How Long Does Fundraising Take?

Discover the typical timelines for raising startup funding and learn actionable strategies to accelerate your fundraising process.

Raising capital is a big step for any startup, but knowing how long it actually takes can feel like a black box. Some founders get funded in weeks, while others spend months chasing warm intros and revising their deck.

So, how long should you realistically expect your fundraise to take?

In this guide, we’ll break down the average timelines for pre-seed and seed fundraising, what slows you down or speeds you up, and how you can make the process faster using smart strategies.

Average Fundraising Timelines: What to Expect

If you're wondering how long it really takes to raise a round, here's the short answer: usually longer than you think.

-

Pre-Seed Funding typically takes 3 to 6 months from your first investor outreach to money in the bank. This includes time for building your pitch, booking meetings, getting feedback, and closing the deal.

-

Seed Funding can stretch out to 6 to 12 months, especially if you're raising a larger amount or don’t already have strong traction or investor connections.

💡 Key Insight: Even with a great pitch, founders should budget at least 6 months for the full fundraising cycle, including due diligence, negotiations, and legal.

Planning ahead gives you room to stay focused and avoid rushing the process when it matters most.

Do You Know: What Happens After the Pitch?

What Affects How Long Fundraising Takes?

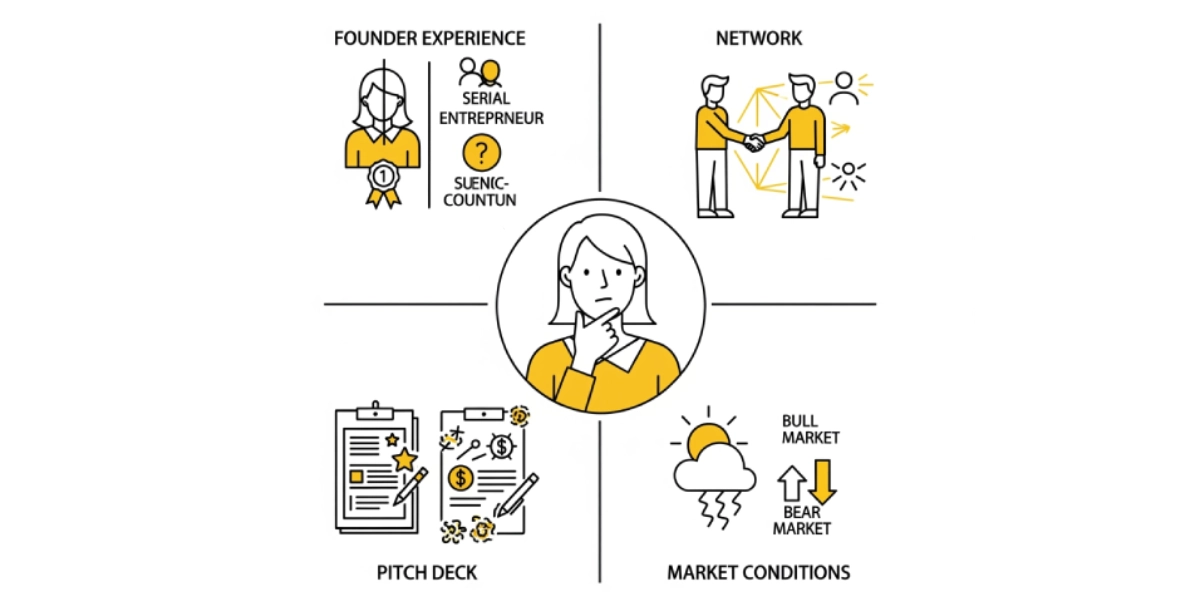

Not every founder’s journey is the same. While some raise quickly, others spend months in back-and-forth. Here are the four biggest factors that influence your fundraising timeline:

1. Founder Experience

-

First-Time Founders often need more time. Without a track record or existing investor network, it can take longer to build trust and land those first meetings.

-

Serial Entrepreneurs usually move faster; they’ve already proven they can execute, and investors often want in on their next thing.

2. Your Network & Warm Intros

-

Warm intros dramatically shorten your timeline. When an investor hears about you from someone they trust, you're more likely to get a fast “yes” or at least a meeting.

-

Cold outreach can still be effective, but it requires more time, effort, and follow-up to stand out truly.

3. Your Pitch Deck Quality

-

A clear story and a strong value proposition make a huge difference. If your deck quickly answers “Why now?” and “Why you?”, you’ll get traction faster.

-

Design matters too. A professionally designed deck signals credibility and attention to detail, two things investors value highly.

4. Market Conditions

-

In a bull market, investors are actively deploying capital, and deals move fast.

-

In a bear market, everyone gets pickier. That means longer waits, more questions, and slower closes, even for great startups.

Good To Know: The Art of Startup Fundraising

How to Speed Up Your Fundraise: 3 Smart Strategies

Raising faster isn’t about cutting corners; it’s about working smarter. These founder-tested strategies can help you cut weeks (or even months) off your fundraising timeline.

1. Use AI-Powered Tools to Tighten Your Pitch

Before you send your first email, make sure your pitch is investor-ready.

-

Evalyze.ai analyzes your pitch deck and gives you a clear, data-backed Investor Readiness Score.

-

You’ll get personalized feedback on what to fix before investors tell you “no.”

📌 Why it works: You’ll show up to investor meetings with sharper messaging and stronger materials from day one.

2. Build a Targeted Investor List (Don’t Just Spray and Pray)

-

Do your homework: Focus on investors who already back your industry, stage, and geography.

-

Personalize your outreach: Mention their past investments or recent LinkedIn posts; show them you’ve done more than copy-paste.

🎯 Bonus: Tools like Evalyze investor matcher can help you build a focused list quickly.

3. Get Your Docs in Order

Speed comes from preparation. Before you book your first investor call, make sure you’ve got:

-

Clear financial projections (realistic, not wishful)

-

Due diligence docs (cap table, founding team bios, basic legal info)

💡 Investors move faster when everything they need is ready, and nothing has to be chased down later.

Must Read: Decoding Investors' Feedback After a Pitch

The more prepared and precise you are, the less time you’ll waste on dead ends. And that means more time talking to the right investors, sooner.

Fundraising Takes Time, But You Can Make It Work for You

There’s no one-size-fits-all timeline for raising startup capital. Some founders raise in weeks, others take months, but the difference often comes down to preparation, clarity, and targeting the right investors.

By using the right tools and strategies, from tightening your pitch to building a curated investor list, you can cut out wasted time and focus on what really moves the needle.

Platforms like Evalyze.ai help you take the guesswork out of fundraising by offering smart insights and investor matches based on your startup’s unique profile.

👉 Try Evalyze.ai for free and connect with investors who are actually a fit.

More Articles

5 Best Pitch Deck Examples Worth Billion Dollars

Imagine you're in a room with potential investors, ready to present your startup idea. You have just a few minutes to capture their attention, convey your vision, and convince them that your business is worth investing in.

December 11, 2024

How to Write a Pitch Deck Storyline to Get You Funded

Have you ever poured your heart and soul into a startup, only to feel like your brilliant idea just isn't resonating with investors?

January 7, 2025