canada and other countries.

| Programme | Where | Best for | Stage fit | What to prep |

|---|---|---|---|---|

| DMZ (Toronto Metropolitan University) | Toronto, CA | Early-stage tech founders who want revenue + investor prep | Early-stage | Deck + traction summary + GTM plan |

| Creative Destruction Lab (CDL) | Multi-site (incl. CA) | Science/tech startups that can set challenging objectives with mentors | Seed-stage | Metrics, objective roadmap, strong founder/tech story |

| Velocity (University of Waterloo) | Waterloo, CA | Pre-seed tech startups turning ideas into scalable companies | Pre-seed tech | Problem clarity + prototype plan + milestones |

| District 3 (Concordia) | Montréal, CA | High-tech/health/biotech teams aiming for first funding readiness | Investor-ready for first round | Deck + evidence of PMF progress + gaps you need help closing |

| Launch Academy | Vancouver, CA | Founders who want mentorship + community + structured startup education | Early-stage | MVP narrative + customer learning + founder plan |

| NEXT AI (NEXT Canada) | Canada | Early-stage/pre-seed teams with prototype + early traction (or strong idea) | Early-stage/pre-seed | Prototype/traction proof + differentiation + roadmap |

| Y Combinator | US (SF) | Teams aiming for a classic seed launch + investor access | Seed funding + batches | Tight application + crisp metrics + “why now” |

| Techstars (Accelerators) | Global | Mentorship-driven cohorts; broad verticals and cities | Early-stage, 3-month | Clear problem/market + progress + why this programme |

| Berkeley SkyDeck (Incubator + Accelerator) | US (Berkeley) | UC-affiliated early-stage teams (Pad-13) + “ready to raise” cohort teams | Idea→“ready to raise” | UC affiliation (for incubator) + fundraising readiness (for accelerator) |

| MassChallenge | Multiple (US/UK, etc.) | Founders who want zero-equity, zero-cost acceleration | Equity-free model | Impact + execution plan + traction indicators |

| Alchemist Accelerator | US (SF Bay) | B2B/enterprise startups (you sell to businesses) | Early-stage enterprise | Enterprise wedge + pipeline logic + why you win |

| Entrepreneur First (EF) | UK + global hubs | Individuals/teams as early as “no startup yet” | Pre-seed formation | Founder story + problem obsession + ability to build fast |

Explore more: Micro VCs vs. Traditional VCs: Which Is Right for Early-Stage Founders?

How to apply without wasting cycles

Here's the truth: reviewers are scanning for signal density.

A clean application package usually includes:

- One sentence: what you're building and for whom

- Proof: prototype/pilot/revenue/research progress (whatever is real)

- Why this programme: specific mentors, partners, city, or model fit (not “great network”)

- Next 90 days: 3 milestones you'll hit with their help

Key point: If your deck reads like “features + market size,” you'll look early even if you're not.

Try Evalyze for Free before you apply:

Run pitch analysis to spot weak signals, tighten your narrative, and use AI investor matching to target the right cheque sizes, then reuse that clarity in every incubator application.

Why Strong Founders Get Rejected

Even with a great product, specific tactical errors can signal a lack of maturity or focus to selection committees. Avoid these 4 common founder traps:

1. Applying To Any Incubator:

Applying to dozens of programs without a clear thesis signals a lack of strategic direction. Top-tier programs look for founders who have chosen them for a specific reason, not those looking for any open door.

2. Treating Support as a Financial Life-Raft:

If your primary reason for applying is the stipend or the initial check, it shows. Reviewers prioritize founders who view the program as a forcing function for execution, using the resources to hit specific milestones that would otherwise be out of reach.

3. Activity vs. Velocity:

Many founders confuse "being busy" (networking, attending events) with progress. A weak application focuses on the number of meetings held; a strong one focuses on measurable learning loops and technical de-risking.

4. The "Marketing Pitch" Fallacy:

Incubator reviewers are not your customers; they are your partners (and often your first "investors"). Avoid fluff-filled marketing copy. Instead, write your application like a decision memo: data-driven, objective, and transparent about the risks you are working to solve.

The Professional Standard:

A high-quality application reads like an internal strategy document. It should demonstrate that you understand your business's weaknesses as clearly as its strengths.

Before you go: Why Early-Stage VCs Say No to 99% of Startups

Conclusion

A founder’s best incubator list isn’t long; it’s selective. Pick programmes that match your stage and force real execution, not just networking.

Try Evalyze for Free to strengthen your pitch deck, spot weak signals early, and match with investors aligned to your stage, then apply to the right programmes with a cleaner, faster story.

FAQ

1. Are these all incubators, or are some accelerators?

Some are accelerators by structure (fixed cohorts), others are incubators by support style. Use the fit checklist above; it matters more than the label.

2. What’s the best stage to apply to?

When you can show credible movement: prototype + customer learning, or technical progress + a believable path to adoption.

3. Do I need revenue to get accepted?

Not always. Several programmes explicitly support very early teams, including pre-seed founders.

4. How do I increase acceptance odds without “gaming” it?

Make your story tighter: a clear customer, a clear pain, a clear proof, and clear next steps. Clarity beats hype almost everywhere.

More Articles

How Long Does Fundraising Take?

Discover the typical timelines for raising startup funding and learn actionable strategies to accelerate your fundraising process.

June 9, 2025

9 Tools For Successful Startup Fundraising

Your go-to toolkit for founder-friendly tools that help you pitch better, connect with investors faster, and raise smarter, without burning time or budget.

June 8, 2025