12 Small Business Grants in Europe

A founder-friendly guide to real EU and national grants you can use to fund specific projects without chasing mythical free money.

If you're building a startup in Europe, you've probably heard rumours like "there's so much free EU money" and then discovered… not quite.

The truth sits in the middle:

- There are programmes (cash grants, tax credits, vouchers).

- Most of them are competitive, bureaucratic, and tied to specific projects, not "free money to start anything".

- The best results go to founders who know where to look and how to match their project to the right scheme.

This guide gives you a founder-readable map of EU-level grants, plus Germany, France, the Netherlands, and Ireland, and how to use them without turning grant-hunting into a full-time job.

How European Grants Actually Work

Before we dive into names and acronyms, a quick map:

- EU-level:

Programmes like EIC Accelerator, Eurostars, and the EUIPO SME Fund run from Brussels and usually support innovation, deeptech, or IP protection across member states. - National:

Each country has its own toolbox:- Germany: EXIST, regional innovation grants.

- France: Bourse French Tech, deeptech grants, Innov'Up.

- Netherlands: WBSO (R&D tax relief), MIT innovation schemes.

- Ireland: Local Enterprise Office grants, Enterprise Ireland vouchers.

- Regional/local:

Regions, cities, and development agencies add their own schemes on top of national ones.

Two more Useful Resources:

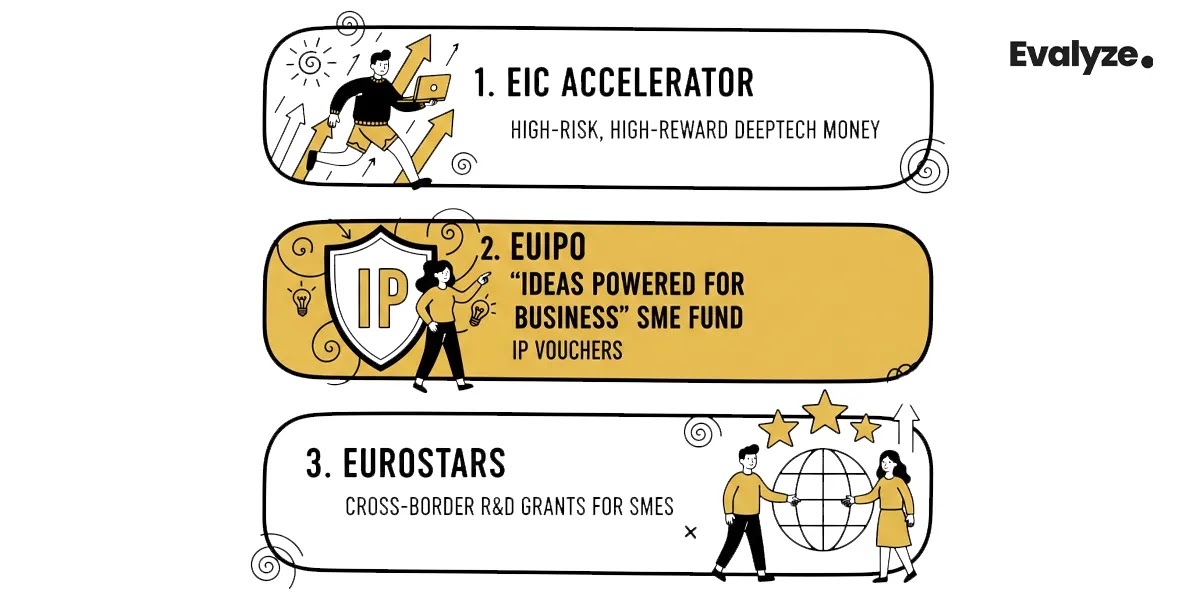

EU-Level Programmes for SMEs & Startups

1. EIC Accelerator - High-Risk, High-Reward Deeptech Money

Good for: Deeptech / highly innovative startups that already have a prototype and want to scale something genuinely new.

- Who it's for

SMEs and startups in the EU or associated countries, typically with technologies around TRL 5-8 (you've moved beyond a slide deck; you have a prototype and early validation). - What it pays

- Grant funding up to about €2.5M for innovation activities.

- Optional equity investment via the EIC Fund, often up to ~€15M or more, as "blended finance".

- What they care about

- Strong technology edge, defensible IP.

- EU/global impact (jobs, competitiveness, strategic tech).

- A team that can actually execute.

- Status

Ongoing flagship instrument under Horizon Europe with a standing application portal and periodic cut-off dates. Evaluation is multi-stage and very competitive.

2. EUIPO "Ideas Powered for Business" SME Fund - IP Vouchers

Good for: Any EU startup that needs to register trademarks, designs, patents, or do an IP strategy scan, and wants to save a chunk of the fees.

- Who it's for

SMEs in the EU (and currently also Ukrainian SMEs) applying for IP protection. - What it pays (typical current structure)

- IP scan: up to 90% reimbursement, with national caps (often around €1,350).

- Trademarks & designs: 75% reimbursement of basic fees at the EU, national, and regional level (up to €700 per SME in many countries).

- Patents: up to 75% of certain patent fees and 50% of some legal costs, usually capped at around €1,000-€1,500 per voucher.

- Plant varieties: up to 75% of online application and examination fees.

- Status

Recurring EU programme with annual calls and limited budgets, awarded on a first-come, first-served basis. The exact voucher structure and caps are updated periodically, so always use the current SME Fund page on the EUIPO site as your source of truth.

3. Eurostars - Cross-Border R&D Grants for SMEs

Good for: Startups doing applied R&D with a partner (or partners) in another participating country.

- Who it's for

R&D-performing SMEs in Eurostars-participating countries, working in international consortia (usually 2+ organisations from at least 2 countries). - What it pays

Funding comes from national agencies, not a single EU pot. Typical patterns:- Each country funds its own SMEs (often 40-60% of eligible R&D costs).

- Individual SME grants typically fall in the low six-figure range.

- Key conditions

- The SME leads the project.

- Clear innovation and commercialisation plan.

- Projects usually run 2-3 years.

- Status

Eurostars runs regular calls under the European Partnership on Innovative SMEs. Rules and funding rates differ by country, so always check your national funding agency's Eurostars page.

Popular on Evalyze: The 20 Most Searched Startup Investors on Evalyze

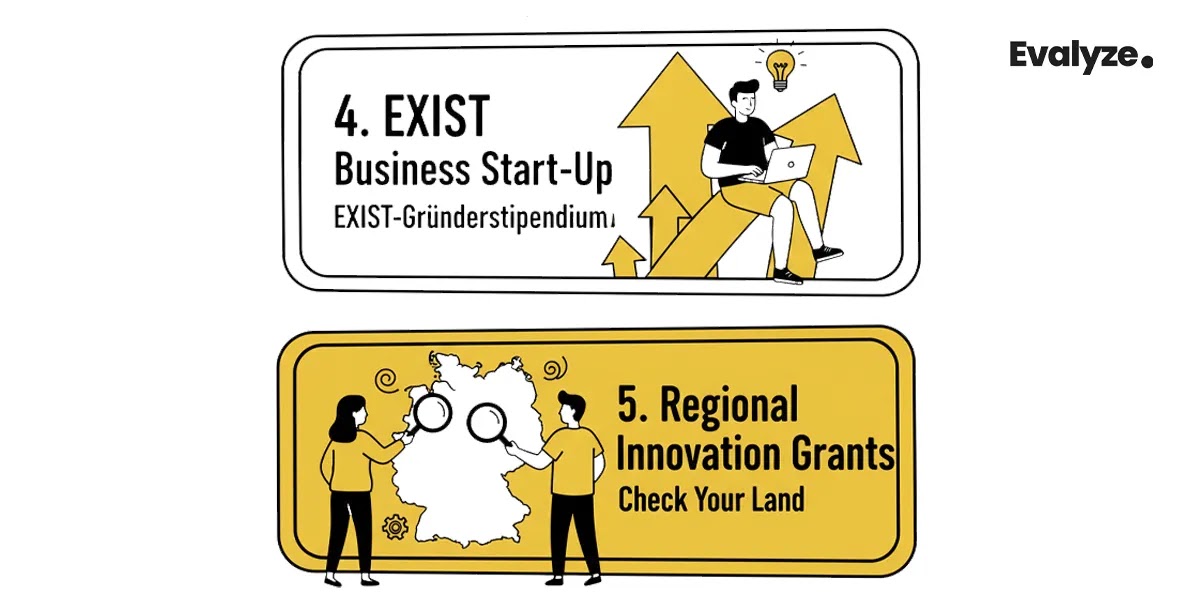

Germany: Grants for Innovative and Academic Spin-Offs

4. EXIST Business Start-Up Grant (EXIST-Gründerstipendium)

Good for: Students, researchers, and recent graduates in Germany spinning out a tech / knowledge-based startup from a university.

- Who it's for

- Students, graduates, and researchers at German universities and research institutions.

- Innovative, technology or knowledge-based projects with startup potential.

- What it pays (per person, typical structure)

- Monthly stipend (approximate ranges):

- Students: around €1,000 / month

- Graduates: around €2,500 / month

- Doctoral founders: around €3,000 / month

- Child allowance per month.

- Material costs up to €10,000 per person, max €30,000 per team.

- Coaching budget of about €5,000 per team.

- Funding usually lasts up to 12 months.

- Monthly stipend (approximate ranges):

- Key conditions

- You apply through your university, which must support the project.

- The year is for building a business plan, prototype, and early validation, not for freelancing.

- Status

Long-running federal programme; calls are recurring. The exact stipend rates and caps may change, so always confirm amounts on the official EXIST page before you submit.

5. Regional Innovation Grants - Check Your Land

On top of EXIST, each German Bundesland has its own innovation and startup instruments. Examples include:

- Distr@l (Hesse) supports digital innovation projects at SMEs and startups.

- Other regional schemes (Brandenburg, NRW, Bavaria, etc.) that co-fund R&D, digitalisation, or climate-relevant projects.

Patterns to expect:

- Six-figure project budgets with 40-60% public co-funding.

- Often requires a GmbH in that region and some matching funds.

Because these change frequently, treat them as "search targets": [your Land] + "Innovationsförderung Start-up" + site:.de Then look for the official websites of the state development bank or innovation agency.

Don't miss: How to Use Evalyze Investor Discovery

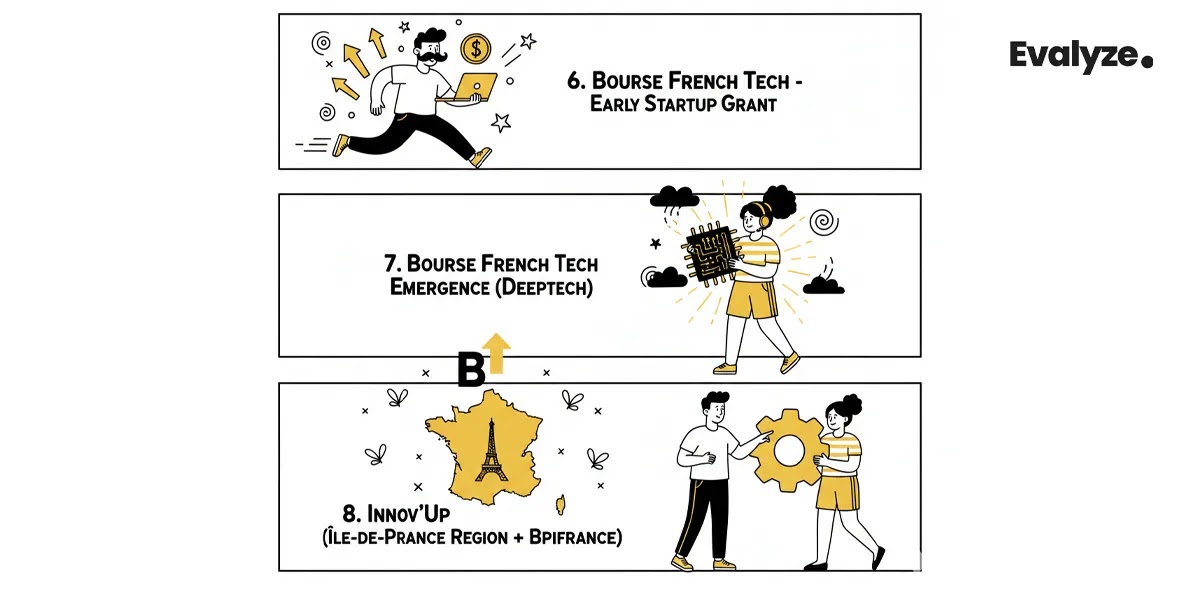

France: French Tech & Regional Innovation Aid

6. Bourse French Tech - Early Startup Grant

Good for: Very early French startups that need a first serious push for feasibility work.

- Who it's for

- Young, innovative companies in France typically less than a few years old.

- Often pre-revenue or early-revenue, with strong growth potential.

- What it pays

Depending on the current version and region, the Bourse French Tech typically offers equity-free grants in the ~€10,000-€30,000 range, sometimes higher for reinforced versions. - Key conditions

- Clear innovation and feasibility project (market study, prototype, validation).

- "French Tech" criteria not a cafe or local service with no scale.

- Status

Operated via Bpifrance as a standard instrument in the French startup toolbox. Exact caps, co-funding rates, and eligibility are updated under national plans like France 2030, so always read the latest Bpifrance fiche before applying.

7. Bourse French Tech Emergence (Deeptech)

Good for: Very early deeptech projects with a strong scientific base and lab connection.

- Who it's for

- Deeptech startups (or pre-startup projects) in France with heavy R&D and IP content.

- Often linked to public research labs or universities.

- What it pays

- Equity-free support up to ~€90,000 to cover early R&D, proof-of-concept work, and business validation.

- Status

A cornerstone deeptech grant under France 2030, run by Bpifrance with regular calls.

8. Innov'Up (Île-de-France Region + Bpifrance)

Good for: Startups and SMEs in Île-de-France (Paris region) running substantial innovation projects.

- Who it's for

- SMEs and startups based in Île-de-France with R&D or innovation projects and job creation potential in the region.

- What it pays

- Mix of grants and repayable advances, typically covering a share of eligible R&D and innovation costs.

- Some variants go as high as €500,000 in grants within larger public support envelopes.

- Status

A recurring family of schemes with multiple calls (e.g., Innov'Up Proto, Innov'Up Expérimentation) often co-financed by the Île-de-France Region and Bpifrance. The labels and focus areas evolve, so always start from the current Île-de-France / Bpifrance Innov'Up page.

Next read: 11 Fundraising Myths

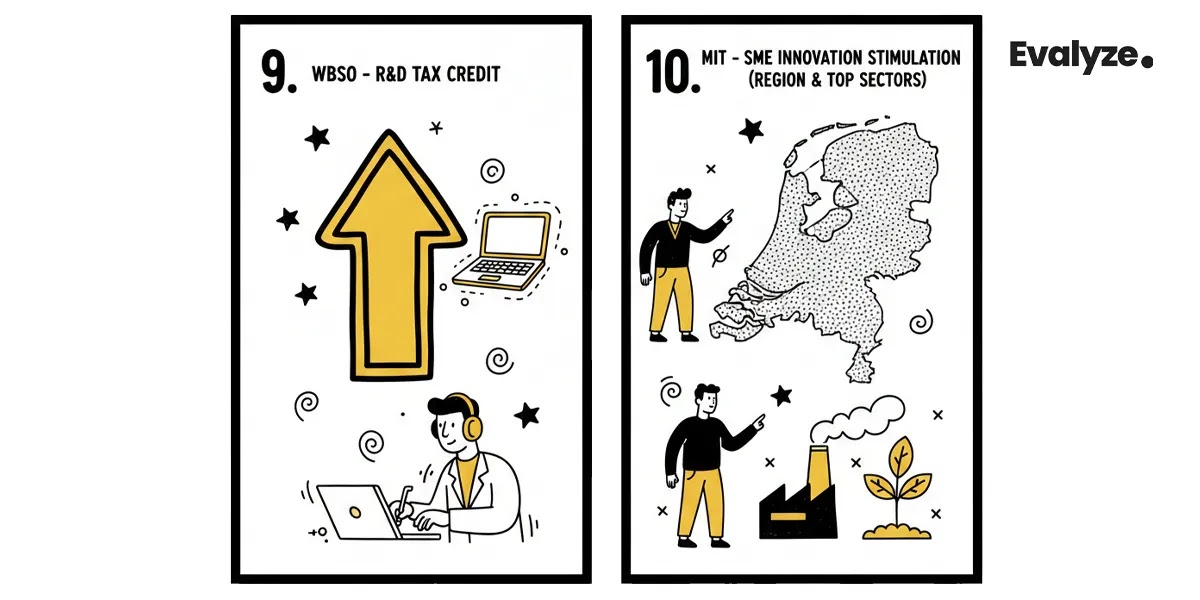

The Netherlands: R&D Tax Relief & SME Innovation Schemes

9. WBSO - R&D Tax Credit

Good for: Dutch startups doing in-house R&D (including software) who want to cut payroll tax costs instead of chasing grants.

- Who it's for

- Companies registered in the Netherlands with employees on the payroll performing eligible R&D.

- What it gives you

- A reduction in wage tax and national insurance contributions on R&D salaries.

- In some cases, relief on other R&D costs and expenses.

- The actual saving depends on your R&D wage bill, but for a small tech team, it can amount to many thousands of euros per year.

- Key conditions

- You submit R&D projects to RVO (Netherlands Enterprise Agency) in advance.

- Work must be technically new and uncertain, not just a routine configuration.

- Status

A structural scheme in Dutch tax law. Rates and ceilings are adjusted from time to time in the national budget, so always rely on the latest WBSO page on business.gov.nl or RVO.

10. MIT - SME Innovation Stimulation (Region & Top Sectors)

Good for: Dutch SMEs running innovation projects linked to the national Top Sectors (AI, energy, life sciences, etc.).

- What it offers

MIT is a set of instruments, not one grant:- Feasibility projects: often 40% of eligible costs, up to about €20,000 per project.

- R&D collaboration projects: grants around 35% of project costs, up to roughly €350,000.

- Knowledge vouchers: smaller vouchers (around €3,750) to buy expertise from knowledge institutions.

- Key conditions

- You must be an SME in a recognised Top Sector, working on a defined innovation project.

- Many instruments work on "first-come, first-served" and are oversubscribed on day 1, so timing matters.

- Status

MIT is a recurring national framework, with annual calls and windows that vary by region and instrument. Always check the current MIT page on RVO for open instruments and dates before investing time.

Founder's favourite: 20 Startup Fundraising Tools For Founders

Ireland: Local Enterprise Grants & Innovation Vouchers

11. Local Enterprise Office (LEO) - Priming Grant

Good for: Very early Irish micro-businesses (≤10 staff) in manufacturing or internationally traded services that need startup capital.

- Who it's for

- Micro-enterprises (≤10 employees).

- Generally, within the first 18 months of trading.

- Sectors with export or growth potential, not local-only services.

- What it pays

- Up to 50% of eligible investment costs, typically capped at around €80,000.

- In exceptional, high-impact cases, caps can go higher (e.g. up to €150,000).

- Key conditions

- Strong business plan and job creation potential.

- You apply through your local LEO, which decides based on regional priorities.

12. Enterprise Ireland - Innovation Vouchers

Good for: Irish SMEs that want to work with a university or research centre on a specific innovation challenge.

- Who it's for

- Registered Irish SMEs with a business number across most sectors.

- What it pays

- Standard vouchers worth €10,000, used to pay a public knowledge provider (university, IT, research centre).

- Co-funded vouchers up to €20,000, where you match part of the cost.

- Key conditions

- The voucher funds collaborative work (e.g. applied research, prototype concepts, process improvements), not generic consulting.

- You must pick an approved knowledge institution and define the challenge clearly.

- Status

Innovation Vouchers are a core, recurring Enterprise Ireland tool, with calls that open or re-open at multiple points throughout the year.

How to Navigate Calls, Deadlines & "Experts"

Here's how to avoid disappearing into a grant rabbit hole:

- Start from official sites

- EU: europa.eu, eic.ec.europa.eu, euipo.europa.eu, eurekanetwork.org.

- National: RVO (NL), Bpifrance, Enterprise Ireland, German federal ministries, etc.

- Local: regional development agencies and city websites.

- Treat consultants like any vendor

Some are helpful; some are pure "success fee" machines, copying and pasting your deck.- Don't sign away big equity chunks or pay huge retainers for generic work.

- If you do use one, make sure they're working from the current official guidelines.

Before You Apply: A Simple Founder Checklist

When you're thinking, "Is this worth the time?", ask:

- Do we have a concrete project?

Not "grow the startup", but "build X", "run trial Y", "enter market Z". - Are we at the right maturity level?

- EIC Accelerator wants something close to TRL 5-8 (real prototype, early users).

- EXIST, Bourse French Tech, and LEO Priming are more pre-seed / feasibility level.

- Can we provide co-funding?

Many grants cover only 40-60% of costs. If you can't fund the rest (from revenue, angels, or your own savings), the project might stall. - Is the admin load proportional to the money?

- Filling a 40-page EIC application for a tiny ask is a bad trade.

- Spending a day on an IP voucher that saves you €1,000 can be excellent.

- What's our runway while we wait?

- Public programmes can take months from application to contract.

- Assume grant cash arrives later than you'd like, not when you desperately need it.

If a grant doesn't line up with your real roadmap, skip it. The worst trap is "we redesigned our entire product just to fit a call text".

You might also like: 5 Questions to Ask Before Saying Yes to an Investor

How Grants Fit Into Your Funding Stack (and Where Evalyze Helps)

Grants and tax incentives don't replace fundraising; they change the shape of it:

- Use them to:

- Pay for R&D, pilots, clinical studies, export missions, and key early hires.

- Turn a sketch into a prototype, and a prototype into real-world data.

- Then raise from:

- Angels and VCs, once you can show traction, de-risked tech, and public co-funding as a credibility signal.

That's where Evalyze comes in:

- You use grants to buy time and proof points.

- Then you plug your deck into Evalyze.ai, clean up the story, benchmark it, and build a targeted investor list that cares about your sector and region, including funds that like public co-funded startups.

FAQ

1. Can a non-EU startup access European grants by opening a small office in Europe?

Sometimes, but not with a "paper" subsidiary. Most programmes require a real EU entity, actual activity, staff, and costs in that country. If you genuinely build a European base, grants can fit; if it's just a mailbox, you'll likely fail eligibility checks.

2. Do grants and public money scare off VCs later?

Usually no. If grants support projects that match your roadmap and you're not entirely dependent on them, investors see them as leverage and de-risking. They only worry when your whole business follows grant calls, or you're locked into awkward conditions.

3. Is it worth paying a grant consultant as an early-stage startup?

Only for complex, high-value calls and with clear, sane terms. A modest fixed fee plus a small success fee can make sense; huge retainers or big equity slices usually don't. Even with a consultant, you must understand the project, budget, and obligations yourself.

4. Should I change my legal form or move HQ just to fit a grant?

Not just for a grant. Incorporating or relocating is only worth it if it also fits your team, customers, and long-term fundraising. If the move only makes sense for one call, skip the grant rather than contorting your entire structure.

5. How do I choose between chasing a grant and raising a small angel round?

Grants fit defined projects you can co-fund and wait on. Angels fit urgent runway needs, fuzzy ideas that still need shaping, and situations where you also need intros and customers. Many teams combine both: small angel money first, then targeted grants, then a stronger seed round once proof exists.